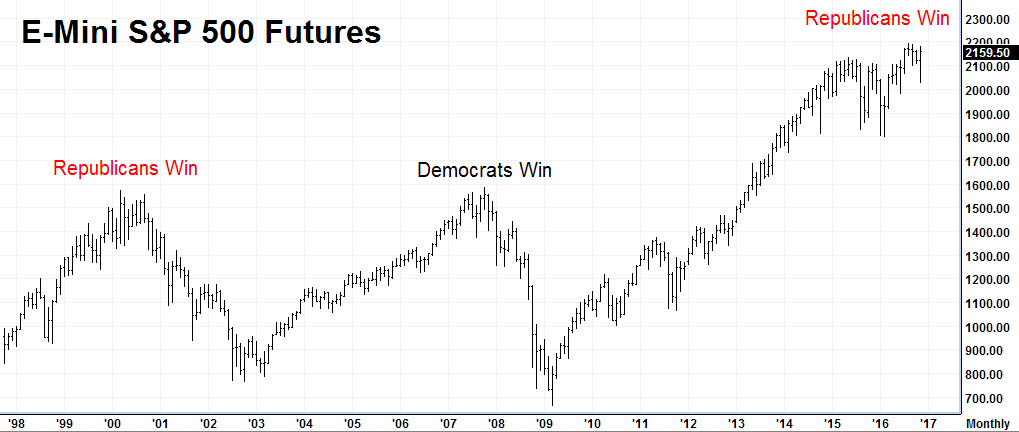

“You can observe a lot by just watching.” This famous Yogi Berra quote sums up our take on the Trump surprise. We always believed Trump could win (check out some of our old Blog Posts on www.rmbgroup.com) but were surprised by the election night certainty of his victory. When you combine Tuesday’s election with last summer’s Brexit vote it becomes obvious that the push towards globalization that began with the collapse of the Berlin Wall and became supercharged by Moore’s Law and the growth of the internet is under attack by those it left behind.

Middle America has now joined the rural UK in giving a big middle finger to the status quo. The populist Nationalism, the force behind surprise outcomes in both cases, was driven by a desire to push back against global business practices that have eliminated traditional sources of income and ways of life. The factory jobs that powered Middle America in the 20th century may not be coming back, but that realization did little for voters left with nothing with which to replace them.

People typically don’t react well to change, especially when it leaves them marginalized both economically and culturally. But the world is changing and doing so at an ever-increasing pace. If the US election has told us anything, it is that the forces behind Brexit and the election of Donald Trump are strong and will probably not fade with Trump’s Tuesday night victory

Tribalism Will Continue To Be A Force

The primitive urge to associate with those of like mind has spilt America right down the middle. Post-election maps show that most districts – red and blue – were won by overwhelming margins. Red team voters don’t live or associate with blue team voters and vice versa. This is tribalism at work. Like it or not, it’s the way we are. Those expecting a Kumbaya movement – some kind of bipartisan coming together now that the election is over — will most likely be disappointed. This fight will go on long after the final vote is tallied.

Similar fights are going on all over the world. All the attention on the US election has obscured similar schisms across the Atlantic. Europe has far more tribes with animosities stretching far into the past. The past two World Wars began on European soil. The creation of the EU and the adoption of the euro were attempts to put a governor on the tribal passions that led to one war after another in Europe. And it worked – for a while.

“Brexit” Just The Beginning?

The problem is Europe is economically divided. The relatively rich north is dominated by the two largest economies in Europe: Germany and France. The south is made up of much weaker economies. Greece has already been bailed out once and is requesting yet another. Portugal may be next to request help. The lack of sovereign currencies in these nations make them hostage to the euro and to economic polices more suited to their northern neighbors.

Unable to reduce the value of their currencies to spur exports and investment, the southern half of Europe has had little recourse. It continues to struggle, losing both faith and face as it is forced to trudge north — hat-in-hand — to beg for more bailout money. Its populations have been ignored and discounted, much like pre-Brexit rural Britain and pre-election middle America. Both countries just witnessed first-hand what is possible in this type of environment.

