Sketchy weather in some of the major wheat-growing regions of the world appears to be putting a floor under wheat prices. Dry soil conditions that hampered the planting of winter wheat in Ukraine and Russia are now being followed by colder-than normal weather, stressing the Eastern European wheat crop.

The collapsing Ukrainian hryvnia (down 40%) and cheap Russian ruble have kept prices in the international wheat market under pressure – enabling both countries to undercut prices in the export market. Like sugar, wheat is priced in dollars. This encourages Eastern European farmers to sell because they receive more of their home currencies when they do. However, fuel and fertilizer are also priced in dollars making them more expensive, discouraging increases in planted acreage for the next crop.

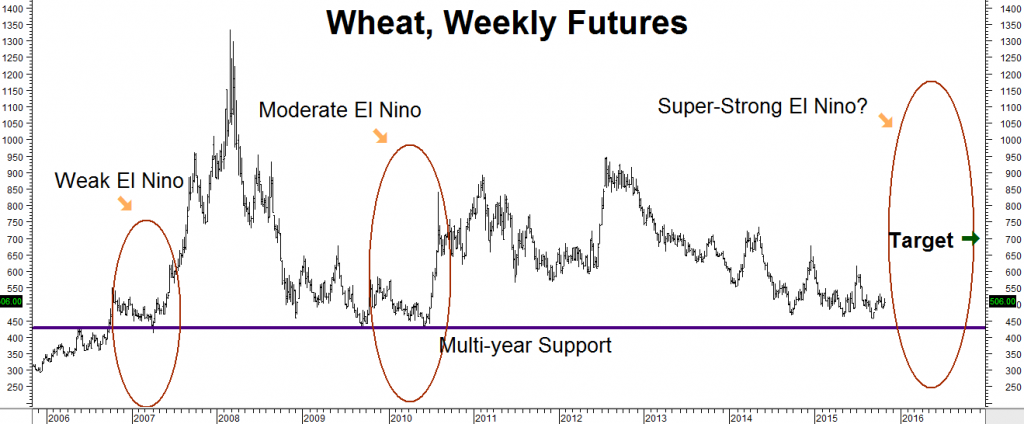

Unsettled weather in America’s southern plains – including flooding that threatened to wash away seeds in Arkansas and Louisiana – is also raising concerns. Australia can export as much as 80% of its wheat in good years. This tends to drive down international prices when the crop is good. The possibility of worsening dry conditions in Australia due to El Niño could remove a lot of the price pressure evident in the chart below.

The past two El Niños have been followed by higher wheat prices. And while there is no guarantee the same thing will happen again, wheat is currently bouncing from multi-year support and appears to be forming a bottom. Our 1-year target for a potentially bullish El Niño event is $7.00 per bushel. This corresponds with an area of long term resistance.

RMB Group trading customers may want to consider using long-term call options in wheat to construct a bullish position. We are currently recommending a bullish position in the December 2016 wheat options with a maximum risk of $900 plus transaction costs. It could be worth as much as $5,000 per unit should our $7.00 target be reached on or prior to option expiration on November 26, 2016. Check with your personal RMB Group broker for the latest or contact us at the numbers listed below.

Getting Started

You need a futures account to trade the recommendations updated in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with this strategy. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more about them, download the “RMB Short Course in Futures and Options” – our easy-to-read booklet covering all the basics. Go to our website www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page, scroll down to find the report and click on it.