Our decision to “roll” our December Japanese Yen short positions in the yen over to January prior to December’s Unemployment report turned out to be a good one. With the Japanese currency currently trading a full 100 points under our strike price and January 3 expiration just a couple weeks away, the conservative play would be to take our cash off the table with the knowledge that the trend is still down, and enjoy the season without having to worry about this trade.

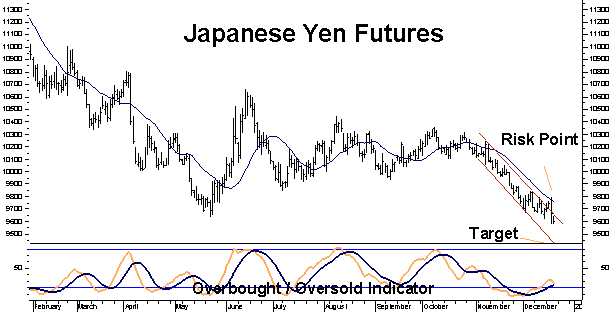

The market may be oversold but the trend is still down, so aggressive traders willing to monitor the market and hold their positions should consider risking two consecutively higher closes over .09797 with an ultimate downside target of .09437. (See chart below.)

Suggested Action

January .09700 yen puts: conservative traders should consider placing an order to exit your January .97 yen puts now. Last price is 121 ($1,512.50). Have your broker help you price the order. Aggressive traders can continue to hold using risk and target parameters discussed above.

Lindsay Hall is Chief Market Strategist with commodities specialists RMB Group. Get the latest futures and commodities commentary from Lindsay and the RMB Group on our Big Move Trades–an online report offering trading ideas backed by research.

Questions about this report or trading futures and options? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures