Gold continued its surge higher last week, hitting our first near-term target of $1,325 per ounce on Thursday before backing off a bit on Friday. January and February are typically very good months for gold, so we expect more upside over the next 3 to 4 weeks – possibly enough to climb to our second near-term objective of $1,407 per ounce.

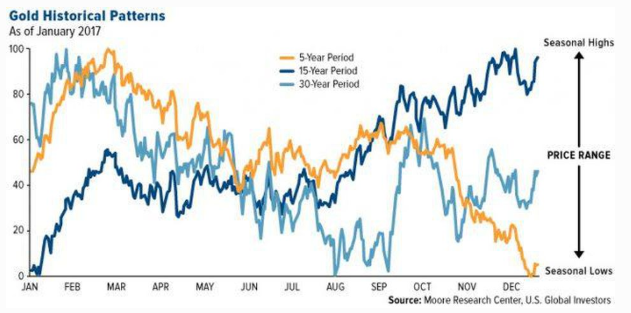

The chart below shows the changing seasonal pattern for gold. Gold’s classic pattern of rallying during January and February, declining in the summer and fall, and rising into the end of the year has changed substantially. Instead of rallying into winter, gold has tanked, making January and February the best months for gold bulls over the past five years.

Will this pattern hold up this year? Only time will tell. As the chart above illustrates, gold’s seasonal pattern is changeable. What is consistent is gold’s ability to rally during the first two months of the year. Consequently, it won’t surprise us to see the Midas Metal head higher over the next three to four weeks, despite being a bit overbought on an intermediate-term basis. Nor will it surprise us to see gold correct substantially in early March.

RMB trading customers who took our suggestion to buy December 2019 $1,400 / $1,450 bull call spreads in the COMEX options should continue to hold. Those without bullish positions, or wishing to add to bullish positions, may want to consider a shorter-term play.

Data Source: Reuters

Aggressive Seasonal Play in Gold

April $1,330 gold call options closed Friday for $1,500. A buyer of these calls purchases the right, but not the obligation, to be long an April 100-ounce COMEX gold futures contract at a price of $1,330 per ounce. This right is good through April option expiration on March 26, 2019. April gold futures closed Friday at $1,322.

We would not normally recommend buying an option with only 53 days left until expiration, but gold’s seasonal tendencies make this an exception. If gold is going to make a move, its recent seasonal tendencies seem to indicate it will do so by early March. This would make the March 26 expiration of our long $1,330 calls reasonable.

A long $1,330 gold call will be worth at least $1,000 for every $10 over $1,330. A rally to $1,350 in gold would make this call worth at least $2,000. A rally to $1,380 would make it worth $5,000, and a rally to $1,400 would make it worth $7,000. The failure of gold to close over $1,330 at option expiration would make this call worth nothing. Our risk is limited to the price we pay for this call plus transaction costs.

We can lower the out-of-pocket cost of this play by taking one more step. June $1,400 COMEX gold calls closed Friday for $1,070. We can sell one of these calls for every April $1,330 call we buy and use the proceeds to help offset the cost of our long April $1,330 calls. We are exchanging the $1,070 we receive for selling the June $1,400 calls for the obligation to be short June gold futures at $1,400. By pairing the right to be long gold at $1,330 with the obligation to be short gold at $1,400, we are limiting our upside.

Subtracting the $1,070 we receive (from our short June $1,400 gold call) from the $1,500 cost of our long April $1,330 call gives us a net out-of-pocket cost of $430. Some additional margin would be needed to hold this position. In all cases, the short June $1,400 gold call would need to be bought back (covered) on the expiration of the April options or when we exit the long April $1,330 call, whichever happens first.

Prices can and do change, so if you are interested in this strategy, contact us. Your personal RMB Broker would be happy to explain this trade to you and/or suggest other ways to play the next leg up in gold. Visit www.rmbgroup.com to learn more.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.