Certain relationships in commodities demand attention – especially when they are out of whack. One of these is the price differential between gold and platinum. Both are “precious” metals, but platinum is much rarer. Miners produce roughly 2,800 tons of gold and only 250 tons of platinum per year. This makes platinum over 10-times more “precious.”

The platinum / gold relationship expresses itself in both price and perception. “Platinum plans” are always richer and more luxurious that “gold plans.” “Platinum records” sell more copies than “gold records.” It follows that the price of platinum itself should be higher than gold. And it is most of the time. Platinum’s average premium over gold is approximately $200 per ounce and has traded as high as $1,290 premium to gold.

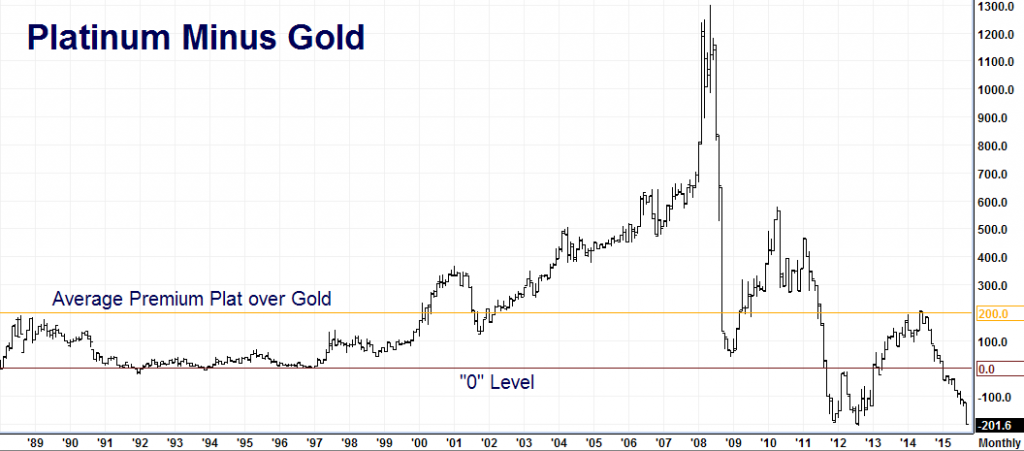

However, there are key times when this relationship inverts and the price of platinum sinks below the price of gold. The 27-year chart below shows the white metal’s average premium to gold and also identifies the “0” level, beneath which the normal premium of platinum to gold is inverted. As you can see, these inversions are the exception, not the rule, and don’t last very long.

We’ve been following the platinum / gold spread since it dropped below “0” at the beginning of the year and made one unsuccessful attempt to play a reversal to more “normal” levels in March. With the price of platinum at more than a $200 per ounce discount to gold, the time to re-enter this spread – buying platinum and shorting an equal amount of gold – is here.

Why is this relationship so far out of whack? Like silver, platinum has a dual personality: it is both a precious and an industrial metal. Slowing Chinese growth and the strong dollar are weighing on all industrial commodities. Like its platinum group metal (PGM) cousins, palladium and rhodium, platinum’s main source of industrial demand is from the auto industry. PGMs are the key components in catalytic converters. All three can be substituted for one another in gasoline-powered cars, but platinum must be used in diesel catalytic converters.

Volkswagen Scandal Signaling a Bottom?

The Volkswagen emissions cheating scandal has decimated the sales of diesel-powered vehicles worldwide, causing speculators to heavily short platinum futures. VW rigged secret software that identified when its diesel vehicles were being tested and changed operating parameters to produce lower nitrous oxide (NOX) emissions in these testing modes. Why? To save money. Reducing emissions the proper way would require more platinum in the catalytic converters of the affected vehicles, in the catalytic converters of the affected vehicles, increasing costs

Open interest in the platinum futures contract has soared with its falling price. This increases the probability that most players wanting to short this market have already done so. With everyone crowded on one side of the boat, the risk of sharp reversal grows by the day. We wonder what will happen to the price of platinum when there is nobody left to sell to increasing costs.

Open interest in the platinum futures contract has soared with its falling price. This increases the probability that most players wanting to short this market have already done so. With everyone crowded on one side of the boat, the risk of sharp reversal grows by the day. We wonder what will happen to the price of platinum when there is nobody left to sell to increasing costs.

