We live in an age of global chaos. Ten years of war by the world’s only remaining superpower frittered away the turn-of-the century “peace dividend” and turned Clinton era surpluses into crushing deficits. To fill the hole left by her wars, the US began a borrowing binge unprecedented in history. A decade marked by excessive credit ended brutally with the 2008 global economic crash – a decline rivaled only by the Great Depression. The world has still not recovered 5 years later despite artificially low interest rates and global central bank printing presses running full tilt.

We live in an age of global chaos. Ten years of war by the world’s only remaining superpower frittered away the turn-of-the century “peace dividend” and turned Clinton era surpluses into crushing deficits. To fill the hole left by her wars, the US began a borrowing binge unprecedented in history. A decade marked by excessive credit ended brutally with the 2008 global economic crash – a decline rivaled only by the Great Depression. The world has still not recovered 5 years later despite artificially low interest rates and global central bank printing presses running full tilt.

Led by Ben Bernanke and the Fed, the world’s central bankers are still trying to manage this crisis – caused by excess debt – with even more debt. But nowhere is this tendency more dangerous right now than in Japan.

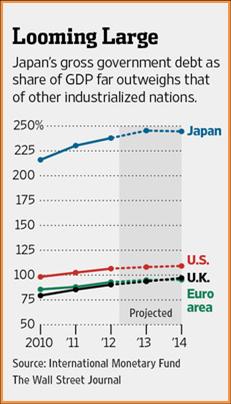

At nearly 250% of its Gross Domestic Product Japan’s (GDP), Japanese government debt is potentially more destabilizing than that of any other developed nation. It is so high that the International Monetary Fund (IMF) recently deemed it “unsustainable” and called upon Japan to bring it under control.

Circumstances are forcing the Land of the Rising Sun to do the opposite. If Japan implemented even half of the austerity necessary to reduce its debt burden, its economy, already struggling, could collapse completely.

Japan’s most recent budget calls for roughly 50% of new spending to be financed from taxes – 24% of which it will spend on interest for bonds already outstanding. The other 50% will come from newly issued bonds, adding even more debt to an already unsustainable load.

Biggest Debt + Lowest Interest Rates = Formula for Disaster

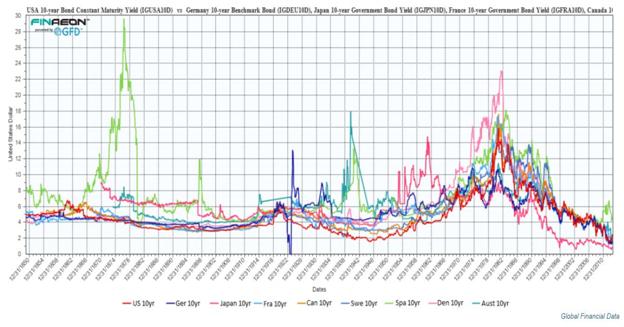

Japan may have the biggest debt problem of any developed nation, but strangely enough, it also has the developed world’s lowest long-term interest rates. How is this possible? Who would lend money to a nation with this kind of debt load at all, never mind for a return of a mere 0.78% for tying capital up for 10 years? That’s what Japanese Government Bonds (JGBs) are currently yielding.

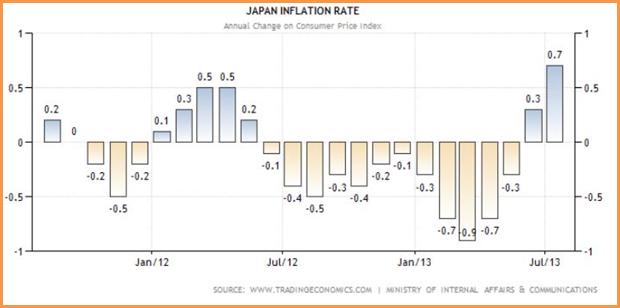

The answer is the Japanese themselves. Japanese individuals and institutions have been buying the lion’s share of JGBs for years. With inflation running at zero and, at times, less than zero, yields of 1% or less still equated to a positive real rate of return.

