A little over a month ago RMB Big Move Trade Alerts recommended a two-step option strategy to take advantage of a possible bottom in silver – a market we felt wasn’t getting much attention. We are very pleased by how that strategy is playing out. (Click here to re-read that report.) While we still believe silver has the potential to outperform gold, we cannot ignore the performance of its richer cousin.

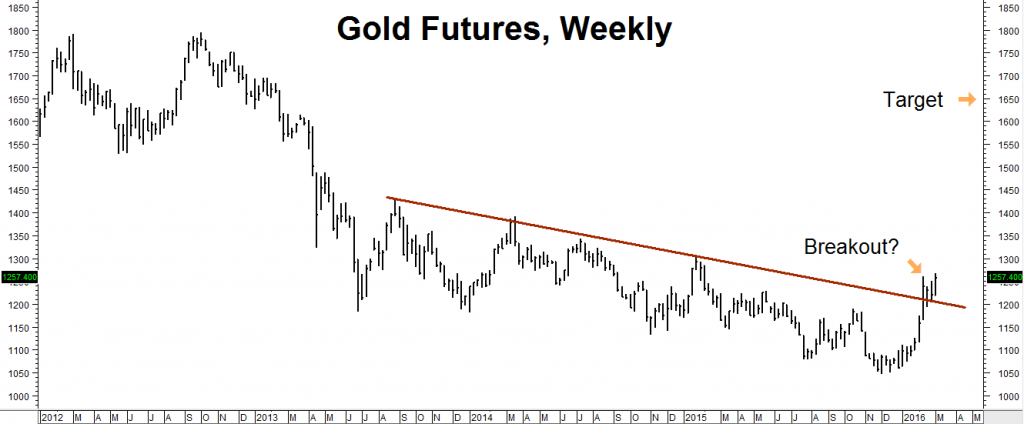

The two charts below show what silver and gold have achieved so far:

Data Source: Reuters / E-signal

Data Source: Reuters / E-signal

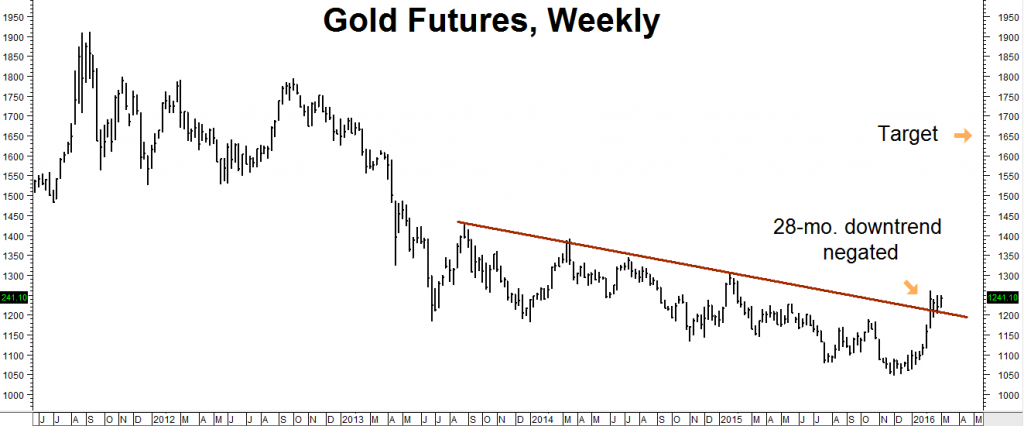

Silver is flirting with a breakout, but gold appears to have broken out to the upside already, negating its 28-month intermediate-term downtrend in the process. We still believe silver will catch up and eventually surpass the yellow metal, but the facts favor gold now. The three main reasons are: 1) negative interest rates, 2) unsettled currency markets, and 3) the “risk off” flight to safety.

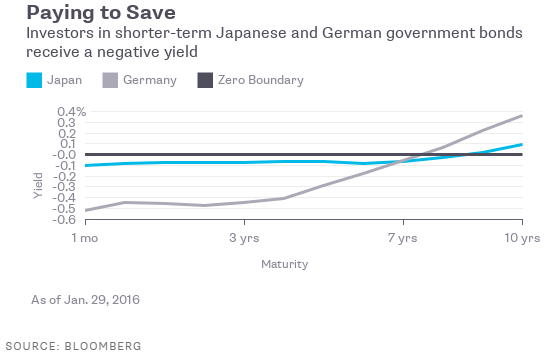

Let’s start with negative interest rates. We covered them in last month’s Big Move Trade Alert on silver. Then we asked a simple rhetorical question: “Want to make sure your money is safe by parking it in a bank or government bonds?”

