Let’s face it, 2013 was a terrible year for commodities. Economic weakness in China and nearly perfect growing weather here in the US were just two of the bearish factors that made last year one to forget for commodity bulls. 2014 was expected to pick up right where 2013 left off but Mother Nature had other things in mind…

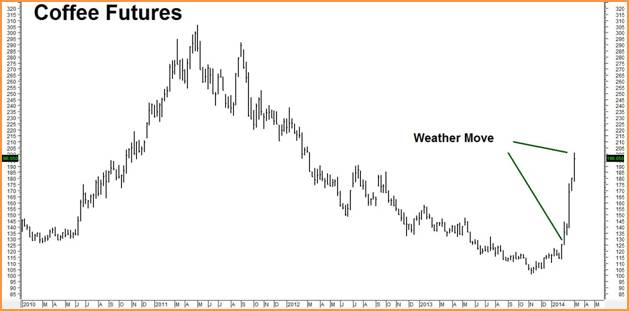

A frigid “Polar Vortex” descended on the most populated portions of North America and decided to stay awhile. Heating demand soared and so did the price of natural gas and heating oil. Meanwhile, drought paid a visit to Brazil threatening yields and causing prices to spike for key export crops like coffee, soybeans, wheat and corn. The coffee chart below shows how this unexpected turn in weather caused coffee to shift from bear market to bull market in a very short period of time. The chart of sugar (not shown) is nearly identical.

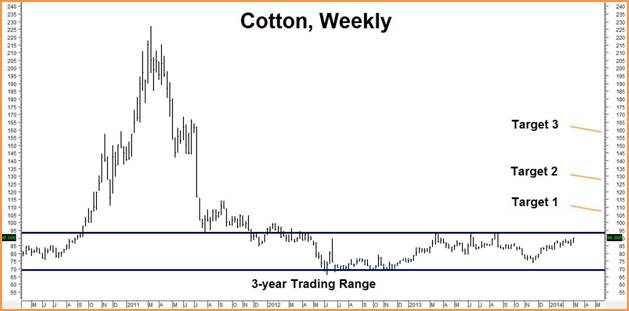

Cotton has not participated in the commodity rally – at least not yet. Concerns about continued economic weakness in China and expectations that US farmers will plant a whole lot of cotton this year have kept the white, fluffy stuff stuck in a trading range defined by lows of 66 cents on the downside and highs of 92 cents on the upside. US production has dropped for the past couple years due to drought in the American Southwest. That is expected to end this year as farmers, responding to a decrease in the price of corn, plant more cotton instead.

But what if the price of corn rises further due to either a continuation of the Brazilian drought or – with more bad weather predicted for this spring – delays in planting in North America caused by floods or frozen ground? What happens if drought reappears in the cotton growing regions of Texas? While there is certainly no predicting the weather, cotton appears to have a lot of room to the upside from a chart perspective.

Expectations of a big cotton crop here in the US mean virtually no one expects the “new crop” December contract to rally much above 80 cents. But, as we’ve observed so far in 2014, expectations do not always pan out. Three years of sideways price action have weighed on the price of December cotton options, making them as “cheap” as we have seen in quite some time giving us an opportunity to take a low-cost flyer on another 2014 surprise in cotton.

We are looking at buying inexpensive calls on the December contract that will give us upside potential in the event cotton breaks out of its trading range to the upside. Our upside Fibonacci targets for the white, fluffy stuff are $1.05, $1.25 and $1.57.

Every now and then options get cheap enough that we feel comfortable swinging for the fences. This is one of those times. The calls we want to buy are currently going for $250 plus transaction costs and would be worth $2,500 if our first target is hit prior to expiration on November 7, 2014. A rally to our second and third targets would make these calls worth at least $12,500 and $28,500 respectively.

RMB trading customers should contact their broker directly for further specifics on this trade. If you are not an RMB Trading Customer and want to know more about how we are playing this or other markets, contact us or give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over a fixed risk strategy with you. You can also e-mail suertusen@rmbgroup.com. Put “cotton” in the subject line.