It was bound to happen. Volatility in the commodity sector is starting to ramp up. And while the increase isn’t exactly across the board, volatility in most of the markets we’ve identified as being abnormally quiet over the course of the last few months is starting to rise. The only low-vol commodity we covered that is still exhibiting extremely low volatility is the typically uber-volatile coffee.

Let’s start with corn. Drought conditions in South America combined with cold, rain and lingering winter over large swaths of the North American heartland have put a nice bid under the yellow grain. Weather is everything at this time of the year, so Mother Nature will have the most to say about the major grain and soy markets. Corn was down on Friday but that was to be expected given the slightly overbought conditions in this market.

Data Source: Reuters

We expect corn to oscillate is its wide trading range until weather nudges it in one direction or the other. Two consecutively higher closes above $3.95 in the front month futures contract should be enough to power the yellow grain to our first objective north of $5.00 per bushel. RMB trading customers should considering holding their long December $4.00 and $4.20 corn calls for now.

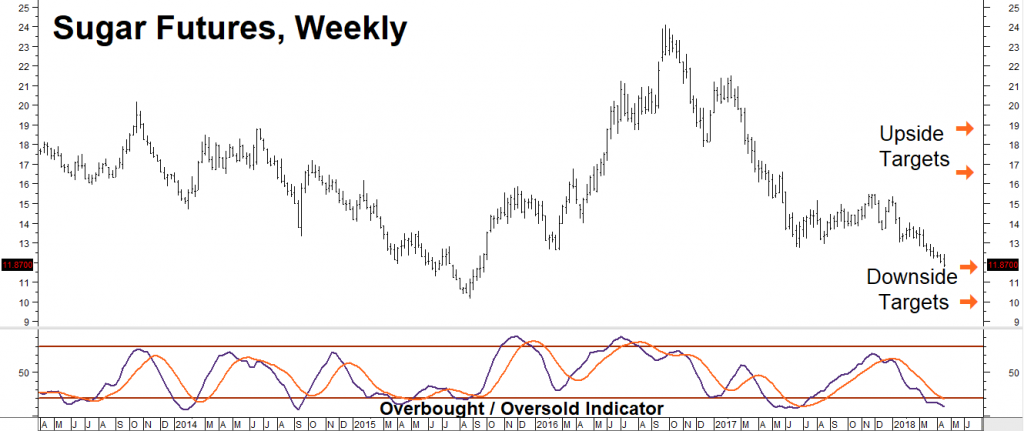

Exit Sugar Puts, Hold Calls & Get Ready to Accumulate Bullish Positions

In October RMB Group identified a marked lack of volatility in both sugar puts and calls. Since both were cheap and because price action in the sugar futures market was providing little help in determining market direction, we decided to buy both puts and calls with the expectation that volatility would eventually revert to the mean and rise. And while this took a little longer than expected, those who followed our suggestion to “roll” their long May 15-cent call / 13-cent put strangles into October should now be solidly in the black.

Data Source: Reuters

Now than the sweet stuff has finally fallen to our first downside objective at 11.50 cents per pound, the time has come to exit our October 13-cent puts, currently offered at roughly $1,700 each. Continue to hold long October 15-cent calls. This calls are now fully paid for. With 154 days left until expiration, and sugar approaching big-time support below 11-cents, anything could happen – including a big bounce.

Get ready to add to bullish positions using March and May 2019 call options as soon as we see more definitive signs of a bottom. We suspect that high oil prices will eventually incentivize the world’s largest sugar producer Brazil to hold back more of the sweet stuff for ethanol. Unexpected weather could cause this market to turn on a dime as well.

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) to for more information and/or to open a trading account. You can also visit our website www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2018 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.