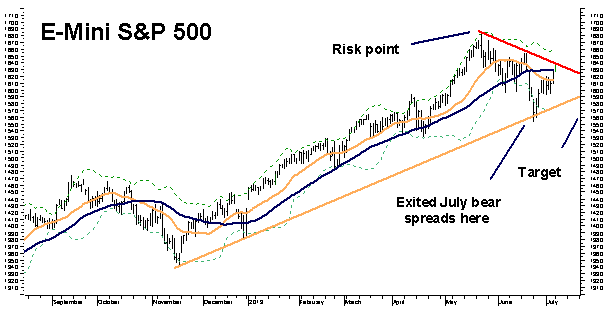

The time has come to re-establish short positions / hedges in the E-mini S&P 500. The market has bounced nicely since we suggested exiting our July positions two weeks ago (Alert #21). Price has retraced a nearly Fibonacci-perfect .618% of the last down move and is running into resistance and the short-term downtrend line.

We do not believe the S&P 500 can maintain bullish momentum with the bond market collapsing around it. Up 14.6% on the year, E-mini S&P 500 futures have already had a great year. Stocks are not expensive but they are not cheap either. With a whole bunch of good news already priced in, we see a bit more trouble ahead for stocks – especially should the recent rout in notes and bonds become out and out panic.

We’ll use two consecutively higher closes over old highs at 1686 as a signal to exit should our analysis prove incorrect.