All Fed, all the time? That seems to be the story in all the financial markets. Tomorrow’s Unemployment Number is no different. A strong number increases the odds of an early “taper” in the Fed’s bond purchases while a weak number probably means they will be delayed a bit longer. An early taper could mean an increase in medium and long term interest rates which should be friendly to the dollar and perhaps not so friendly to currencies whose values are measured against the dollar.

We got the downside breakout from the sideways triangle we were looking for in Alert 13-19. If you took our advice to buy June puts or bear put spreads you should be doing well enough to take a little cash off the table. Ditto if you own March puts or bear put spreads (Call your RMB broker for specifics.)

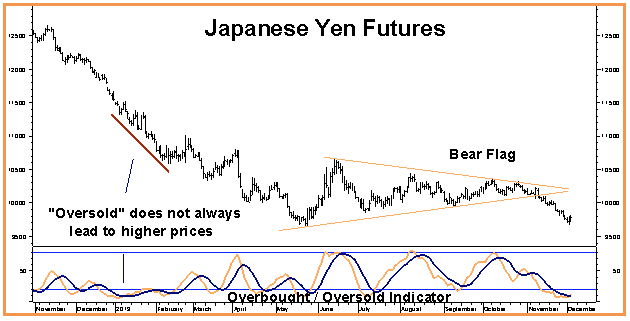

However, do not exit all of your bearish positions in the yen. The Japanese currency may be extremely oversold here but, as recent history suggests (see chart above), “oversold” does not necessarily means prices are going higher. A strong number tomorrow could push the yen down to old lows at .09640 and send it on its way to our ultimate .09000 objective.

Roll All December .09700 Yen puts into January

December yen options expire tomorrow so if you own the December .09700 Japanese yen puts recommended back in early August the time has come to roll them forward into January. Sell your December puts now and then use the proceeds to help offset the cost of buying January .09700 puts. This will allow you to stay short into tomorrow’s number with a relatively inexpensive close-to-the-money option.

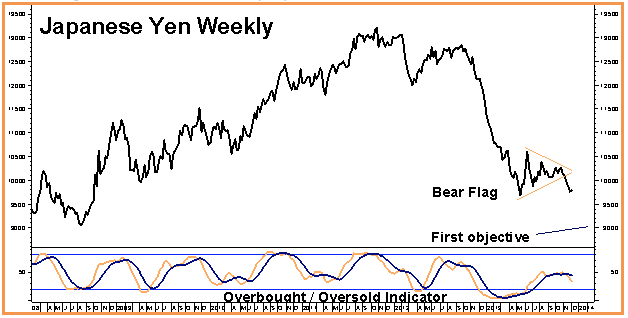

Why do we want to stay short if the market is so oversold? Because the weekly chart tells a different story (see below). Tomorrow’s number will go a long way to determining whether the yen is beginning an overdue upside correction or the next leg lower. We want to be prepared for both alternatives.

Lindsay Hall is Chief Market Strategist with commodities specialists RMB Group. Get the latest futures and commodities commentary from Lindsay and the RMB Group on our Big Move Trades–an online report offering trading ideas backed by research.

Questions about this report or trading futures? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures