Option traders know that volatility is perhaps one of the most important factors determining options prices. Extremely volatile markets tend to have expensive options. Extremely quiet markets tend to have cheap options. That’s why some of the best option buying opportunities occur when traditionally volatile markets go quiet and stay that way for an abnormally-long time. Option sellers grow complacent and are willing to accept less for their obligations to buy and sell. Options get cheap on a relative basis.

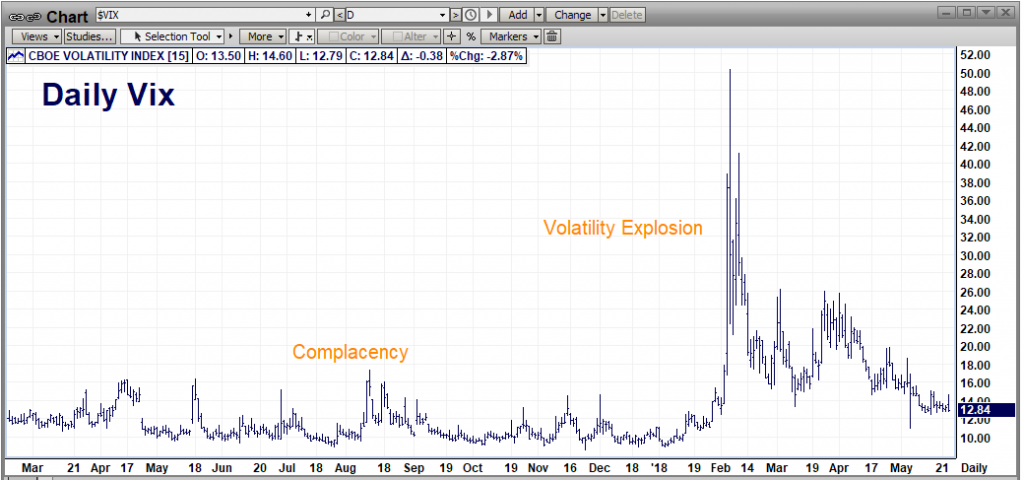

The past 7 months have been full of such opportunities. Perhaps the most well-known was the huge spike in the stock market in early February. Volatility as measured by the VIX spiked, soaring from a low of just below 9% in late December 2017 to a high above 50% in early February 2018 after weeks of abnormally-low readings. Volatility sellers, mesmerized by what seemed to be a “new normal,” were decimated. Volatility buyers who were long stock index puts or VIX calls made out like bandits.

The chart below shows what happens when complacency takes hold in a market with a history of higher average volatility. Stocks spent months trading at volatilities closer to 10% than the 15% average. Option sellers interpreted this as the new normal and were gored when the market reverted to its historical tendencies.

Data Source: FutureSource

Data Source: FutureSource

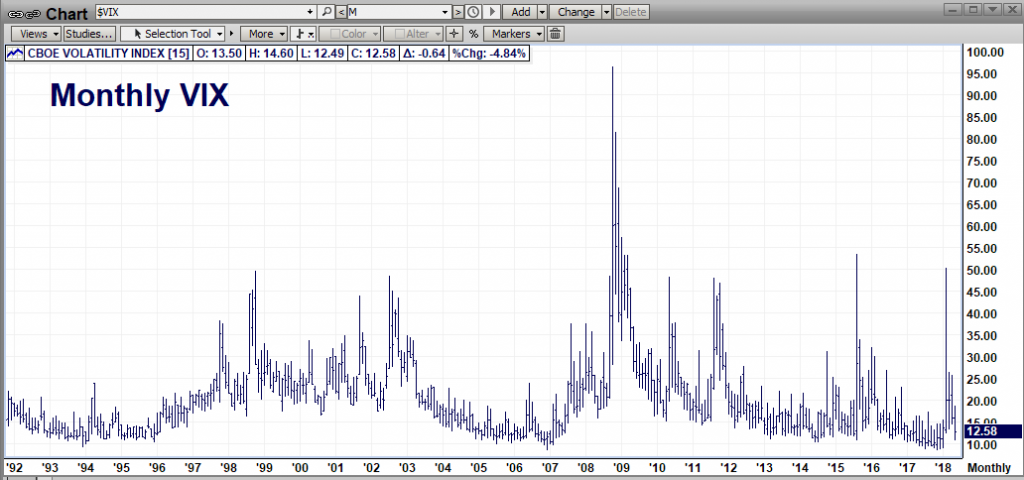

This pattern, marked by long periods of complacency interspersed with explosions of panic, repeats over and over in the stock market as illustrated in the monthly chart of VIX below. The 2008 crash was particularly brutal with volatility approaching 100%.

