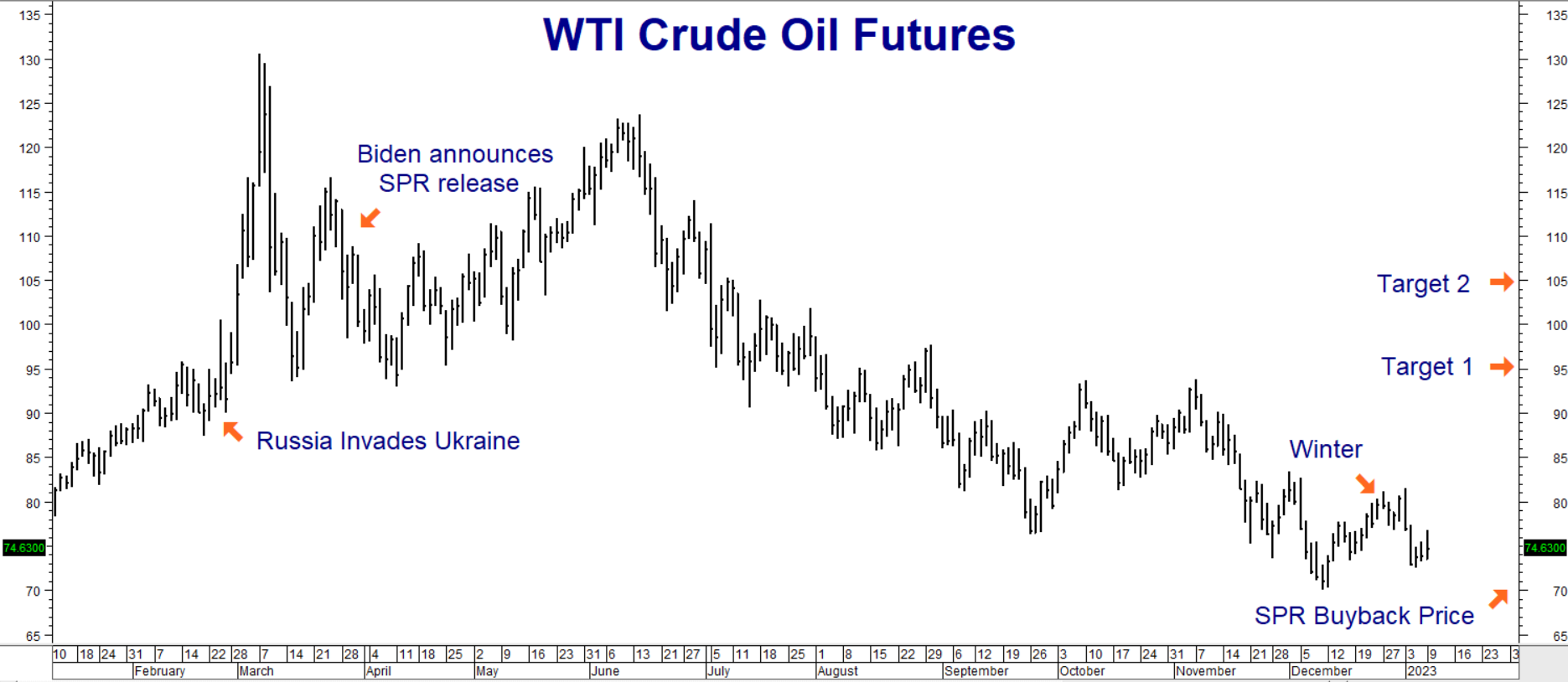

Crude oil is volatile. It exploded 44% in the two weeks following Russia’s invasion of Ukraine and then declined 28% in the two weeks after it. Crude sold off sharply with the first announcement of a release of Strategic Petroleum Reserves (SPR), but the exploded higher two months later. Crude was expected to trade higher with the approach of winter in Europe. As the chart below illustrates, it went the other way instead.

Data Source: FutureSource

An economic slowdown in China caused by the COVID crisis along with multiple releases from the American SPR, kept a lid on prices. Fears of a recession triggered by an overly aggressive Fed also helped chill the “animal spirits” of the bulls. These bearish forces are fading. China is accelerating its return to economic growth by letting COVID run its course; strong employment in the US belies a severe recession; and West Texas Intermediate (WTI) crude oil prices are approaching the “magic” $70 level.