“Brexit” may be the first shot in the war against globalization but, as the entire world observed last Tuesday, it definitely won’t the last. Italy votes to change its constitution on December 4. Anti-EU forces could take over the Italian government should the vote fail. Italy is the fourth largest economy in Europe and the third largest economy in a UK-less EU. Its exit from the EU would not be good news for the Euro as it could lead other southern European countries to consider exiting the EU as well

The obvious way to play a breakup in the EU would be to short the euro. RMB Group brokers have been recommending limited risk, short euro put option strategies for the past few weeks now. RMB trading customers interested in shorting the euro should contact their personal broker for the latest.

British Pound Could Benefit From EU Breakup

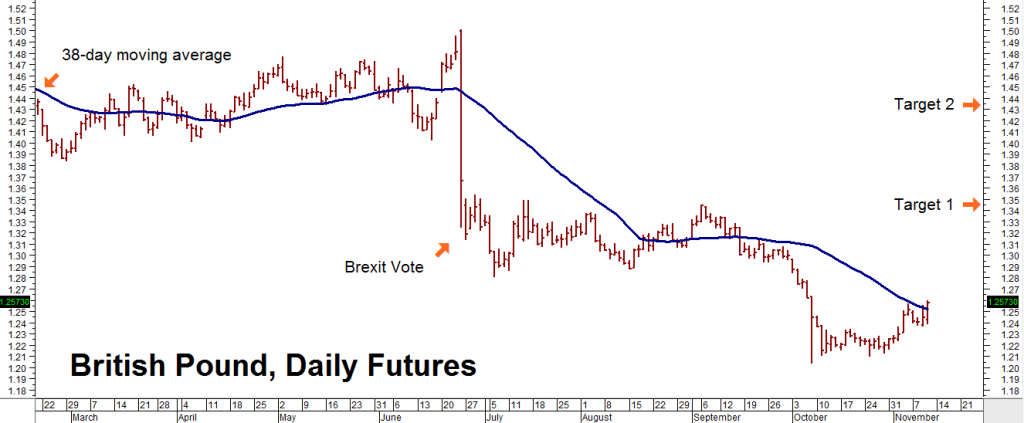

But short euro is not the only play. A potentially cheaper alternative would be to buy the British pound, especially in combination with a short euro position. A trader that wants to sell the euro must sell it against something. That something is usually the US dollar. But the dollar is expensive after 2 1/2 years of a bull market. The British pound, on the other hand, is cheap after getting hammered immediately following last summer’s Brexit vote.

The chart below shows how the pound has fared against the euro. The big drop last summer was a direct result of Brexit. The current recovery is the first indication that Sterling’s decline against euro may be nearing an end.

Data Source: FutureSource

Since the British pound has always been independent of the EU, we expect it to be one of the critical, flight-to-quality currencies if signs of a breakup in the EU become more pronounced. Sterling has a history of moving independently of the euro. It also has the backing of a central bank that is far more flexible than the European Central Bank. Being short euros in British pound, rather than the dollar, makes some sense.

But simply being long the British pound using dollars makes sense as well – especially since the UK’s inevitable “Brexit” has already been priced into the market. Since it separating from the EU, Britain will probably be the beneficiary of a huge inflow of cash if the nearly two-decade financial experiment known as the “euro” starts to self -destruct.

Data Source: Reuters/Datastream

British pound options are also cheaper on a relative basis than euro options. That’s why we are currently recommending RMB Group trading clients to consider taking a limited risk long position in Sterling by purchasing CME call options. Right we are looking at a March call costing roughly $694 that would be worth at least as much as $3,125 should the British Pound hit our $1.35 objective prior to option expiration on March 3rd. $694 per option plus transaction cost is the most we can lose on this trade.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.