September has been very friendly to our bearish positions in both the euro and the Japanese yen. And while the jury is still out on our short positions in hogs and T-bonds, recent price action in the latter is getting more encouraging as well. If you’ve been following our publications you know that we’ve been bearish the yen and the euro for a long time. We’ve had to remain patient in both markets, rolling our bearish option positions forward, buying more time when we needed it. That patience is finally paying off.

Will the same kind of patience pay off in hogs and bonds? It is still too early to tell. However, we see no reason to abandon either – especially since our December T-bond puts are back in the black after spending the last few weeks on the red side of the ledger. We are monitoring the energy complex closely for signs of what we believe will be a big upside reversal but are not yet ready to commit yet — perhaps next week.

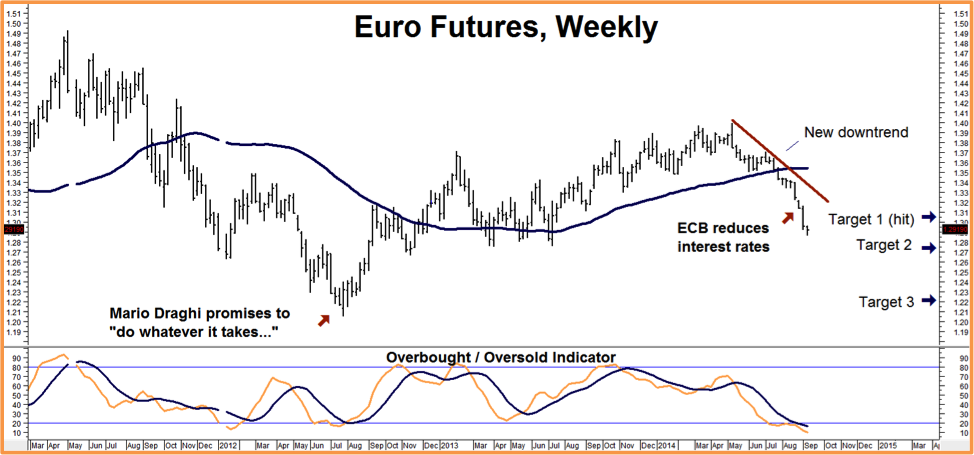

Meanwhile, let’s review some our recent recommendations, starting with the euro:

As we’ve pointed out in past Alerts, Europe needs a weaker euro if it has any chance of defeating the dangerous deflationary forces threatening the solvency of member nations. European Central Bank President, Mario Draghi finally agrees. A little over two years after promising to “do whatever it takes…” to prop up Europe’s sovereign debt market, the ECB cut interest rates this summer, effectively ending the 2-year bull market in the euro.

Could the new downtrend in the common currency be the beginning of something larger? We think it may be. If you followed our suggestion in Alert #24 to take a little cash of the table, odds are good you were able to take cover initial risk on this position and maybe even lock in a small gain depending on your entry and exit levels.

The euro is extremely oversold on an intermediate term basis, so now is not the time to add or enter new positions. We expect a bounce and will probably use it to get more aggressive if and when it occurs. That doesn’t mean the euro can’t go even lower first – which is why we suggest staying with your remaining put option strategies.

Our first downside target of $1.3050 has already been hit. Our next target is long-term support in the $1.2800 / $1.2750 band. We are close to that now.

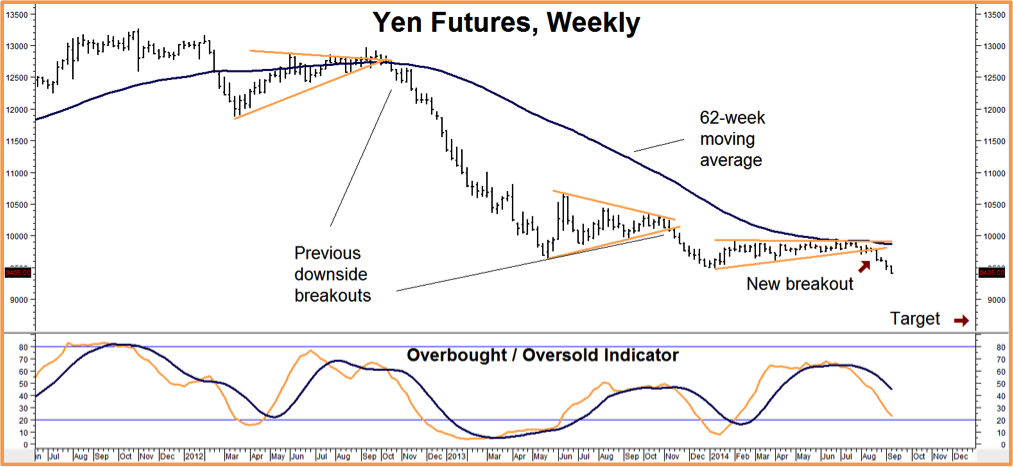

Yen Finally Joining Race to Bottom

Europe may need a weaker euro but it is our opinion that Japan cannot avoid bankruptcy without a much weaker yen. We covered this in Alerts #14 and #21. A close below old contract lows at .09486 this Friday will confirm the downside breakout we have been expecting. Currently trading for .09370 on Wednesday afternoon – the yen is roughly 100 points below this level.