The market for diesel-powered cars and trucks may be in shock now, but the demand for these vehicles will not disappear – especially in Europe where tax polices heavily favor more-efficient diesels. Almost 50% of vehicles on the road in Europe are diesel-powered. This is not going to change without changes in policy – something we do not see happening. At the same time, regulators are on the lookout for more software short-cuts. This could lead to increased demand for platinum as manufacturers are forced to bite the bullet and add more platinum to meet emission mandates.

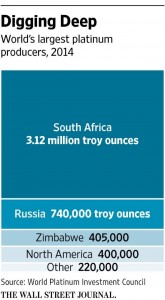

Deeper, more dangerous mines mean it costs a good deal more to produce an ounce of platinum than gold. Unlike the Midas metal, which is mined worldwide, 79% of the globe’s platinum comes from just 2 countries – Russia and South Africa. The strong dollar — and correspondingly weak Russian ruble and South African rand — is incentivizing both nations to convert their platinum stockpiles into dollars, adding to near-term supplies.

Above-ground stockpiles will not last forever – nor will the seemingly non-stop rally in the dollar. Janet Yellen’s reticence to raise rates could extend into 2016, knocking the mighty buck down a peg or two. We believe a rate increase of 25 basis points is already built into the dollar. This could lead to a “buy the rumor, sell the fact” sell-off in the dollar even if rates rise. Since much of the weakness in platinum is due to the strong dollar, corrective weakness in the greenback should trigger a corresponding relief rally in platinum.

What About Investment Demand?

The problem with precious metals that are used industrially like platinum has to do with market perception. Investors view these metals as “precious” in a bull market and as “industrial” in a bear market. This is happening now. Most traders are focusing on the industrial side of platinum, ignoring the “precious” side altogether. Analysts know how to measure industrial demand, but measuring “preciousness can be tricky. Since most individual investors use coins to buy platinum, looking at the coin market can provide insights to hidden demand not evident in the futures price.

Writing for Seeking Alpha, commodity expert and former trader Andy Hecht makes the case for bargain hunting in platinum with his recent piece “The Only Way to Buy Platinum Here”. Mr. Hecht points to the extremely high premiums ($125-$150 over market price) of platinum coins as a possible sign of supply tightness on the investment side of the market. What many don’t know is platinum can be purchased much more cheaply by purchasing futures contracts and taking delivery. Mr. Hecht does a nice job of explaining this in his piece.

(Editors’ Note: RMB Group knows all about buying metals using futures delivery and does so regularly for a select group of our trading clients. Call or e-mail us if interested.)

What To Do Now

While we don’t pretend to know when the bear market in gold and platinum will end, we do know the “normal” relationship between platinum and gold is severely out of whack and oversold. We believe this spread is so overdone on the downside that it could widen – even without a reversal of the downward trend in precious metals – and has the potential to really perk-up on any sustained weakness in the dollar.

The weekly chart above shows current support around minus $200 and platinum’s RSI – a measure of overbought and oversold conditions – scraping the bottom of its range. We believe well-capitalized trading customers should consider buying this spread (long platinum / short gold) right around current levels. Look for the relationship between these two metals to normalize sometime in the next 12 to 24 months.

Platinum trades in 50-ounce contracts and gold trades in 100-ounce contracts. To make this trade, we suggest buying 2 contracts of platinum for every short contract of gold. Gold and platinum share October and April contract expirations on the COMEX, but they can also be mated across different liquid contract months. Each $1 per ounce move in the platinum / gold spread is worth $100. Each $100 move is worth $10,000.

The current margin to trade the platinum/gold spread is $3,300. Be prepared to risk a move to minus $300. A move to this level would mean a loss of roughly $10,000 per spread. Do not attempt this trade unless you are comfortable with risking this amount or more. Speculators should be ready to back their positions with a margin deposit of at least $15,000 per spread to avoid margin calls.

Our first long-term target is parity – represented by the $0 level on the chart above. A move to this level would result in a gain of roughly $20,000 depending on your fill price. Our second target is resistance at plus $200 per ounce in favor of platinum. This could result in a gain of approximately $40,000 per spread. Coincidentally enough, the plus $200 level is also platinum’s average premium over gold.

This trade is a longer term play so patience will be required. Futures contracts will also need to be “rolled over” periodically – something your personal RMB Group broker is happy to help you with.