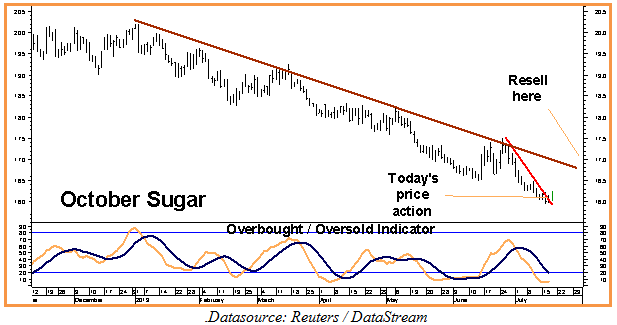

The time has come to lift the put leg of the October $19.50 / $16.50 call / put “strangles” we suggested purchasing for 60 points ($672) or less back in April (Vol. 19 #10). We finally got the breakout we were looking for, but it is beginning to show signs of stalling out. Expectations of a huge crop in one of the world’s biggest producers, Brazil, have kept pressure on this market. But instead of falling apart the decline has been more of a slow grind.

Low prices have incentivized Brazil to use much more of its crop to make ethanol to fuel domestic automobiles, removing it from the world market. This combined with notions that the current crop may not be as large as expected is causing a pop in the market this morning.

With sugar heavily oversold and overdue for a big correction, let’s go ahead and see if we can exit the put leg of our October strangles for what we paid for the entire position back in April, removing all our risk from the market. We may consider repurchasing them at a lower price later but for now, the market is telling us that the slow grind we’ve been experiencing may not last much longer.

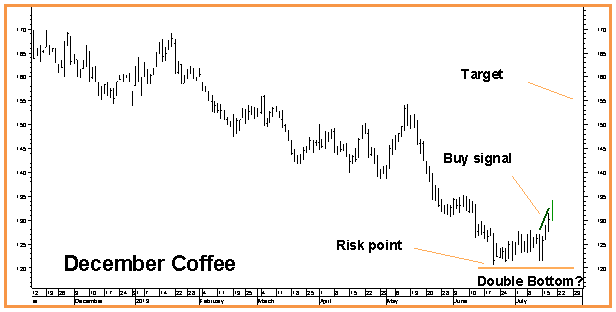

Buy Signal in Coffee

Another soft commodity market, another Brazilian story… Big Brazilian crops have kept pressure on the Arabica coffee market as well, but recent developments could be changing things. A devastating coffee fungus is wreaking havoc on the crops of Central America – another big coffee-producing region – creating conditions for a potential disruption in supply. Called “La Roya” or coffee leaf rust, this fungus has spread across nearly half of the region and destroyed a fifth of the 2012-2013 crop.

According to a recent article in the Financial Times: “…coffee traders believe Central America will lose a much larger share of the crop of high quality arabica in 2013 -2014 when the full effect of the disease becomes apparent.” Yesterday’s second consecutively higher close over the previous day’s high gave us the buy signal we were looking for in this market. That rally is being extended this morning.

Let’s see if we can use a bit of a pullback to get positioned on the long side of this market for the rest of the year. The trade suggested below may require a little patience in getting filled. We won’t cry “uncle” on this trade unless the market can manage two consecutively lower closes below our risk point of $1.20 in the December coffee contract.