The December puts we suggested purchasing for $600 in Alert #21 are currently going for $2,800, so now may be a good time to take some cash off the table if you are so inclined. However, this market is not nearly as oversold as the euro so there could be a lot left to the downside before the next bounce. Our near-term objective is .09200 with an ultimate target of .09000 or even lower.

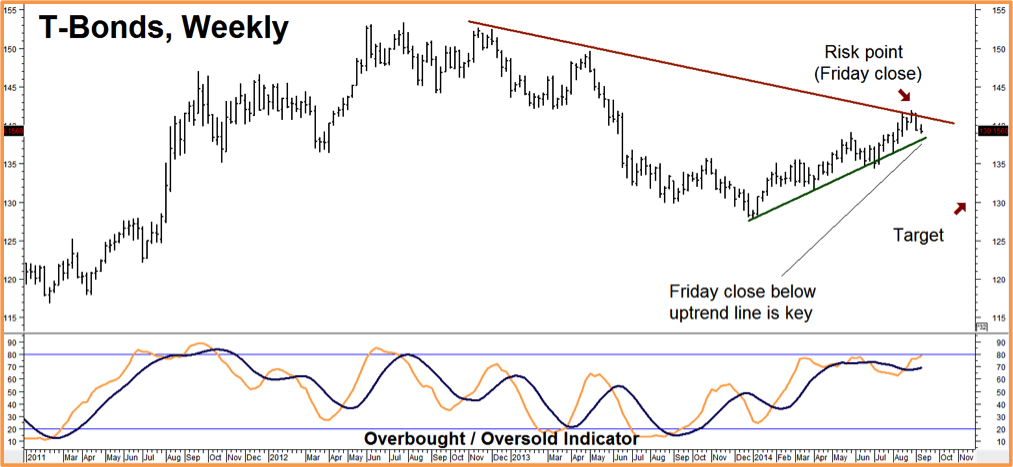

Bonds Caught Between Two Trends

Sometimes the charts (technical analysis) and market fundamentals tell the same story: bonds are caught between two trends – a long-term downtrend and an intermediate-term uptrend. (See chart below.) At the same time, the bearish influence of the Fed’s expected exit from its QE bond-buying next month is vying with the bullish influence of crashing yields in Europe for the market’s attention. Abnormally low yields in Europe make US sovereign debt look very attractive by comparison.

In Alert #23, we suggested placing a small amount of cash on the side of Janet Yellen and the Fed by purchasing put options in T-bonds. Who’s winning? It is still too early to tell.

A Friday close or a — better still – a series of Friday closes below the intermediate uptrend line puts the odds squarely in our favor. Conversely, two consecutively higher Friday closes above old swing highs of 142-00 in the front month futures contract would be a signal that we are wrong. Bonds have been weak all week, which is encouraging. Consequently, RMB Group trading customers should continue to hold their puts for now.

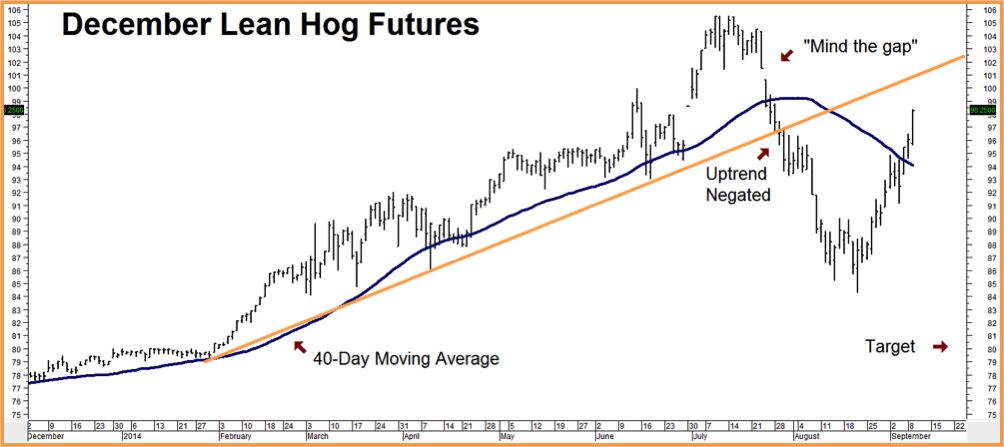

Resilient Hogs Frustrating Bears

Count us among the frustrated… The good news is put spreads we suggested purchasing for $460 or less in Alert #25 didn’t cost us a lot of money. We also waited for a bullish retracement to the 40-day moving average before making our recommendation. Prices have since moved back above it but we are not ready to throw in the towel yet.

It is not uncommon for markets to retest a negated trend line before confirming a reversal. Hogs appear to be in the process of doing that right now. Right now we a “minding the gap” that preceded the last big down move. Should the market close this gap we might reconsider, exit and try to limit our already low risk even further. We’ll continue to hold our December put spreads until then.

If you don’t have an RMB Group trading account and would like to know more these or other about “Big Move” strategies that we are currently recommending, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.