Data Source: FutureSource

Data Source: FutureSource

Data Source: FutureSource

Data Source: FutureSource

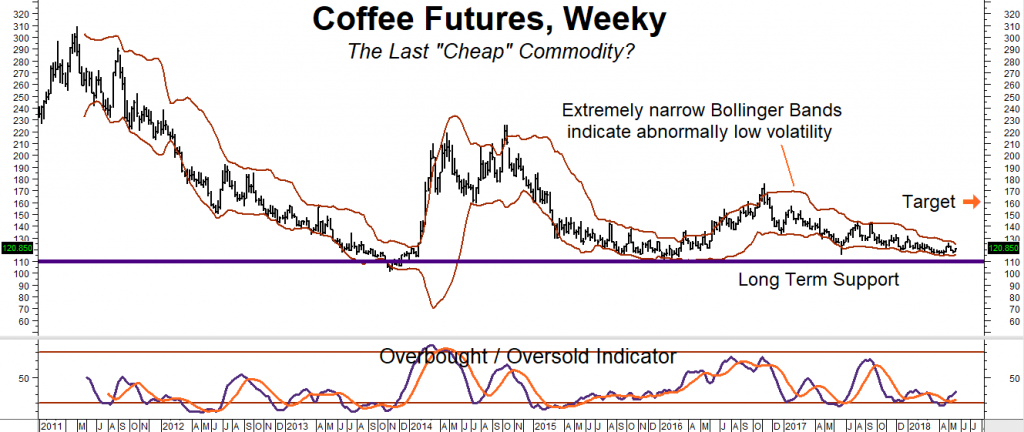

Coffee Options Pricing in Continuation of Quiet Trade

What does the VIX have to do with the price of coffee? Note the similarity of the two charts above. Both markets are prone to violent moves. However, coffee is typically far more volatile than the stock market. Market moves of 20%, 50% and even 100% occur with fair regularity in coffee. Not so in stocks where 20% is a huge move. The December at-the-money coffee puts and calls are currently pricing in a maximum volatility of only 11.78%. This is strangely reminiscent of the abnormally-low readings of VIX in the days prior to February’s panic in stocks. Option sellers in coffee have become complacent, providing those of us on the buy side with an opportunity.

This isn’t the first time we’ve written about abnormally-low volatility. In October we first identified abnormally-low volatility in the sugar market. We wrote about this phenomenon in subsequent blogs covering corn, wheat, soybeans and, yes, coffee. We are writing about the black, bitter stuff again because it is the only market that we alerted our trading customers to in which abnormally-low volatility hasn’t risen yet – something we expect to occur sooner rather than later.

Data Source: Reuters

Data Source: Reuters

Coffee Offers Best Potential “Bang For the Buck”

Is coffee the “last cheap commodity” on the board? It’s definitely in the running. Price is just above good long-term support at $1.10 per pound, discounting most if not all of the ample supplies currently priced into the market. Extremely narrow Bollinger Bands confirm the abnormally-low volatility signaled by the December at-the-money put and call options. Option prices tell us that option sellers believe coffee has lost its “kick” – at least for the foreseeable future. They see a decaffeinated market extending well into the future.

Meanwhile, global demand for coffee continues to grow, especially in China. Starbucks is making a huge bet on the Middle Kingdom. It has a goal of opening 6,000 stores by 2022 and eventually generating as much revenue from China as it does from the US. Starbucks is currently opening a store in China every 15 hours.

We do not know what the catalyst will be to jolt coffee out of its sleepy state, and we don’t know when it will appear. What we do know is that markets like coffee do not stay asleep forever. History tells us that when coffee does finally wake up, it will not do so peacefully. Given its cheap price, inexpensive options and short position complacency, we believe coffee calls could give us one of the best bangs for our speculative buck right now.

Four months ago, it seemed as if the entire commodity sector was asleep. Rallies in grains, energies and huge gains in soft commodities like cocoa and lumber mean morning has finally arrived. It’s time to wake up. As we pointed out in our last blog post, sugar is also beginning to stir. Let’s use recent market weakness as an opportunity fire up the coffeepot.

What to Do Now

RMB trading customers without a bullish position in coffee should consider buying the March 2019 $1.45 / $1.60 bull call spreads for $690 or less. The trade we are looking at right now settled last night at a cost of $690. It has the potential to be worth as much as $5,625.00 should coffee reach or exceed our $1.60 per pound price objective prior to the expiration of March options on February 8, 2019. Your maximum risk is the amount paid for the trade plus transaction costs.

If you purchased the December $1.50 / $1.65 bull spreads we suggested buying in early February, continue to hold. With 170 days left until option expiration, we still have plenty of time.

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) to for more information and/or to open a trading account. You can also visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2018 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.