Managed futures can be confusing to individual investors. Technical jargon and a lack of familiarity with futures and options leave many investors befuddled and wary. But managed futures are more than just esoteric, “black box” mumbo jumbo. During times of crisis, they can be the best friend an investor can have. Managed futures are often at their best during time of increased volatility.

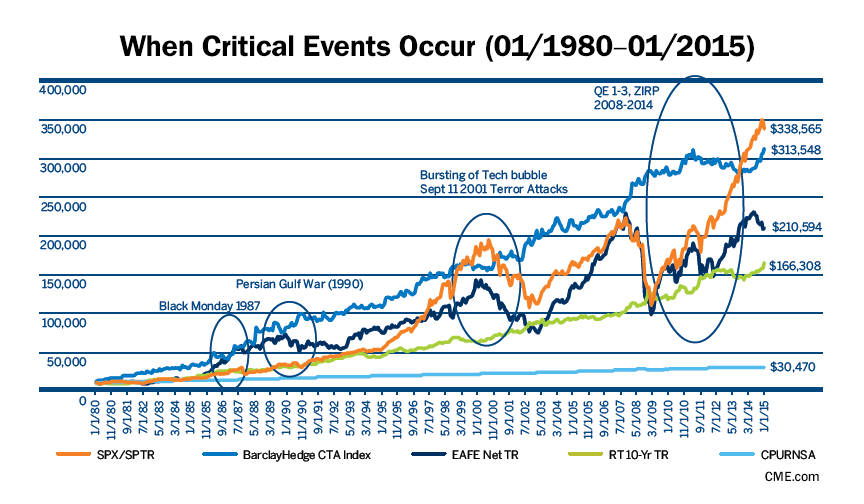

This played out in spades during the 2008 financial crisis. The S&P 500 got crushed, falling more than 50% in just fifteen months. Commodities, high yield debt and real estate took it on the chin as well. The damage wasn’t just limited to the US; the entire globe felt the pain. Amidst all this carnage the Barclays CTA index was up over 13%. We’ve referenced the chart below before, but it warrants another look now.

2008 Crash Effects Still Being Felt

Much of the world is still reeling from the 2008 crash today. Europe is flat-lining; Japan remains a basket case 30 years after its stock market crashed in the 1980s and, with a debt-to-GDP ratio approaching 300%, China is a huge financial accident just waiting to happen.

The zero interest rate (ZIRP) policies employed by the globe’s central bankers to break the fall of the world’s economy in 2008 have morphed into the negative interest rate (NIRP) policies of today. ZIRP funneled cash through the banking system. This benefited those closest to the banking system. Wall Street did great. Everyone else got left behind.

Central bankers believed that forcing savers to take on more risk in the stock market would push stock prices higher. They were right about that. Stocks are higher – much higher. Central bankers also thought higher stock markets would inspire confidence which would “trickle down” into the overall economy causing consumers to open their wallets and entrepreneurs to plow cash back into their business. They got this dead wrong.

By artificially forcing interest rates lower, the Federal Reserve robbed America’s smaller investors of their only source of safe retirement income. Savers could no longer earn any meaningful return on their savings and could not afford risking the small amounts they had put aside in the stock market so they took the only course of action the Fed allowed them; they saved more. This was money that would normally have gone into consumption, but didn’t. So rather than encouraging growth, the Fed’s policy did the opposite.

More well-off investors can afford to take on more risk. Not surprisingly, they’ve been the biggest beneficiaries of higher stock prices. By imposing a de-facto tax on safe interest income, the Fed inadvertently redistributed wealth from savers and retirees into the pockets of those who could afford to take more risk – the already well-off. The ones who could least afford the burden of bailing out the banks after the 2008 crash, were the ones forced to.

Negative interest rates are forcing savers to actually pay the banks for the privilege of holding customer deposits money in Japan and Europe. Negative rates could be coming to the US as well – despite the failure of the Fed’s zero interest rate policy to help the average American. Instead of earning nothing on savings, depositors would be penalized for just having them.

Expect More Political and Economic Volatility

Voters worldwide are justifiably angry and are looking for someone or something to blame. Bernie Sanders, Donald Trump, Brexit, and the rise of nationalist parties all across Europe are manifestations of an anger that has the potential to be very destructive. Anger allows no nuance. It assigns blame rashly and almost always demands immediate justice – consequences be damned. It is dangerous. But that where the world is right now.

Add to this raw anger, the looming US Election, overvalued stock and bond markets, soaring instability in the Middle East and the increasing possibility that a global war could be triggered by nuclear North Korea or by just a small miscalculation by the great powers in the South China Sea increase odds that markets will be more volatile going forward.

Nobody knows when the next financial calamity will occur or what will ultimately be the trigger. That’s why we believe it is important to be prepared and why professional money managers like university endowments, pension funds and family offices use managed futures. Managed futures are not correlated to stocks, bonds and most other traditional investments, making them effective diversification tools.

Three Managed Futures Programs versus the S&P 500

S&P 500 Stock/VIX Program Agricultural Program Energy Program

The table above shows the performance of three managed futures programs we are following versus the S&P 500 and each other. The first specializes in trading stock market volatility and global stock indexes. The second trades agricultural commodities and third trades energy. We have not supplied the name of these programs because we do not want anyone making a decision to enter them based solely on the information supplied above.

Investors should consider adding managed futures to their investment portfolios only after carefully reviewing the Disclosure Documents of each CTA they are interested in. A Disclosure Document is to managed futures what a Prospectus is to stocks. It includes the background, trading style and experience of traders running the program. It also lists risk factors and other information, including the minimum account size each program will accept and audited track records for the trader or traders running the program or programs.

What the table above is meant to do is provide a real-time (albeit limited), real-world example of portfolio diversification using managed futures. The 20 month time period of this example is far too short to take to the bank but, it is enough to show how each program performed over different market conditions — including bull markets, bear markets and sideways markets.

How to Make Friends with Volatility

The traders that run successful managed futures programs are well-versed in volatility. It is just as easy for a CTA to go short a given market as it is to go long. Most CTA’s are trend followers. They don’t care which way a market is moving as long as they are on the right side of it. Fear is a much more powerful emotion than greed, making downtrends potentially more powerful than uptrends. This ability to trade from either side of a market, along with the ability to trade markets that have nothing to do with stocks, bonds or real estate make managed futures a particularly effective diversification tool.

What you are buying when you add a managed futures program to your portfolio is the skill of the Commodity Trading Advisor (CTA) managing the portfolio. This is the hardest concept to grasp for individual investors – even those well-versed in stocks and bonds. The markets a given CTA trades are important, but not as important as the skill of the CTA trading them.

Institutional investors understand this but, as we mentioned at the beginning, it is much harder for individual investors to get their arms around this concept. To help individual investors understand managed futures better, the RMB Group wrote a booklet on managed futures called “Opportunities outside the Stock Market” which can be found on our website.

If you would like to know more about the managed futures program we are currently following or would like more information on managed futures in general, please feel free to give The RMB Group a call toll-free at 800-345-7026 or 312-373-4970 direct.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.