Huge deficits, deflation and dangerous demographics have defined Japan for the past two decades. Japan’s shrinking population and growing number of retirees continue to threaten the solvency of the Land of the Rising Sun despite Prime Minister Shinzo Abe’s successful campaign to weaken the yen. A weaker yen helps in two simple ways: 1) It makes Japanese exports less expensive, providing a growth alternative separate from its demographically-constrained local economy and 2) it also reduces debt in real terms.

The yen has been one of the worst performing currencies, dropping 28% in just 2 years. We think it has the potential to go much lower. Our first target is .0900 in the front month futures contract, or roughly 7% below current levels. The problem is Japan is still struggling despite the yen’s massive drop which may mean even lower levels for the Japanese currency down the road.

Japan nearly doubled its national sales tax yesterday hiking it from 5% to 8%. That’s an immediate 3% hit to domestic consumption. It would not surprise us to see further yen devaluation to combat the potentially dangerous deflationary effects of this action.

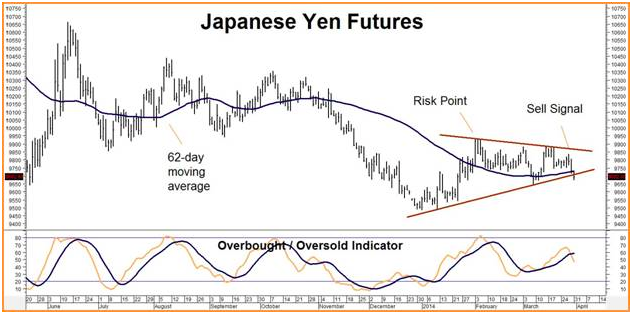

We especially like the yen’s shorter term chart setup. (See chart below.) Friday’s close was the second below a previous day’s low. This sell signal was confirmed by yesterday’s second consecutive close below the yen’s 62-day moving average. Our overbought / oversold indicator has also rolled over, leaving plenty of room to the downside. But what we like most about this chart are the risk parameters. Only 2.8% higher than current levels, our risk point of .09927 is both tight and realistic.

We are currently suggesting a bearish put option strategy with a total cost and risk of roughly $1,000 plus transaction costs and the potential to be worth as much as $5,000 should the yen hit our .09000 objective prior to option expiration in early September.

Prices can and do change so RMB trading customers should contact their broker directly for further specifics on this trade. Your broker can also help you custom design a strategy based on your risk level and/or differing price targets.

If you are not an RMB Trading Customer and want to know more about how we are playing this or any other market, contact us or give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over some of our fixed- risk, “Big Move” strategies with you. You can also e-mail suertusen@rmbgroup.com. Put “Yen” in the subject line.