The weather may be cooling down, but things are definitely heating up in the crude oil market. Yesterday’s announcement that Vladimir Putin would support OPEC in “balancing the oil market” sent prices over a dollar per barrel higher, setting the stage for a possible breakout to the upside. Russia is the globe’s largest oil producer so Putin’s move to align his nation with OPEC’s recent decision to cut production by 1% to 2% has to be viewed as a bullish development.

Russia and Saudi Arabia have been on opposite sides of the Syrian Civil War with the former supporting the forces of Bashir Assad and the latter backing the opposition. Russia’s close alliance with Iran – Saudi Arabia’s biggest rival in the Middle East – means Russia and Saudi have been at loggerheads over oil policy ever since the latter’s decision to flood the world with oil.

What has changed is mutual interest. Two years of weak oil prices have severely damaged the domestic financial positions of both nations, threatening social stability in Saudi Arabia and the ability of Russia to continue its aggressive and expensive projection of military power in Ukraine and Syria. Both nations desperately need higher oil prices. Putin’s tacit endorsement of a supply cut is a signal that the Saudi plan to flood the globe with oil and force North American frackers and shale oil producers out of business has failed. Saudi Arabia’s new willingness to limit production puts new bite into a formerly toothless OPEC.

Data Source: Reuters / Datastream

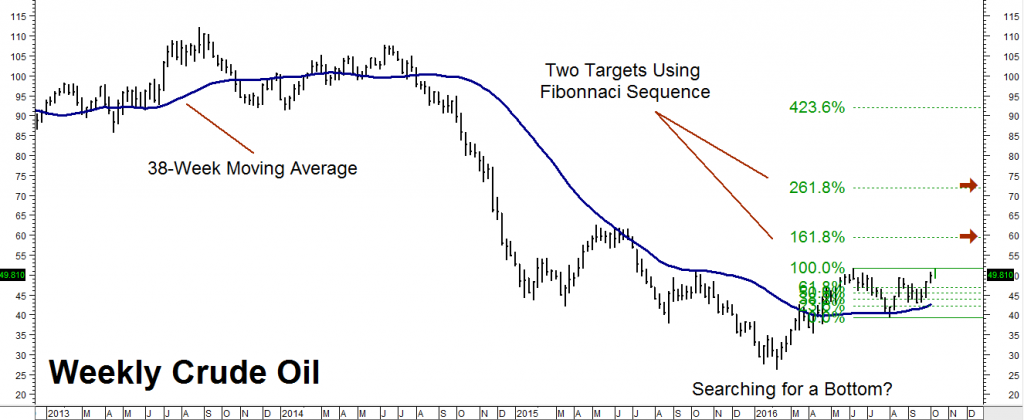

The return of OPEC as a force in the crude oil market is visible in the price chart of crude oil (above). The black, sticky stuff negated its long-term downtrend back in April by closing convincingly over its key 38-week moving average. It tested that moving average again in August and bounced smartly, pushing prices firmly against resistance just above $51.70 per barrel.

Two consecutively higher closes above this level would help confirm the “reverse head and shoulders” bottom that has been forming in crude oil for the past year. Our intermediate-term upside targets are $60.00 and $72.00 per barrel respectively once $51.70 is convincingly breeched.

Crude oil call options are expensive so one way to play crude oil to the upside would be to buy bull call spreads. April 2017 $56 / $60 bull spreads in WTI crude oil closed yesterday for $1,500. This, plus transaction cost, is the most the buyer of these spreads could lose on the trade. Each spread could be worth as much as $4,000 should crude oil hit our $60 per barrel target prior to option expiration on March 16, 2017.

“Canuck Buck” Is Solid Alternative to Crude

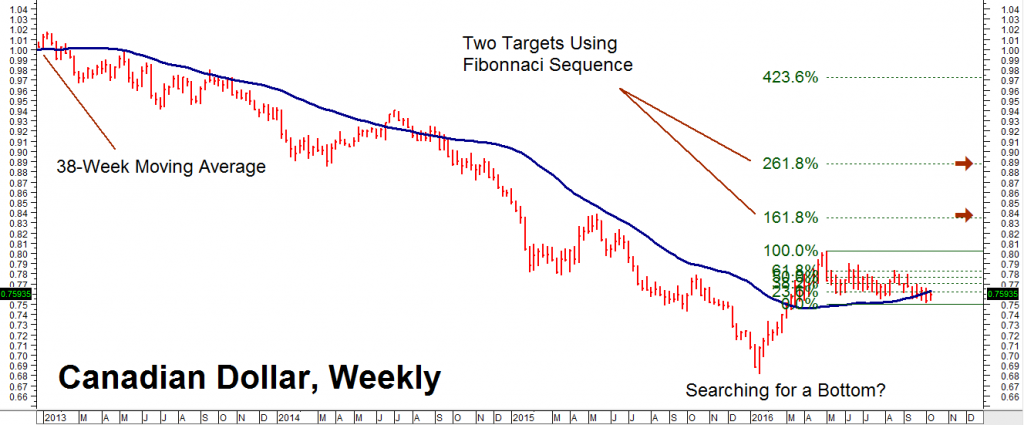

Canada’s vast supplies of oil sands have kept the fluctuations of its currency tied closely to the price of crude oil. As the chart below illustrates, the “Canuck Buck” has long history of tracking the price of crude oil, making it a surprisingly reliable surrogate.

![]()

Data Source: Reuters / Datastream

Crude oil is notoriously volatile. This volatility is reflected in the relatively expensive prices of crude oil options. The Canadian dollar, on the other hand, tends to be far less volatile. This is also reflected in the price of Canadian dollar options. Using Canadian dollar options to make a bet on the direction of crude oil makes it possible to risk less while keeping the potential for similar, and at times even better, returns then by just sticking with crude oil.

We examined the weekly chart of crude oil earlier in this “Alert.” Now let’s take a look at the weekly chart of the Canadian Dollar. They look almost identical but there is on important difference. The crude chart shows prices knocking against overhead resistance at old swing highs but the Canadian dollar chart shows prices still testing its 38-day moving average. That Canadian dollar appears to be lagging crude oil.

Data Source: Reuters / Datastream

Should the relationship between crude oil and the C-dollar hold up, this means the latter could have a relatively bigger move as it tries to catch up to crude oil on the upside. Better still, cheaper Canadian dollar options have the potential to provide a bigger bang for our buck than the bull call spreads we suggested earlier.

Our price targets for the Canadian dollar, given an upside breakout in crude oil are .8350 and .8900 respectively. Buying the March 2017 .7900 Canadian dollar call gives us the right but not the obligation to be long the Canuck Buck for .7900 from now until option expiration on March 3, 2017. These calls closed yesterday for 56 points or $560. They will be worth as least as much as $4,500 should the Canadian dollar reach our .8350 upside objective prior to early March expiration and even more at prices above that.

The Canadian call options not only costs less than half the bull spread in crude, potential gains are not capped, making potential rewards greater.

Your personal RMB Group broker knows this strategy backwards and forwards and would be happy to walk you through it. Give him or her a call if you are interested. We are recommending this trade for all RMB Group trading customers with a bullish outlook on crude oil. After all, why pay more than you have to?

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.