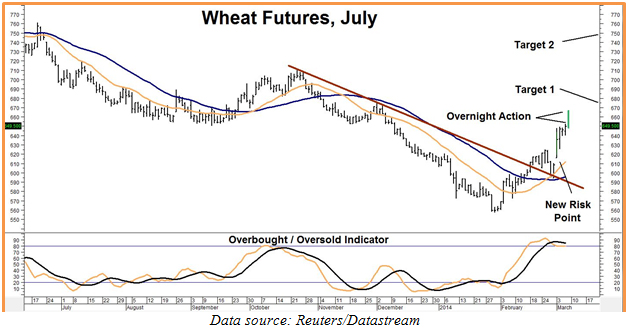

Both corn and wheat have confirmed the breakouts we identified 3 days ago in Alert #6. Wheat got to within spitting distance of our first upside target in overnight trading so let’s go ahead and exit half of our position now, holding the other half for an eventual move to our second upside objective of $7.50 in the July contract. Let’s also raise our risk point to $6.16 on our remaining positions. $6.16 is the low of Monday’s big “gap up” day.

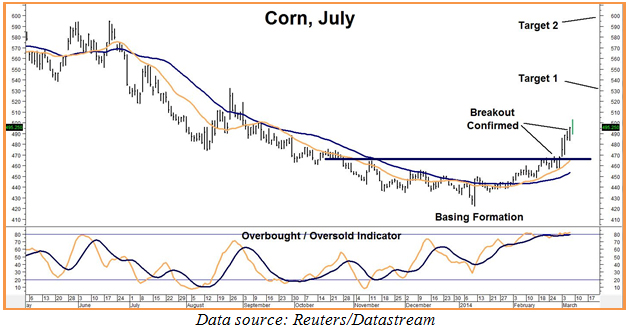

Corn is more a question of risk control. The call options we were looking when we made our original recommendation to get long this market have jumped in value and are providing us with a potential opportunity to take our initial risk off the table. If you own more than one, you may want to consider exiting half now and letting the other half ride. The drought in Brazil is for real and could be the catalyst for higher prices down the road so you DO NOT want to out of this market altogether – at least not yet.

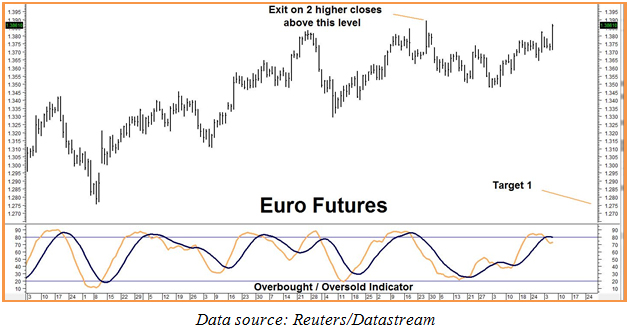

Set Risk Parameters in Euro

While this morning’s Unemployment Numbers (nonfarm payroll up 17,000., unemployment rate 6.7%) were enough to know the euro off overnight highs, this market is clearly not doing what we expected – at least not yet. One of the reasons we’ve been suggesting shorting this market is a clear and close risk point. Let’s use two higher closes over the old high at $1.3893 in the front month contract as a signal to exit and cut losses.

We briefly exceeded this level in European trading but are back below it following the unemployment #. If kicked out, get ready to get right back in on the short side as soon as the market tells us it is ready.

RMB trading customers should contact their broker directly for further specifics on these trades. If you are not an RMB Trading Customer and want to know more about how we are playing the grains or other markets, give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over a fixed risk strategy with you. You can also e-mail raissa@rmbgroup.com. Put “trade update” in the subject line.