Futures Outlook: 4/25/14

High Cotton

Cotton has had a nice run recently, but is it about to drop?

Cotton

Some of you may have entered Cotton on our recommendation. Right now, it looks as if it is prepping for a near term retracement. The longer term charts still have yet to break in a remarkable fashion, but it may be time to protect profits.

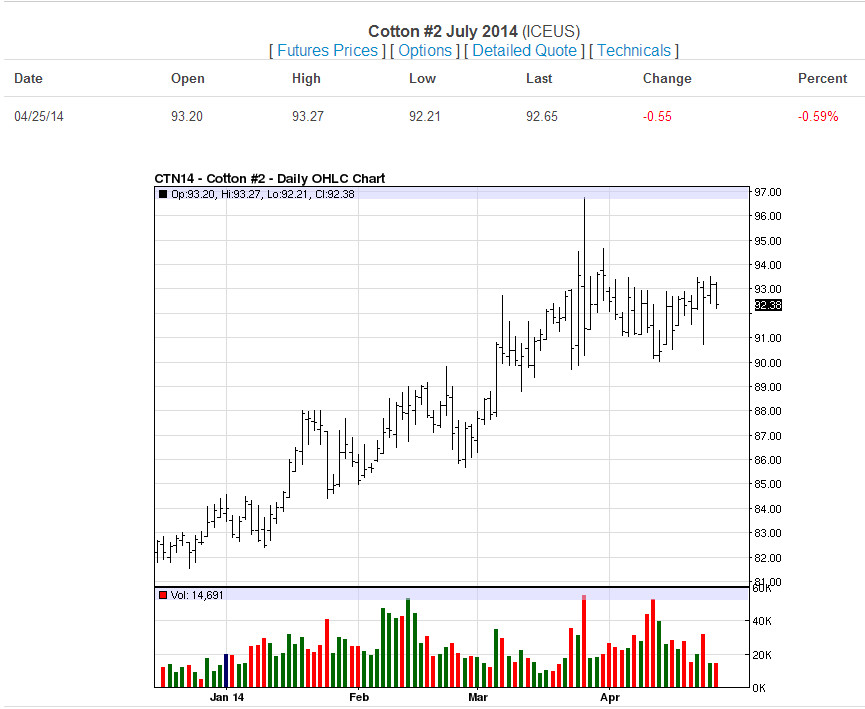

This is the Daily Chart:

As you can see, we’ve been pushing higher almost the entire year. This month we have had a slight retracement and consolidation. We may still push higher, but at this point if you are in a long position and profitable, you might want to consider protecting that profit. One of the numbers to watch here will be the area around 90 for the near term. If we are able to remain above this level then that will be a positive for additional bullish longer term activity.

From the Weekly Chart perspective:

You can see here that the steep ascent on Cotton has been impressive and has lasted for a number of months. At this point it would be “healthy” for the market to take a breath and falter slightly. I personally would be happy with a retracement to around 88 or even 86 as it may potentially refuel the market for the next run up to be truly break the longer term stagnation which you can see on the Monthly chart.

Monthly chart for Cotton:

Here you can see that for the last few years we have actually seen Cotton trade in a range bound fashion. We are still waiting for a true break on this. A near term retracement may offer it the chance to take a bullish action later that is strong enough to break this to the high side. For now however, be prepared to protect your profits if you have them, should we start to see a break down near term.

Questions about this report or trading futures? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures