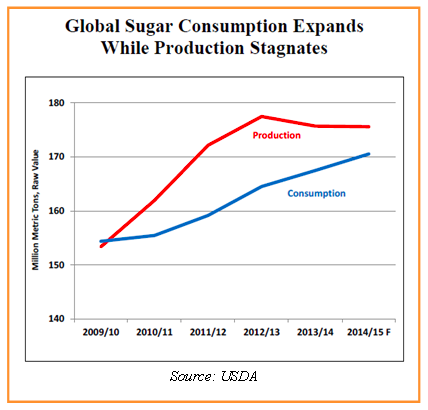

Drought in Brazil – the world’s #1 sugar producer – was the catalyst behind last week’s move higher in sugar. Dry conditions have caused production in the sugar-growing regions of Brazil to drop 7.4% compared with one year ago. Worsening drought means they could fall even further. At the same time, global consumption driven mainly by India and China is increasing. China now consumes more than it produces which means it needs to import sugar. India’s surging domestic consumption means it exports less.

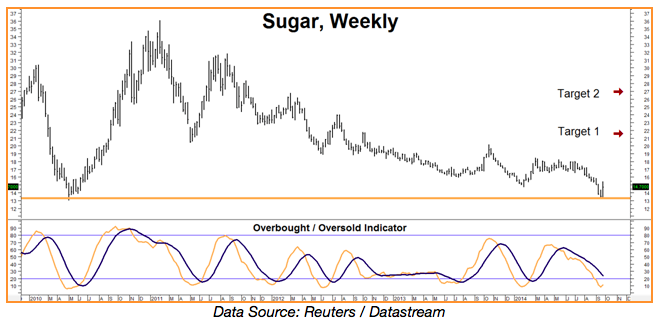

Plagued by huge stockpiles, sugar spent the last four years cascading lower but, as the Weekly Sugar chart below suggests, things could be changing. Prices have bounced nicely off long term support just above 13.00 cents per pound last week, closing higher than the last two weekly highs on Friday. We view this as an extremely bullish sign.

Plagued by huge stockpiles, sugar spent the last four years cascading lower but, as the Weekly Sugar chart below suggests, things could be changing. Prices have bounced nicely off long term support just above 13.00 cents per pound last week, closing higher than the last two weekly highs on Friday. We view this as an extremely bullish sign.

Existing stockpiles may be enough to meet demand for now, but the outlook going forward is not as good. Should recent lows hold, we believe prices could rise from current levels of around 15.40 cents per pound to our first target of 22.00 cents – and perhaps as high as 27.00 cents before all is said and done.

Consequently, we are asking our trading customers to consider purchasing sugar call options (currently trading just above $700) that have the potential to be worth at least $5,040 should the sweet stuff reach our 22 cents per pound target prior to option expiration. If we are wrong, all we risk is the cost of our option plus transaction costs.

Prices can and do change, so customers should check with their personal RMB Group broker for the latest. They may have an alternate recommendation more tailored to your individual needs.

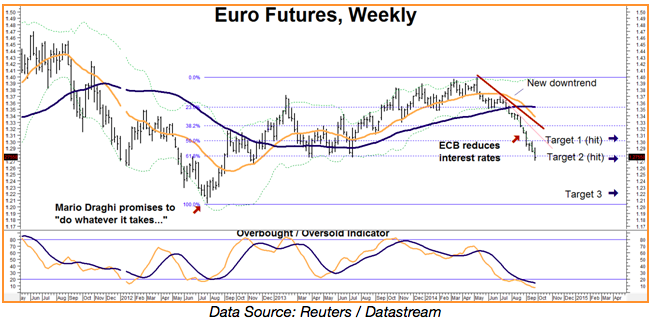

Important Euro Update! Our second long-term, downside target of $1.250 in the euro was achieved on Thursday and exceeded on Friday. Consider exiting all remaining bearish positions and take your money off the table if you haven’t done so already. This market is extremely oversold which means an upside correction could begin at any time. We plan on using it to re-establish a bearish position designed to benefit from a drop to our ultimate downside objective of $1.2200.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy that we are currently recommending, give us a call at 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.