Grains have taken it on the chin lately. Corn, wheat and soybeans have gotten crushed as nearly perfect weather conditions and the expectation of bumper crops in the US weigh on prices. This may be a calamity for some farmers, but for patient investors looking to add a little diversity to their portfolios, it could be a huge buying opportunity. We will be issuing a more in-depth report later this month, but with corn finally in our long-term buy zone we want to spread the word now.

Five Reasons to Expect a Rebound in Grain Prices

Within The Next Two Years

1) Higher incomes in the developing world are changing eating habits favoring meat. It takes 4.5 pounds of grain to produce 1 pound of chicken meat; 7.3 pounds to produce 1 pound of pork; and 20 pounds to produce 1 pound of beef. Only 4% of the protein in corn is converted to edible protein in beef. It’s just 10% in pork and 20% in chicken. Meat consumption is soaring in the developing world – and with it the demand for grain.

2) China is losing land to pollution and overuse. China’s arable land per capita is less than half of the global average. Twenty percent of China’s arable land is polluted and 40% is degraded due to overuse. With 19% of the world’s population, China will need to import more grain in order to satisfy changed eating habits. It has the foreign reserves to do so.

3) Global climate change is real. The biggest impact on grain prices is the weather. There have been three droughts in key grain-growing regions of the US in the past 6 years – two major and one minor. Many forecasters are predicting the return of El Niño this year. El Niño is associated with drought-like conditions in corn-growing areas of China. China is the world’s second largest producer of corn after the US.

4) Over one third of the huge US crop is used to produce ethanol. The collapse of order in the Mideast and the growing potential of a Sunni versus Shiite world war could keep prices high for a while. The higher the price of crude, the more incentive refiners have to blend ethanol into gasoline. We expect the percentage of the American crop diverted to ethanol to grow.

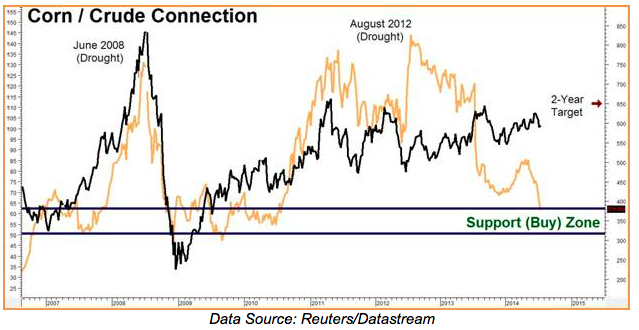

5) The price of food is ultimately connected to the price of crude and other hydrocarbons like natural gas. Farm productivity relies on two key factors: mechanization and fertilizer. Crude oil produces the diesel fuel to drive the former. Natural gas provides the nitrogen to enrich the latter. Crude oil prices are currently high in relation to corn. As the chart below suggests, they tend not to stay that way for long.

What to Do Now

Instead of sinking a lot of capital into expensive farmland or buying agricultural companies whose stocks may or may not rise with the price of corn, we “rent” the golden grain for approximately two years. How do we do that? By using the corn options traded on the Chicago Board of Trade (CBOT).

Since corn displays a fairly solid tendency to peak during summer months, we use long-dated July 2016 options. Each CBOT option covers 5,000 bushels of corn and is priced in cents per bushel. Our two-year price target is a return to $6.50 per bushel. We are currently recommending a long-term play with a maximum cost and risk of $600 and the potential to be worth as much as $5,000 should the golden grain reach our long-term target prior to option expiration in late June 2016.

RMB Group trading customers should check with their personal broker for the specifics of this trade. Prices change, so call or e-mail us for the latest.

If you are not an RMB Trading Customer and want to know more about how to play this or any other market, contact us or call us at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’re happy to go over some of our fixed- risk, “Big Move” strategies with you. You can also e-mail suertusen@rmbgroup.com. Put “corn” in the subject line.