Our answer? It’s going to cost you in a growing number of nations. Central banks hope negative rates will discourage investors from playing it safe, encouraging them to invest their cash in the “real” economy instead. Central banks are run by economists who assume people make rational decisions. But evolution has wired humans first and foremost for fear.

“Negative rates send a signal that things are bad and could get worse. Safety quickly becomes something that investors are actually willing to pay for – defeating the whole purpose of negative rates in the first place and forcing central banks to make them even more negative to achieve the desired effect.”

This is already happening. Investors in German and Japanese government bonds need to go out more than 7 years to get a positive return.

Cash Hoarding Environment Favors Gold

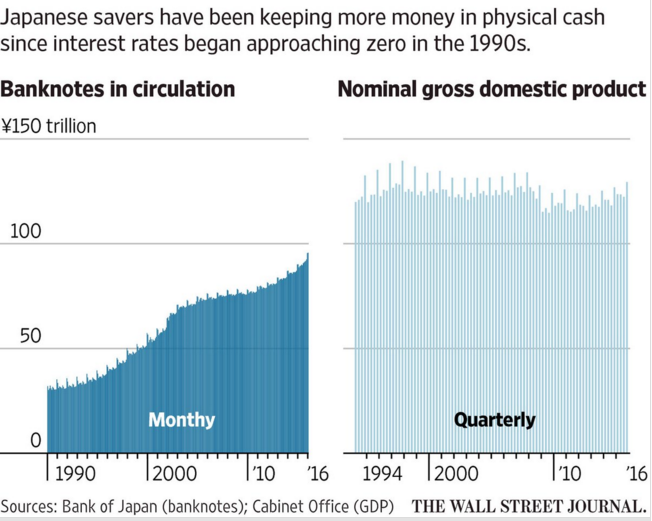

Why is gold so strong right now? Because if it costs money to store money safely in banks or government securities, investors will begin hoarding cash rather than paying to store it. Japanese interest rates have been negative for some time, so it is not surprising that the sales of vaults and safes are skyrocketing.

The Bank of Japan (BOJ) has been using negative interest rates to discourage saving, incentivize consumer spending and generate inflation. But why should consumers buy when they believe lower prices are coming? This problem has now spread to Europe.

Like the BOJ, European central bankers do not want potential consumers to hoard cash, so they are talking about discontinuing the €500 note under the guise of fighting drug-money laundering. Similar conversations about the $100 bill are occurring in the US. Storing cash can take up a lot of room – especially when large denomination bills are left out of the question.

One single 100-ounce gold bar weighs 6.25 pounds, can be transported fairly easily and is worth $126,300 at the current price of $1,263 per ounce, or the equivalent of 1,263 $100 bills. Which is easier to store (or hide as the case may be)? Could this be part of the reason gold is becoming so popular?

Quoting from a Wall Street Journal article, billionaire bond investor Bill Gross has a similar take: Mr. Gross takes note of the “somewhat suspicious uniform attack on high denomination bills,” the sudden crop of arguments against the $100 U.S. bill or the €500 euro. Why might that be? It appears that the one remaining escape hatch for ordinary citizens is being closed…” (Note: the emphasis is ours.)

Let’s borrow from January’s Big Move Trade Alert on silver as well:

“Precious metals like silver and gold have been associated with money since the dawn of history. Some people believe they actually ARE money…one of the big knocks on silver and gold is that it pays no interest and therefore generates no return. Worse yet, holding physical gold and silver actually costs money in terms of storage costs, insurance, etc.

“What happens when these disadvantages are removed by forcing similar conditions on investors looking for safe ways to store their cash? Gold and silver don’t look so bad when it costs money to leave cash in a bank or in government securities.

“Depending on how high the negative interest rate premium becomes, gold and silver may turn out to be even better alternatives than cash. Have we reached that point yet? No. Are we getting closer? You bet we are.”

Gold is almost exclusively a monetary metal – unlike silver which also has a large industrial component and is a more liquid market. These two factors alone could account for gold’s outperformance up to this point.