No more… Newly elected Japanese Prime Minister Shinzo Abe has declared war on deflation, opting to put an end to three decades of shrinking prices. 0.78% on a ten-year JGB doesn’t look so good when prices are actually rising. That’s partly why Mr. Abe and BOJ Governor Haruhiko Kuroda have embarked on a massive bond buying spree. They know that their nation is between a very big rock and a very hard place.

Japanese debt is so large it cannot be mathematically paid off without a combination of much stronger economic growth (which means more government revenue), inflation and higher taxes. The math barely works with all three. Remove one and the odds of an eventual default rise dramatically. Since it is a developed economy with a huge demographic problem of not enough new workers to pay for retiree benefits, the only way Japan has a chance to service its debt is to cheapen the value of the currency that debt is denominated in.

Japan has no choice; it must inflate, raise tax revenue and grow rapidly to have any hope of avoiding eventual default. The quickest way to this is to debase its currency. A cheaper yen makes Japanese exports cheaper, while reducing the real value of debt still outstanding.

But Japan has another huge problem. The staggering debt it has already accumulated becomes downright deadly at higher interest rates. US 10-year yields have nearly doubled in just the past eight months. A similar increase in JGB rates would soak up well over 50% Japanese tax revenue just to pay the interest. The chart on page 2 shows the yields of 10-year government securities for the largest G7 economies. The pink line tracks JGBs. Why do yields remain so low despite Japan’s precarious fiscal position? The Bank of Japan has a vested interest in keeping them that way.

The “Widow” Maker

Investors are willing to own the yen and Japanese government bonds because of the belief that, no matter what happens, the Japanese themselves won’t crash their own market. So far this logic has proven correct. For all the reasons above, a short JGB position has been the favorite big, contrarian, “I know more than you” bet of the past decade. It has also been dead wrong. As the chart on page 2 suggests, JGBs destroyed anyone trying to short them. That’s why they were given the name: “The Widow Maker.”

What’s different now? Real Japanese interest rates. The BOJ massive bond buying program is finally creating inflation. At the current inflation rate of 0.7%, real yields on JGBs are essentially zero. If the BOJ succeeds in its stated goal to push inflation to 2%, and yields remain at the current 0.70%, JGB investors will lose over 1.30% on every single bond they purchase. How long do you think Mrs. Watanabe will put up with this?

The biggest purchasers of JGBs over the past few decades have been retirees and pension funds. The aging Japanese population will need to start selling these instruments soon in order to get cash to live on. The dynamics of the JBG market that caused so many shorts to lose so much money is changing and changing rapidly. Remember, most investors didn’t believe US 10 year yields would nearly double from 1.66% to 3% eight months ago either. But they did.

What to Do Now

Step 1: In order to have any hope of digging itself out of the hole it has dug the Bank of Japan has no choice (in our esteemed opinion) but to weaken its currency whether or not JGB yields rise. The way we see it, there is simply no way for Japan to pay its accumulated debt without a weaker yen. Expect a huge escalation of the currency war the Land of the Rising Sun has already begun. That’s why our first move would be to short the yen using low cost, fixed risk put options.

Right now we are looking at a strategy with a maximum risk of $1,200 plus transaction costs with the potential to be worth as much as $6,000 should our first target of .9000 be reached in the next seven months. A decline to our second target would make this play worth at least $18,750. (See chart below.)

Step 2: We believe the days of a short JGB position being a “Widow Maker” are numbered and that, like bets on rising yields in the US, short bets on JGBs will eventually pay off big. Rather than risk getting our head handed to us in futures or a short cash position we are looking at JGB put options that can give us big exposure (like the yen puts suggested above) with a reasonable fixed risk.

If you would like to know more about either of these strategies or see our detailed latest real-time recommendations and trading plans for both the yen and /or JGB market, complete the inquiry form below or call toll-free at 800-345-7026 or 312-373-4970 direct and we will go over the trades with you and send you everything you need to get started.

Get the Trade!

Fill out the form below and receive specific trade ideas that

stipulate entry and exit points and risk management techniques.