The productivity miracle of the twentieth and early twenty-first centuries was fueled by crude oil and its derivatives. Diesel made from crude oil powered tractors and combines. Farmers, aided by fertilizers synthesized from the same, produced exponentially more food on the same land leading to rapid population growth. The modern transportation we all take for granted would be impossible without gasoline and jet fuel. Solar, wind and other forms of renewable energy may be making big inroads but the modern world still runs on crude oil.

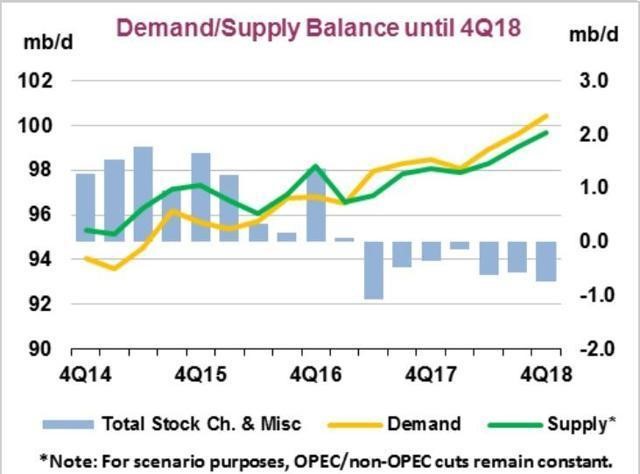

Today’s surprising strength in crude is due to three factors: 1) growing global demand, 2) constrained supply and 3) political risk. Global demand for crude oil was 90.4 million barrels per day (mb/d) in 2012. Today it is 98.4 mb/d and is expected to reach 101.5 mb/d by 2020. The growing affluence of population-heavy China and India account for the lion’s share of this growth. Higher standards of living mean bigger budgets for motorbikes, cars and electricity.

Source: International Energy Agency (IEA)

Horizontal drilling and hydraulic fracturing (“fracking”) have boosted US production to over 11 mb/d. This has made the United States one of the world’s biggest producers and helped drive down prices to as low as $26 per barrel in early 2016. Low prices were met with increased consumption as Americans ditched their small sedans for pickups and SUVs and the global economy went on a tear. It did not take demand all that long to catch up.

Supply Constrained By OPEC and Venezuela Collapse

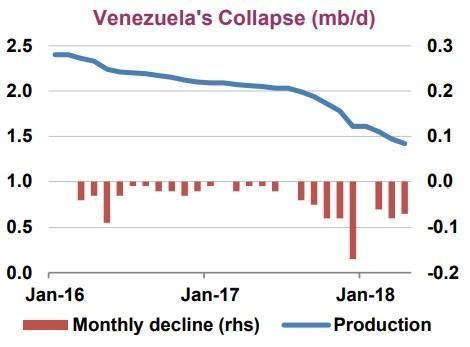

Rising demand for crude oil has not been met by a consummate increase in supply due to successful market manipulation by OPEC and the economic collapse of OPEC member Venezuela. OPEC’s 2016 agreement with mega-producer Russia to cut production by 1.8 million barrels per day succeeded beyond even the wildest expectations due to Venezuela’s rapidly decreasing production and the shuttering of expensive production capacity.

Source: International Energy Agency (IEA

Venezuela’s inflation rate was 112% in 2015. It is now 13,865%. Skilled oil workers, unable to afford to eat on salaries decimated by hyper-inflation have resorted to vandalizing production facilities, selling off anything they can to earn cash. Venezuelan production, already in a steep decline, has fallen off a cliff. Production expected to drop to 1 mb/d by the end of 2018, subtracting 1.5 mb/d from global supply.

New US sanctions on Iran have the potential to remove yet another 1 mb/d from production. This is why oil prices have risen despite OPEC’s late-June agreement to increase production by 600,000 barrels per day. The possibility for further kinks in supply due to ongoing conflicts in Syria and Libya as well as the continuing proxy war between regional powers Saudi Arabia and Iran have also helped blunt the effects of OPEC’s recent production increase.

Refining Margins Remain Bullish

The “crack spread” measures the profitability of turning crude oil into end products like gasoline, diesel and jet fuel and what it is telling us is that the refining business is good. Refiners are making roughly $17 per barrel turning crude into gasoline and roughly $20 per barrel turning it into distillates like diesel and jet fuel.

These kind of margins encourage crude oil consumption. Higher gasoline prices could eventually impact consumption causing these margins to shrink, but this probably won’t happen until the average retail price of a fill-up approaches $4.00 per gallon. This is roughly $1.00 per gallon higher than the current average retail price.

Data Source: Reuters

What to Do Now

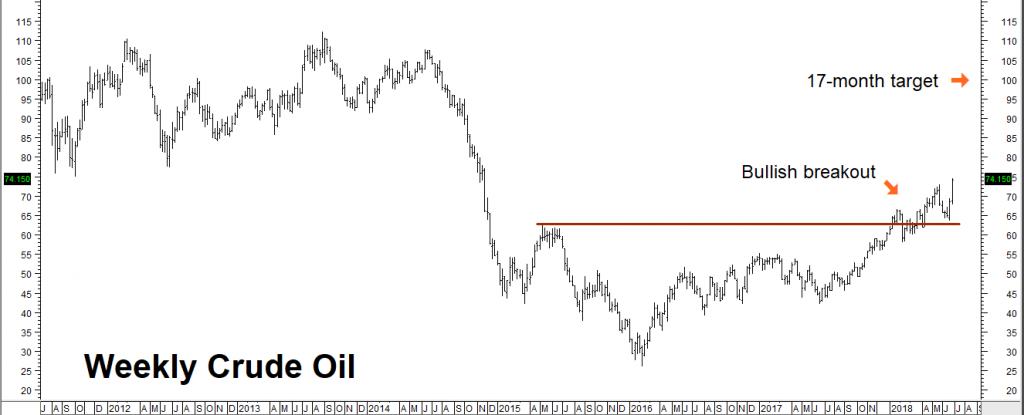

As the chart above suggests, there seems to be plenty of room to the upside for crude oil. We believe the psychologically important $100 per barrel market is a reasonable long term target given growing global demand and structural supply tightness. Old resistance at roughly $62.50 per barrel has now become good support. Front month crude needs to hold February lows at $58 per barrel on a weekly closing basis in order to maintain bullish momentum.

Oil’s big decline in 2016 caused many expensive production ventures like offshore drilling and Artic exploration to get mothballed. It will take years for these projects to restart and to come on line, if at all. However, oil for delivery in the future is trading at a huge discount to oil trading for immediate delivery, counting on supply to equal or exceed future demand. This “backwardation” is generally a bullish sign. It also enables us to take a position in long-dated crude oil options for very reasonable cost. Today’s supply/demand imbalance is not shrinking. Consequently, we expect back month futures contracts to catch up to the near month contracts as supplies flatten out.

RMB trading customers may want to consider purchasing December 2020 $90.00 / $100.00 bull call spreads in crude oil for $600 or less, looking for the December 2020 futures to hit our target of $100 per barrel on or prior to option expiration on November 17, 2020. Maximum risk on this trade is $600 plus transaction costs. Our spreads could be worth as much as $10,000 each at option expiration if our $100 per barrel target is met.

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) to for more information and/or to open a trading account. You can also visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2018 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.