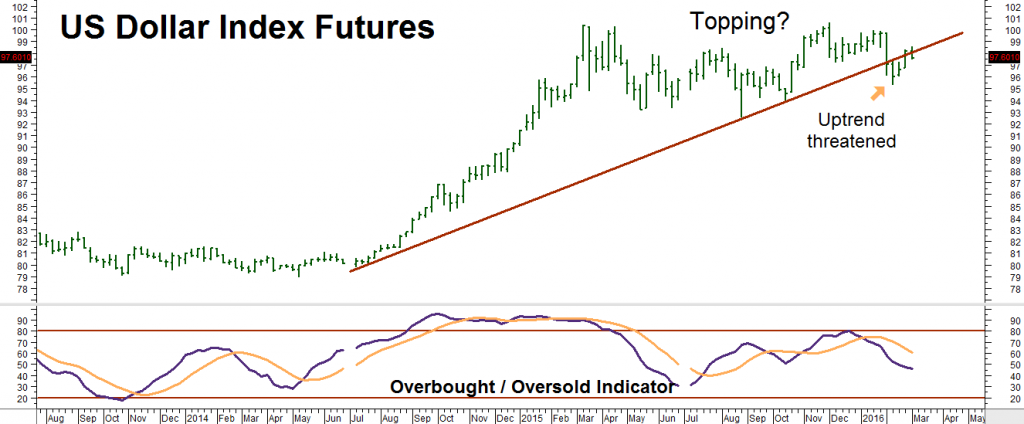

Dollar Topping?

Data Source: Reuters / E-signal

The strong dollar has been one of the biggest impediments to gold and silver. If you read the financial press, you get the impression that the dollar is in a rip-snorting bull market. But is it? Not according to the chart above. In fact, the mighty dollar is starting to look a little “long in the tooth.”

It may not be moving down yet – but the dollar has definitely stopped going up. As the chart illustrates, the big, bad buck has been moving sideways for over a year, shaping up to be a classic “head and shoulders” topping pattern. The dollar has stalled and, judging from this chart, the path of least resistance appears to be lower. Cheaper dollars make gold (and silver) more expensive.

Safe Havens Are Harder to Find

“Safe haven” buying is the third prop underneath the gold market. The world is so unsettled that we would need an entire report just to list the events that could negatively impact the global economy. Just pick up your daily paper or turn on your computer, it’s all there – from the crazy US election, to the war in Syria, to the immigration debacle in Europe, Britain’s threat to leave the EU (Brexit), North Korea putting its nukes on alert; the list goes on and on…

Traditional “safe havens” like government securities and bank accounts currently provide little return or, in the case of negative rates, a losing return. Even the almighty dollar has stopped going up. No wonder investors are feeling the need to add a bit of gold to their portfolios.

What To Do Now

In our last Big Move Trade Alert on silver we recommended a long-term call option trade with two levels. We are recommending an almost identical strategy for our trading customers in gold:

Step 1: Consider buying COMEX December 2017 $1,400 / $1,650 bull call spreads in gold. The strategy we are recommending right now costs roughly $4,200 and has the potential to be worth as much as $25,000 should our long term target of $1,650 per ounce be reached on or prior to the expiration of our options on November 27, 2017. Our maximum risk on the trade is the $4,200 cost of our spreads plus transaction cost.

Step 2: Sell a December 2017 $1,050 put for roughly the same amount and use the proceeds to cover all (or most) of the cost of Step 1. When we sell this put, we receive money in exchange for the obligation to buy 100 ounces of gold at $1,050 per ounce.

To add “Step 2” you need to be willing and financially able to own 100 ounces of gold at a price of $1,050 per ounce and to fund a futures account with enough margin to hold a long futures position.

Why not buy gold outright? Because it would cost more to get the same bang for the buck. Step 1 of the trade above gives us exposure to $126,300 worth of gold for a maximum cash outlay and risk of $4,200 plus transaction costs – or roughly 3.4 cents on the dollar. Adding Step 2 reduces our cost to zero (or thereabouts) in exchange for our promise to own gold for $263 per ounce less than the going rate.

Data Source: Reuters / E-signal

Your personal RMB broker can help you customize this strategy to fit your risk tolerance levels by changing strike prices and/or eliminating Step 2. He will be happy to walk you through the trade and explain all the rewards and risks of each version.

Getting Started

You need a futures account to trade the recommendations in this report. The RMB Group has been helping customers trade futures and options since 1984 and are very familiar with all long-term Big Move Trade strategies. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page, scroll down to find the report, then click on it.

——————–

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.