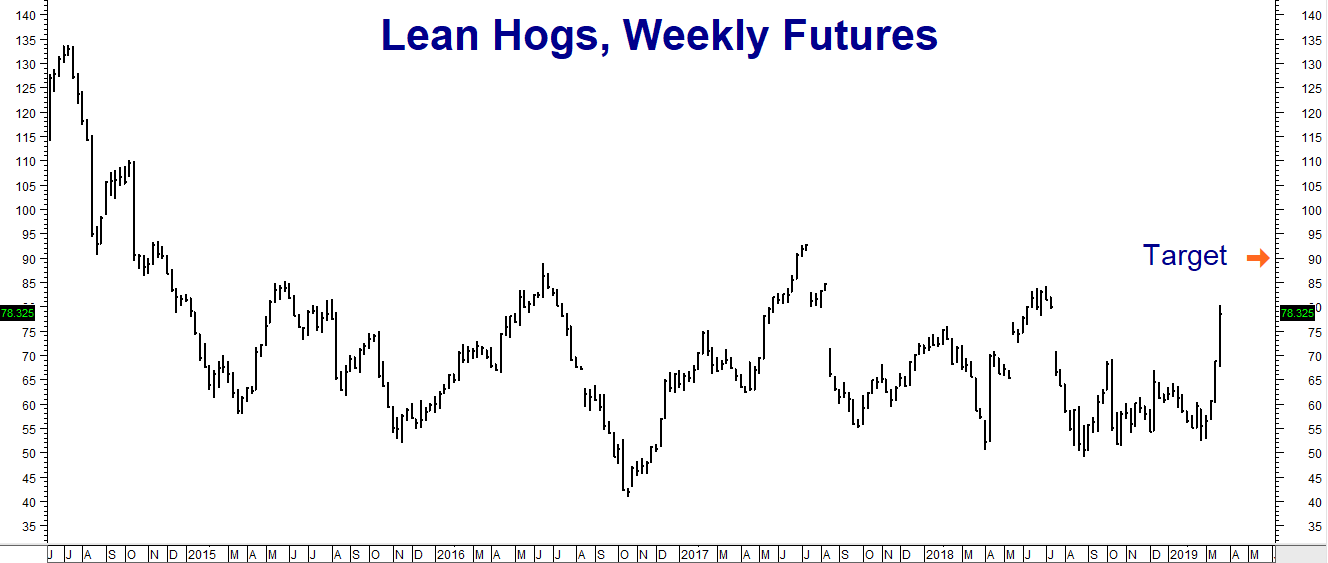

Hog prices are soaring as the effects of African Swine Fever (ASF) are finally starting to hit home in pork-loving China. We wrote about ASF in a September blog post and recommended a six-month option play to try to take advantage of higher prices caused by a supply shortage directly related to the disease. The market ignored the potentially devastating effects of the disease and went nowhere for months. But, as the chart below illustrates, things have changed:

Data Source: Reuters

Three weeks ago April hog futures were trading at 53 cents per pound – 37 cents below our original 90 cent target. This morning they are trading for 78 cents per pound, proving once again the wisdom of the most famous “Yogi-ism”: “It’s not over until the fat lady (or in this case, fat “piggy”) sings.”

Wildly bullish action in the hog market means the April 80-cent / 90-cent bull call spreads that we suggested buying for $700 or less back in September, and had pretty much written off, are now trading at a price slightly above where we initially purchased them. That’s the good news. The bad news is they have just 18-days left until expiration.

This leaves us with a choice. Do we take our money and run? Or do we let crazy bullish scenario caused by this disease play out a little longer? It is a tough call, but a great choice to have given where our spreads were trading just a month ago. The next 18 days will determine whether this trade is a home run or just a long out: worth as much as $4,000 or as little as zero. How you play it depends on your tolerance for risk.

Here’s our take:

RMB trading customers owning more than one of the bull call spreads referenced above should consider exiting half at current levels. Hold the balance for a move above 80-cents per pound. Exit all remaining positions should our 90 cents per pound target get hit at any time during the trading day.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1991 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.