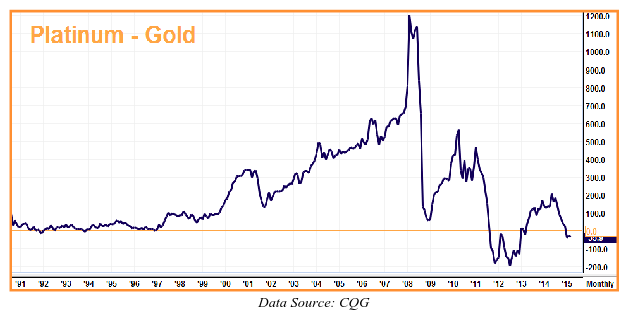

There are certain relationships between commodities that bear watching, especially when they get out of whack. The chart below shows the relationship between platinum and gold going back to 1991. Platinum is nearly always more expensive than gold – soaring as high as $1,180 per ounce more than the Midas metal in 2008. It is currently $53 cheaper than gold as we write this.

The chart below illustrates the platinum minus gold spread. The thin, gold horizontal line represents zero or the point at which platinum and gold trade at the same price. The current decline in this spread is only the second time the white metal has been significantly cheaper than gold – just twice in the past 24 years and only the fourth time it has been cheaper than gold ever. (Platinum dipped below gold in the 1990s, but only by a few dollars.)

We believe this pricing anomaly in gold and platinum is a tradable event – especially for players with a long-term outlook.

There are a number of reasons why platinum has been more expensive than gold for most of the past quarter century. Let’s start with the simplest: platinum is 15 times rarer than its yellow cousin. Unlike gold, which is mined at numerous locations throughout the world, approximately 90% of platinum comes from just four major mines: three in South Africa and one in Russia. This make platinum more vulnerable to supply disruptions and political disruptions.

Platinum is a key strategic metal for modern technology and industry. Like silver, it has a dual personality with the characteristics of both a precious metal and an industrial metal. This makes platinum more sensitive than gold to ups and downs in the global economy. It behaves more like a precious metal in bull markets and more like an industrial metal when the trend is heading south.

Slow Economy & Auto-catalyst Tooling Keys to Platinum Underperformance

Platinum is one of only three metals used in automobile catalytic converters. The others are its PGM (platinum group metal) cousins: palladium and rhodium. This gives the two tradable metals – platinum and palladium – a huge, built-in source of industrial demand. Auto-catalyst use is responsible for up to 50% of the demand for these two metals. One of the reasons for platinum’s recent weakness versus gold has to do with the slow global economy – especially in Europe.

Diesel-powered automobiles make up 50% of Europe’s fleet. Compare this with only 2.8% in North America. The relatively low temperature of diesel exhaust means platinum must be used in diesel catalytic converters. Gasoline-powered cars can use platinum, palladium, rhodium or a combination of all three. The amount of each metal automakers use is heavily dependent on relative prices.

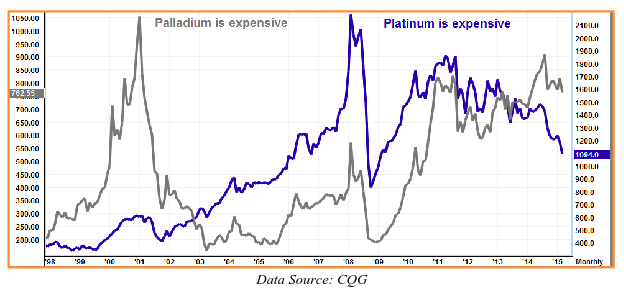

The chart above illustrates two instances when platinum and palladium were out of whack. Palladium soared in 2001, costing $750 per ounce more than platinum. The auto industry retooled to use more platinum, helping to drive its price higher. They did the exact opposite after 2008’s spike in the price of platinum and changed catalytic converter tooling in favor of palladium.

