Futures Outlook: 07/8/13

Potential Short Term Fail for Soybeans

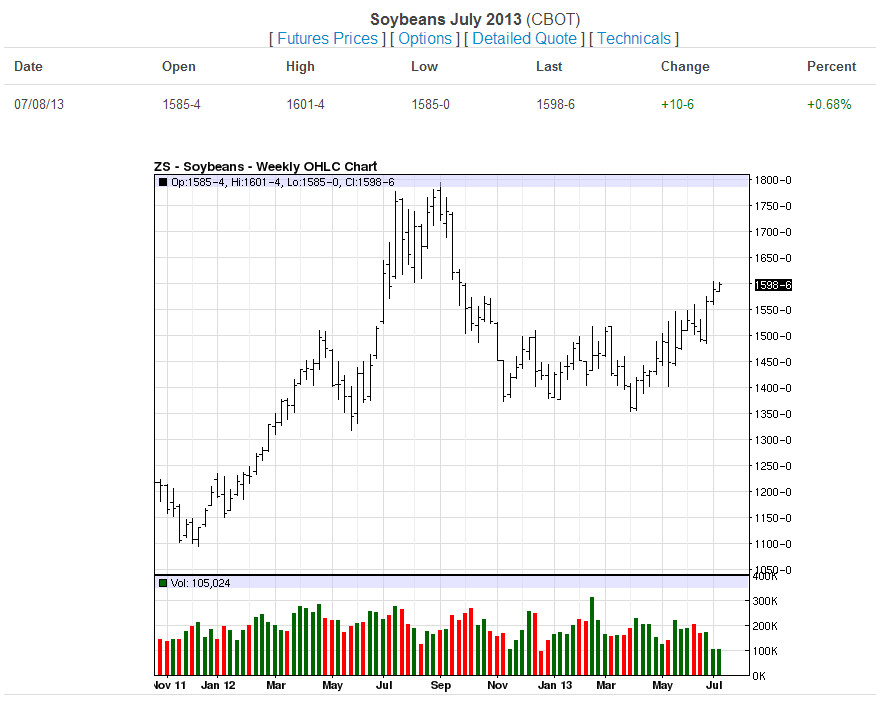

When looking at Soybeans, you will notice that they have been a bit bullish of late. Now might be the time to start looking at them for a short term failure that might stretch into an intermediate type of failure.

Soybeans

Soybeans have had a peak territory in recent years around the 1800 territory and have been in an ascending trend since around 2007. While I do believe that over the next number of years, we may have an opportunity to see almost all food based commodities gain in their price points, for right now I am keen on watching Soybeans for a potential near term failure that could stretch into months.

On the Daily chart, I have highlighted the extreme strength that we saw from the end of April coming through June and July. We moved from the 1300’s up to the 1600’s. Right now the action on the Daily chart seems overextended and in need of short term correction. In the very near term, I would be looking for potential retracement down towards the 1550 territory.

Your Weekly chart on Soybeans shows what could have been a head and shoulders pattern, but one that ended up without the development to the short side. This additional strength is impressive, but we may very well be bumping our heads against a rough resistance level between 1650 and 1750. That 100 point range could be very difficult to get through. In addition, you will notice that we have rallied for a number of weeks in succession. It would be a very healthy time for Soybeans to retrace a bit. From the Weekly chart’s perspective and for those that might be looking at this trade for a number of weeks, a retracement to 1500 I think could be easily done, but it will potentially get “sticky” on the way down between 1500 and 1400.

Now, we come to the Monthly chart which illustrates the amazing run that Soybeans have had over the last six years. The initial slope of the trend line was solid, but not nearly as impressive as the slope has become over the last year or so. Again, when slopes become too strong for too long, the market typically needs a reprieve and that is what I am watching for in Soybeans. I mentioned 1500 as a near term target and that the levels between 1400 and 1500 might be a little difficult to break down, but if 1400 is able to be breached well over the next number of weeks then you may have months of short side capability as it would then be a nice little trend line break. If it is able to do that, then I would look to 1100 as an ultimate retracement target.

Keep in mind that right now all things appear to remain bullish, so you will need to realize that this play would be counter trend which means that you would need to be more attentive. In addition, you will need to watch for the market to initiate the selling pressure that you need to get started.

If any of you are contrarians, but don’t like “betting the farm”, you might actually consider using options to allocate lesser capital in a fixed risk scenario. That would allow you to bet on the farm without betting the farm.

For more information or for daily assistance with the Options market on Commodities and Futures, visit www.rmbgroup.com or click here to get started today. Call: 1-800-345-7026 for additional information.