Silver bulls finally have something to cheer about. After months of lagging its richer cousin, silver is making a move on gold. This is good news for both metals should it continue. Silver nearly always leads in bull markets and lags in bear markets. Its months-long slide against gold has led many traders to question – rightly, in our opinion – the staying power of the recent mini rally in gold. The past two days have gone a long way towards reducing some of that apprehension.

The gold / silver ratio spread measures how many ounces of silver it takes to buy one ounce of gold. Gold is roughly 16 times rarer than silver. Back when both metals were considered money, silver was roughly 16 to 20 times cheaper than its richer cousin. 14 days ago, silver was 82 times cheaper than gold. As the price action illustrated in the chart below suggests, this trend of silver getting cheaper versus gold has broken down and done so in a big way.

Data Source: FutureSource

Wednesday’s close below old lows at 79.50 was the first time this spread has managed a close below a previous low in five months. Yesterday’s follow-through to the downside confirms the end of the bearish bias in silver. While it is not the time for silver bulls to pop the champagne corks yet, this kind of price action in the gold / silver ratio spread is definitely one of the most encouraging things we’ve seen in quite some time. However, the poor man’s gold needs to do more.

Silver in Sideways Mode, But For How Much Longer?

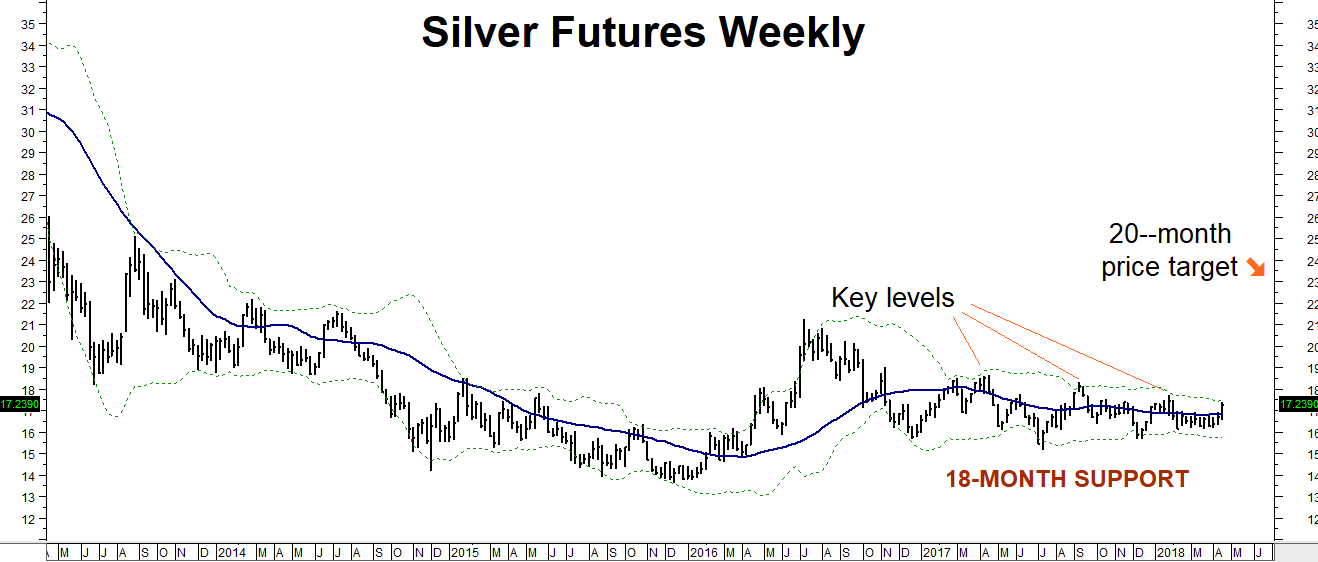

Silver has plenty of support at the $15 per ounce level but also a trio of resistance levels on the way up, starting with January’s high of $17.70. It will take a pair of closes over the twelve-month high of $18.66 to really get this market moving. Wednesday’s big price spike means silver calls are not as cheap as they once were but they are still relatively inexpensive on a relative basis.

Data Source: Reuters / Datastream

Keep the Faith

Holders of the December 2018 and December 2019 bull call spreads we’ve been recommending for the past 12 months should continue to maintain their positions. We expect silver’s next big upside move — if and when it finally happens — to be dramatic, much like the spring rally that saw it rise from $14.89 to $21.22 from late April to early July in 2016. RMB Group trading customers that don’t have a bullish position in silver may want to consider establishing one soon.

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) to for more information and/or to open a trading account. You can also visit our website www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2018 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.