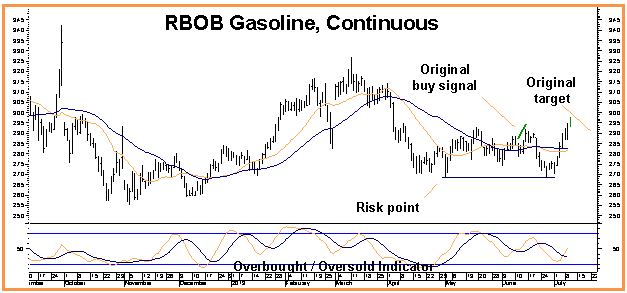

Three weeks ago OE suggested selling (shorting) August $2.85 / $2.90 put spreads for 250 points ($1,050) to establish a bullish position based on 2 major factors: 1) a solid technical buy signal and 2) a strong bullish seasonal tendency for the month of July. Our position went south on us rather quickly as unleaded gasoline tumbled but, fortunately, did not trigger our exit.

The ongoing coup in Egypt in combination with the seasonal factors we were counting on when we made our original recommendation appear to have saved the day. Unleaded RBOB gasoline has been pretty much straight up for the last 7 trading days. Let’s go ahead and use this rally as an opportunity to take some cash off the table.