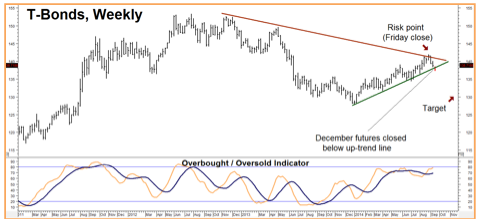

Last week was a good one for bond bears. December T-bond futures managed to close below the weekly uptrend line and shift momentum to the downside. However we need to see another lower close this Friday to confirm the trend has changed. Wednesday’s report on consumer inflation as well as this week’s price action will help tell the tale.

We weren’t completely certain about momentum when we recommended buying December T- bond and T-note puts in Alert #23 three weeks ago, but we knew we were getting them at a good price. They are not nearly as cheap anymore. In fact, the options we suggested purchasing for $750 three weeks ago, closed Friday at $1,562.50.

Consequently, let’s go ahead and exit half of our positions now. Hold the other half for a potential move to our downside objective of 130-00 in the front month futures contract. A fill anywhere close to Friday’s close should enable us to take most of not all of our initial risk “off the table.” Prices in this market can change quickly, so check with your personal RMB Group broker for the latest.

If you don’t have an RMB Group trading account and would like to know more about this or any other about “Big Move” strategies that we are currently recommending, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.