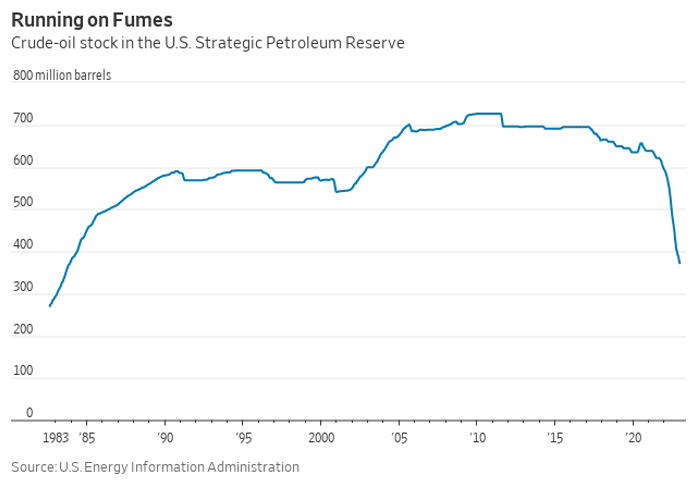

Strategic Petroleum Reserve is Depleted

Why is $70 magic? Because it is the target price the Biden Administration initially set to begin buying back oil to refill the SPR. It is going to take a heck of a lot of buying to replace the 180 million barrels released since Russia invaded Ukraine. 180 million barrels is the equivalent of 180,000, 1,000-barrel futures contracts. Buying back this much crude anywhere close to the current spot price of $75.00 would go down in history as one of the best short trades ever. And by the government no less!

Can it be done at current price levels? This much buying could, and we believe should, boost prices. Some analysts are predicting a delay due to the hesitancy of the Biden Administration to see energy prices rise over the near-term. With the Mid-terms over, the smart move politically would be to refill the reserve now – before the 2024 Presidential race begins in earnest – even if it means paying a bit more. Either way, just the threat of government purchases should help keep a floor under the crude market for now.

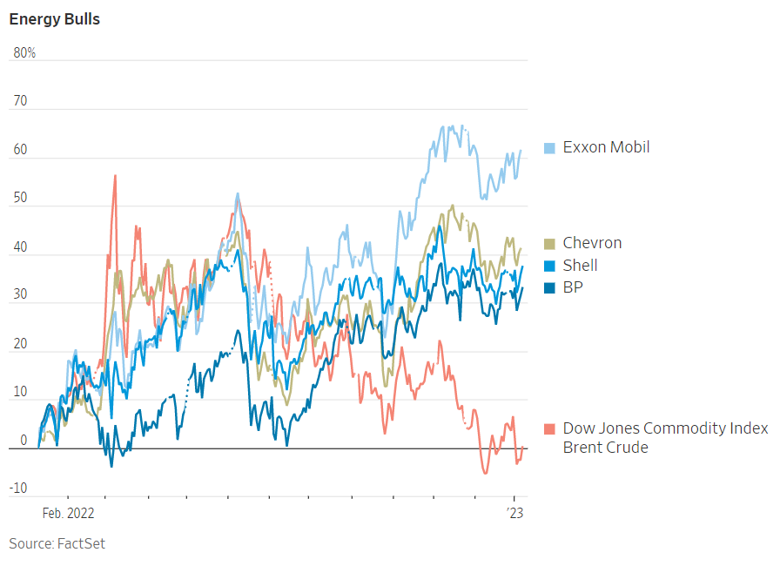

Energy Stocks Anticipate Price Increases

Energy stocks are also anticipating a return to higher prices. Crude declined substantially from its mid-summer highs of $121.00, bottoming out at $70.08 per barrel in December. However, none of the major oil companies followed crude lower. Their prices remain at levels near or above where they were at the beginning of the war. It is as if the $50 per barrel sell-off in crude never occurred.

While there are reasons to own energy stocks other than as a proxy for crude oil, the current gap between these stocks and crude itself suggest that: (1) oil stocks are extremely overvalued, (2) crude oil is incredibly undervalued, (3) or a bit of both. This makes crude oil futures very attractive from our perspective. Crude should gain far more than energy stocks from the next rebound. Oil’s volatility makes a direct play in the futures extremely risky. Options allow us to control our risk, which is why will we use them to construct our bullish strategy.

