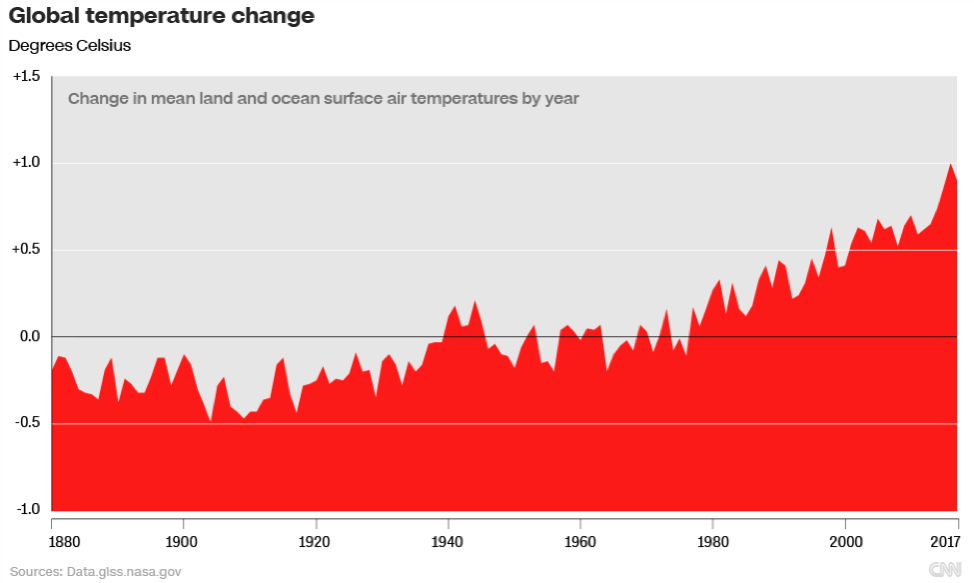

It has been a brutal weather year in the Northern Hemisphere: 119 people died from a heatwave in Japan; 29 succumbed to heat in South Korea; 91 people perished in wildfires in Greece and at least 8 have died in record-breaking wildfires in California. Scientists can now predict with relative certainty how much of an abnormal weather event is due to global climate change.

All of these events were caused, in part, by changing weather patterns. Deadly heatwaves are expected to be much more frequent as global climate change continues. An article, published on August 5, 2018 by CNN, summarizing a National Oceanic & Atmospheric Administration (NOAA) release reported the following:

“The major greenhouse gases — carbon dioxide, methane and nitrous oxide — all rose to record levels last year. The global average carbon dioxide concentration was the highest ever recorded, and higher than at any point in the past 800,000 years, according to ice-core data.”

The effects of climate change have been most severe in the northern and southernmost latitudes. Sea levels have reached new records and polar ice is melting at an increasingly rapid pace. The Arctic and Antarctic regions are the “air conditioners” of the planet. They cool tropical ocean currents and send cold currents back towards the Equator, maintaining a global “equilibrium” in the process.

Warming of the Arctic is occurring at twice the rate of the rest of the world. It could be one of the reasons that North America and Europe, both with increases of 1.1 degree Celsius, have the biggest climb in average temperature of the continents. Rapid changes in the Arctic could be behind the clustering of “100-year” weather events both continents experienced in just the past 3 years.

