It finally happened… Germany joined Japan and Switzerland in the negative interest rate club. It will now cost you to lend money to the governments of these three advanced, industrial nations for 10 years or less. It seems one would be better off buying a vault and stuffing it with paper money or gold. No interest is better than paying for the privilege of lending money to a government, right?

Soaring vault sales in Japan and a rising gold price are just two of the effects of negative interest rates – but they aren’t the only ones. European bank stocks are getting killed because negative rates have robbed them of prime revenue. Banks typically make a substantial chunk of money by borrowing at low, short-term rates and lending at higher, long term rates. This difference is known as the “spread.”

Negative rates on long-term sovereign debt means there is essentially no “spread” left. Negative interest rates are also knocking down returns on mortgage and corporate debt. Because they use sovereign debt as a benchmark, interest rates on these instruments have fallen as well, making it even harder for banks to make a return. If banks can’t make money, they fail. If banks fail, so does the entire fractional interest rate banking system and the modern economies that depend on it.

As go the banks, so goes everything else. This is why both Republicans and Democrats bailed out the banks following the Lehman crash. It is also why Janet Yellen and the Fed have been so hesitant to raise short term interest rates. Banks have a hard enough time trying to stay solvent with today’s two-year versus ten-year spread of 0.87%.

Negative interest rates cause capital to flood into the US from negative rate nations, driving up the price of US bonds and notes and driving down yield. This causes the spread that banks depend upon for their survival to narrow even further. Another Fed rate increase on the short end of the yield curve would cause this it to shrink to virtually nothing. The Fed didn’t act because it couldn’t act without putting the banking system at risk.

Negative Feedback Loop Threatens Financial System

We are living in an era of unexpected consequences. Negative interest rates are one of them. In order to limit the fallout from the 2008 collapse, the globe’s central bankers drove interest rates to historically-low levels and kept them there. Their intention was to force capital into the greater economy by severely limiting, and in many cases eliminating, “risk-free rates of return” on saving accounts, CDs and money market funds.

The globe’s central bankers hoped to force investors into riskier assets like stocks, expecting to fuel a bull market which would foster confidence and growth in the broader economy. It worked briefly in the US – at least as far as the stock market – but it did not transfer across borders or percolate into the greater economy.

Instead, artificially-low interest rates caused a self-fulfilling prophecy. They generated a negative feedback loop in which low rates led to expectations of slower growth. This caused businesses and individuals to hoard cash rather than invest. This slowed growth and lowered interest rates, perpetuating the cycle and increasing the intensity of the feedback loop.

Artificially-low interest rates are an impediment to growth, even in the US. By refusing to normalize interest rates and give businesses and savers hope, the actions of the Fed and other central bankers have made investors hunker down even more.

Scared Money is Skittish Money

Negative interest rates are just the latest in the central banks’ campaign to punish risk-adverse capital. Zero rates didn’t work, so why do Japan and Europe think negative rates will? It’s like trying to save a drowning man by throwing him an anvil. The money pouring into the US Government bond market is scared money, desperate for even a paltry return. Negative rates in Europe and Japan drove it here. Scared money is skittish money which will flee at the first sign of trouble.

Worldwide, there is now $10.4 trillion invested in bonds with a negative return. Bond prices move opposite interest rates. There is only one reason why anyone in their right mind would pay for the privilege of lending someone else money – the hope that they can sell their bonds at an even higher price. (As the yield on bonds becomes more negative, the price of the underlying bond goes up.) This means that virtually all $10.4 trillion anticipates offloading their losing assets to someone at a higher price.

Bond Market Liquidity is Drying Up

Who are they going to sell to? No sane private investor would buy a bond with a negative return unless he or she felt they could unload it at a higher price. That leaves government as the sole buyer. The Bank of Japan is responsible for nearly the entire Japanese bond market. The European Central Bank is heading down the same path, guaranteeing buyers the ability to offload their bonds at a fixed price. This cannot continue forever without more currency debasement and growth suppression.

When government steps into a market, it often squeezes out private capital. Liquidity dries up. When governments stop buying bonds – as they all eventually must – there will be no one left to sell to. Imagine what will happen to the global bond market when all $10.4 trillion tries to run out a door jammed half shut. This is why we believe that, like the housing market of 2007, the current bond market is a balloon in search of a pin.

What We Recommend Now

Timing is everything. Millions have been lost trying to pick a top in the global bond market. The traders featured in “The Big Short” had to sit through months of devastating losses before being proven right. We aren’t planning on risking even a small fraction of that.

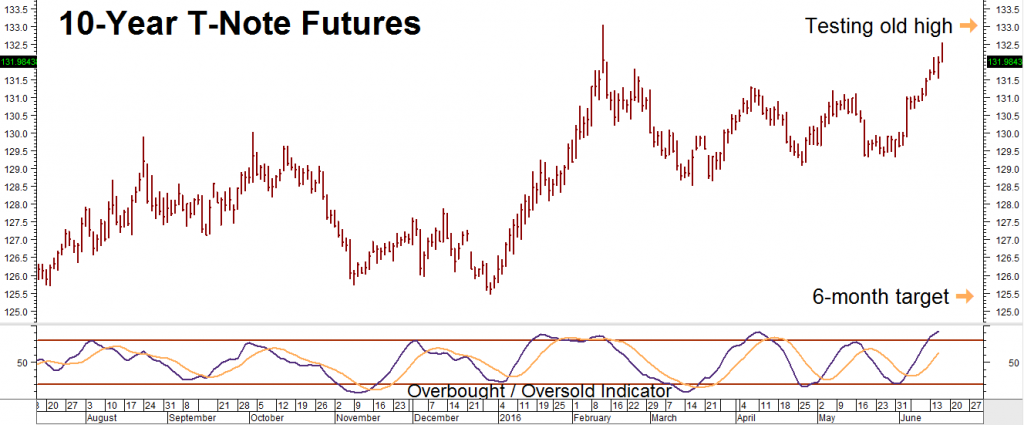

T-bonds and T-notes have rallied sharply following Janet Yellen’s abrupt dovish turn. We suggest RMB Group trading clients consider using this strength as an opportunity to establish a fixed-risk short position in US 10-year notes. The strategy we are recommending right now uses the Ten-year T-note options traded on the CME and costs approximately $600 plus transaction costs. This is the most we can lose on each unit of this trade. Since we don’t have more than this at risk, we don’t have to be perfect on timing. If we are right, our position could be worth as much as $4,000 each.

Ten-year notes are currently testing old highs at 133-00. Failure to follow through could cause longs to abandon this market in a hurry. Our six-month target is a retest of 12-month lows at 125-16. Prices can and will change, so contact your personal RMB Group broker for the latest.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendation in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.