Our four-month target is $95.00 per barrel, which is roughly a 21% jump from current levels. (See chart at the beginning of this report.) Crude oil options are expensive, reflecting the possibility for big volatility in the market due to the war in Ukraine. The strategy we outline below lets us reduce a big chunk of this “volatility premium” in exchange for limiting our upside. It is a trade-off we are happy to make.

Use NYMEX Call Options to “Rent” Crude Oil for Pennies on the Dollar

The strategy below is designed to give RMB Group trading customers upside exposure to crude oil for a lower cost and risk than purchasing futures (or energy stocks) outright, freeing up capital to generate a return somewhere else.

We will use 1,000-ounce NYMEX crude options to create our “pennies on the dollar” strategy. Each option covers 1,000 barrels of oil, making each $1.00 move worth $1,000 and each 1-cent per barrel move worth $10. Buyers of crude oil call options pay money, known as a “premium,” for the right but not the obligation to be long crude oil futures at a specific price for a specific time period.

Call option buyers do not buy the market; they merely buy the right but not the obligation to be long that market. The key phrase is “but not the obligation.” Should crude oil decline or fail to rally before the option expires, the option buyer will simply not exercise the right to buy the futures contract. The maximum risk for a crude oil call option buyer is the premium paid, plus any transaction costs.

Crude oil call option sellers receive money in exchange for the obligation to sell crude futures for a specific price for a certain timeframe. Notice how this definition is the exact opposite of call option buyers. Think of it this way: if you are an employer, you pay money to your employees. This gives you the right to tell them what to do. As an employee, you receive money from your employer, obligating you to do what your employer tells you. Options work the same way.

Combine Long and Short Positions to Reduce Risk

We can lower the cost and risk of our bullish position by combining long crude oil call options with short crude call options. Our first upside target for crude is $95.00 per barrel, which is slightly above the price of crude before the Russian invasion. Our second $105 per barrel target would come into play given a faster-than-expected Chinese recovery.

RMB Group trading customers may want to consider buying a July NYMEX crude call option with a strike price of $85.00 per barrel, while simultaneously selling a July 2023 call option with a strike price of $95.00 per barrel. This “bull call spread” pairs the right to buy 1,000 barrels of crude at $85 per barrel with the obligation to sell 1,000 barrels of crude at $95. This “spread” settled January 10, 2023 for $2,350 as of the close that day.

Compare this to the roughly $75,300 it currently costs to buy 1,000 barrels of crude oil outright. July 2023 NYMEX crude options expire on June 27, 2023. This gives us time for the trade to work. We will lose the entire amount we pay for this spread plus any related transaction cost should crude oil fail to rally above $85.00 per barrel prior to this date.

Buying the $85.00 call gives us the right to be long a 1,000-barrel futures contract at $85. Selling the $95.00 call obligates us to sell 1,000-barrel futures contract for $95. This means the most our bull call spread will be worth is the $10.00 per barrel difference between the two strike prices. Multiply $10 times the 1,000-barrel contract size and you get $10,000 – not a bad outcome given our $2, 350 (plus transaction cost) risk.

Prices can and will change, so contact your RMB Group broker for the latest. Your RMB Group broker will work with you to match a strategy to your risk tolerance and market conditions.

Take Advantage of High Interest Rates to Create Your Own “Crude-Backed” CD

Yields on T-bills and CDs have soared in the past few months. This makes it possible for RMB Group trading customers to create their own “crude-backed” CD. Combining the bull spread strategy above with the purchase of a one-year CD generates interest and provides extra potential in the event of significant rally in the oil market.

For example, NYMEX crude oil futures are currently trading for roughly $75 per barrel, making each contract worth $75,000. Instead of buying 1,000-barrel futures contract, or an equivalent amount of energy stocks, one could purchase a 12-month FDIC-insured CD. A quick search of www.bankrate.com shows several 12-month CDs with APY yields of 4.75%. $75,000 invested at 4.75% is roughly $3,562. This covers the $2,350 cost of our spread.

The failure of crude to rally would cause a loss of $2,350 plus transaction costs on the option portion of the “CD,” reducing the net return on this combined strategy to $1,212 or less. RMB Group customers interested in this strategy would need to purchase their own CD.

Please be advised that you need a futures account to trade the options in this report. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.