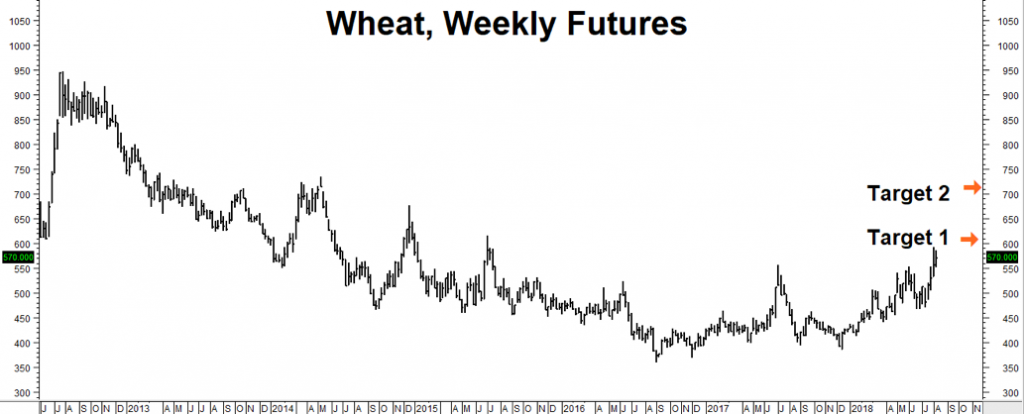

Fortunately, major global crops like corn, soybeans and rice have not been severely impacted yet. However, the odds that one or more will experience negative impacts due to climate change are rising along with global temperatures. Wheat prices are already climbing due to warming in the Northern Hemisphere.

Hotter and drier-than-normal conditions in Europe have significantly reduced expected yields of both Russian and Ukrainian wheat crops. A devastating drought in Australia has hurt the wheat crop there as well. Not surprisingly, wheat continues to buck the bearish pull of the Trump Tariffs. Wheat prices are now within striking distance of our first upside target of $6.10 per bushel. Further disruptions could drive prices above that fairly quickly.

Data Source: Reuters

Hotter Climate Has Direct Effect on Crop Yields

Weather disruptions could have more pronounced effects on other critical commodities. A study conducted by the National Academy of Sciences has discovered a direct correlation between warmer temperatures and decreased crop yields. Quoting from that study:

“Wheat, rice, maize, and soybean provide two-thirds of human caloric intake. Assessing the impact of global temperature increase on production of these crops is therefore critical to maintaining global food supply, but different studies have yielded different results. Here, we investigated the impacts of temperature on yields of the four crops by compiling extensive published results from four analytical methods: global grid-based and local point-based models, statistical regressions, and field-warming experiments.

Results from the different methods consistently showed negative temperature impacts on crop yield at the global scale, generally underpinned by similar impacts at country and site scales. Without CO2 fertilization, effective adaptation, and genetic improvement, each degree-Celsius increase in global mean temperature would, on average, reduce global yields of wheat by 6.0%, rice by 3.2%, maize by 7.4%, and soybean by 3.1%. Results are highly heterogeneous across crops and geographical areas, with some positive impact estimates.”

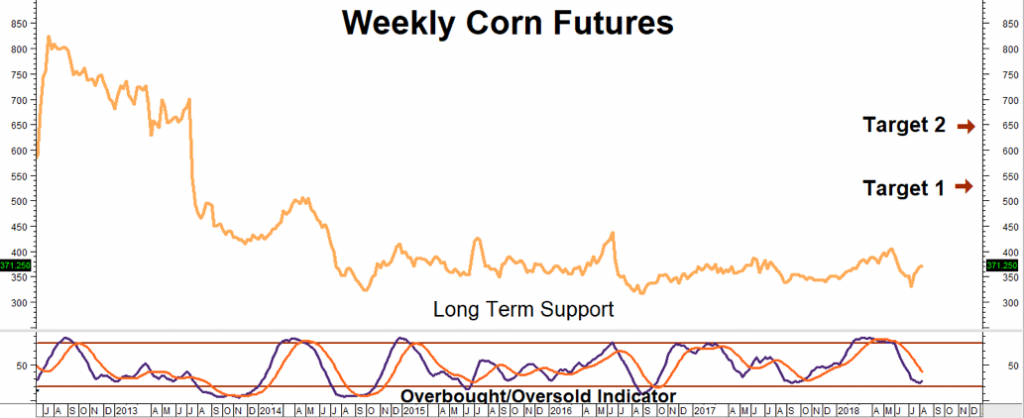

Corn is the most affected by increased temperatures. Two of the globe’s biggest producers of corn are the US and China. Searing June heat in China’s corn-producing areas caused the Chinese agriculture department to slash production estimates to the lowest in 4 years. This heatwave was immediately followed by storm-driven downpours and flooding.