This change, along with a far stronger (almost exclusively gasoline-powered) American automobile market and a weaker (mainly diesel-powered) European automobile market, is largely responsible for palladium’s outperformance over platinum and platinum’s underperformance versus gold.

Stronger European Economy & Supply Concerns Are Potential Game Changers

The European Central Bank is pumping billions of newly-printed euros into the European economy. Increased demand for new cars should follow – just like they did in the US following the Fed’s 3-phased QE on this side of the pond. The price of palladium has been rising rapidly in relation to platinum and, while not at levels that would trigger a new round of retooling yet, appears to be well on the way there.

The real threat is the source of supply. The majority of platinum is mined in South Africa. Palladium is mostly mined in Russia. Given the current state of Russian relations with the West, the possibility of a sudden supply shock in palladium is not far-fetched. Should this happen, the price of palladium would skyrocket versus platinum, paving the way for another retooling. Since platinum competes with palladium, a spike in the price of palladium would also help pull up the price of platinum – especially vis a vis gold.

When will this happen? We don’t know. What we do know is the cheaper platinum gets in relation to the price of palladium and gold, the bigger the opportunity we see.

What We Are Doing Now

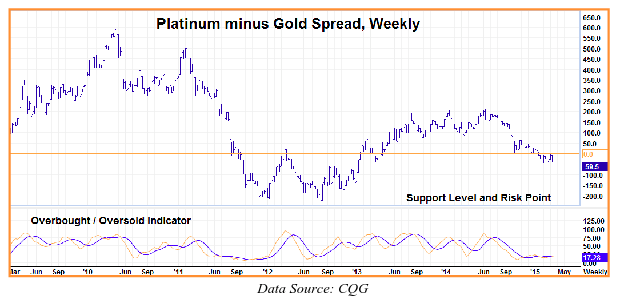

We see two potential events as triggers for recommending a long platinum / short gold play to our trading customers: 1) the platinum gold spread dips below minus 100, or 2) the spread closes higher than the previous week’s high for two consecutive weeks.

Our risk on trigger 1 will be a close below old lows at minus $220 per ounce. Our risk on trigger 2 will depend on the market low prior to our entry signal. We’ll be prepared to exit and cut losses following two consecutively-lower closes beneath that level.

Platinum trades in 50-ounce contracts and gold trades in 100-ounce contracts. To make our trade we suggest buying 2 contracts of platinum for every short contract of gold. Gold and platinum share October and April contract expirations on the COMEX. With April expiration just around the corner, we’ll be focusing on the October contracts for now.

Each $1 move in the spread is worth $100. Each $100 move is worth $10,000. The current margin to trade the platinum–gold spread is $3,300. However, speculators should be ready to back their positions with a margin deposit of at least $15,000 per spread.

Our first long-term target is resistance at a platinum premium of $200 per ounce –a gain of roughly $25,000 from current levels. Coincidently, this is also platinum’s average premium over gold. Platinum prices soared $600 per ounce over gold three years ago. We won’t be surprised to see levels far in excess of plus $200 in the next few years with the right market conditions.

We are watching this relationship closely and will do our best to alert you when we believe it is time to take a position. It could be as early as next week or weeks from now. RMB Group trading customers interested in this play should check with their personal broker for details and latest margin to do this trade.

Getting Started

If you are not an RMB Group trading customer, you cannot trade this spread in your stock account or in the cash bullion market. You need a separate commodity account. The RMB Group has been helping their customers trade futures and options since 1984 and are intimately familiar with this strategy. Call us toll-free at 800-345-7026 or 312-373-4970 direct. We’ll send you everything you need to get started. Or visit www.rmbgroup.com to open an account online.

If you are new to futures and options and would like to know more, give us a call at the phone numbers above or e-mail suerutsen@rmbgroup.com and we will send you the RMB Short Course in Futures and Options (a $14.99 value) absolutely free. You can also download the “Short Course” from our website at www.rmbgroup.com.