Ukraine, Schmukraine… Markets are ignoring the biggest and potentially most disruptive geopolitical crisis the world has seen in a while and focusing instead on the vague testimony of the Fed’s new Chairperson, Janet Yellen whose suggestion that interest rates could rise as soon as early 2015 in testimony last week caused big hiccups in a number of markets. We are going to take a look at two of those markets today.

Let’s start with gold…

RMB has been bullish gold since January and remains so. We expected a correction and suggested exiting half of our bullish positions in late February, taking some cash and risk off the table. We recommend holding our remaining bullish positions for now. Given gold’s steep correction, let’s go ahead and move our risk point up from $1,160 per ounce to $1,230 per ounce. Two consecutively lower closes below this level will be our signal to exit.

We will also be watching the 40-day moving average which crosses today at $1,312 in the April futures contract. We will consider adding to our bullish position should the market hold and bounce decisively from this level. Corrections are a normal part of any trending market. A bounce from today’s levels means this is probably a correction. Similarly, failure to bounce may be a harbinger of something worse.

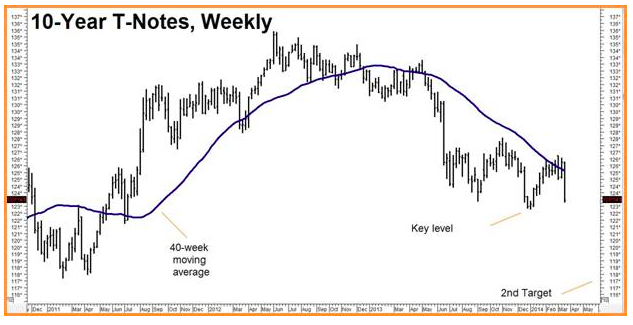

10-year T- Notes Poised for Bearish Breakdown

The threat of higher rates also sent T-notes tumbling, just as flight-to-safety investors were finally starting to crowd back in. Prices initially rose on Ukraine fears, testing and ultimately failing against the important 40-week moving average. The market has now swung the other way and is currently testing support just above old swing lows.

RMB has been bearish bonds and notes for the past two years. Our first long-term objective of 125-00 was achieved last July. Two consecutively lower closes below 122-24 in the June futures contract would put our second objective of 117-00 squarely in our sights. If you’ve be following our “Defusing the Bond Bomb” put option strategy, consider holding all of your positions for now.

Prices do change so RMB trading customers should contact their broker directly for further specifics on these trades. Your broker can also help you custom design a strategy based on lower risk levels and/or differing price targets.

If you are not an RMB Trading Customer and want to know more about how we are playing this or other markets, contact us or give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over a fixed risk strategy with you. You can also e-mail suertusen@rmbgroup.com. Put “Yellen” in the subject line.