North China Plain Particularly Vulnerable to Heat

China’s northern plain is one of the most densely-populated areas of the planet, containing the super-cities of Beijing and Tianjin. It is also one of the most fertile areas of China and is critical to the food security of the Middle Kingdom’s 1.4 billion people.

According to a recent article published by www.news.com.au : “This spot is going to be the hottest spot for deadly heatwaves in the future, especially under climate change,” warned lead author MIT professor Elfatih Eltahir “…Records show that, since 1970, heatwaves there have become both more intense and more frequent. Since 1990, their frequency has exploded.”

Like the Arctic, China’s North Plain is experiencing climate change at double the rate of the rest of the world. And why this doesn’t mean catastrophe is right around the corner, it does point to trouble brewing for China’s food supply. Temperatures could rise far enough to kill outright – especially when combined with high humidity.

The Chinese government is aware of this. It is one of the reasons why China has developed the world’s largest “weather machine,” which uses silver iodide particles to create rain and can alter the weather over a landmass the size of Alaska.

Will this machine be enough to manage the outsized effects of global climate change on the North China Plain or will it cause more problems than it is intended to solve? The ad tagline, “Don’t mess with Mother Nature,” is worth remembering. Let’s hope China doesn’t ever have to test it.

Global Grain Supply Meeting Demand, But Just Barely

As we’ve stressed in past blogs, five years of bumper crops in the US and South America have been enough to meet the growing global demand for grain caused by increased populations and changing eating habits in the population-heavy countries of Asia – but just barely. Emergency stockpiles exist, but are nowhere close to what would be required to make up for major shortages of any of the world’s major food crops. Meanwhile, the side effects of global climate change are appearing more frequently – and packing more of a punch.

We believe the probability of a catastrophic weather event affecting one or more of the world’s key commodities is not a question of “if” but “when.” Like purchasing hurricane insurance after the storm passes, waiting for such an event before acting will massively increase both the expense and the risk of entering a bullish position.

Commodities Still On Sale

Wheat may already be out of the gate, but many key commodities are still on sale. This is something we’ve been writing about and will continue to write about until they disappear from the discount rack. Most commodities are still hovering at or slightly above recent lows. We can use beaten-down call options to take bullish positions in a number of commodities for surprisingly low cost and risk. The commodity we want to focus on right now is corn.

Data Source: Reuters

Not only is the yellow grain one of the vulnerable crops planted on the North China Plain, it has decent fundamentals according to the USDA’s July World Agriculture Supply and Demand Estimates (WASDE) report. Beginning stockpiles dropped 75 million bushels due to exports designed to beat the implementation of China’s retaliatory tariffs. Exports rose 125 million bushels despite the tariffs. And while 2018 production is 190 million bushels higher than previously estimated due to increased acreage, larger supplies were more than offset by usage.

The Trump tariffs may have halted corn’s ascent in April, mucking up our plans for the December 2018 $4.00 and $4.20 calls we recommended, but it remains on sale despite its rather impressive recovery from post-tariff lows. With 100 days left until expiration there is still plenty of time for corn to chug higher. As a result, we would like to buy a little more time.

What to Do Now

RMB trading customers who purchased December 2018 $4.00 corn calls should consider “rolling” them into December 2019 $4.20 corn calls. This “roll” will cost roughly an additional $800 at the time of this writing. It will also extend the life of your bullish position by 364 days. Your replacement $4.20 call has the potential to be worth as much as $5,500 should corn hit our $5.30 target prior to option expiration on November 22, 2019.

RMB trading customers who purchased December 2018 $4.20 corn calls should consider “rolling” them into December 2019 $4.40 corn calls. This “roll” will cost roughly an additional $750, but like the “roll” suggested above, it will extend the life of your bullish position by 364 days. Your replacement $4.40 call has the potential to be worth as much as $4,500 should corn hit our $5.30 target prior to option expiration on November 22, 2019.

RMB trading customers without a bullish position in corn may want to consider the purchase of a December 2019 $4.20 or $4.40 call outright. Prices can and do change, so check with your personal broker for the latest.

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) to for more information and/or to open a trading account. You can also visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There