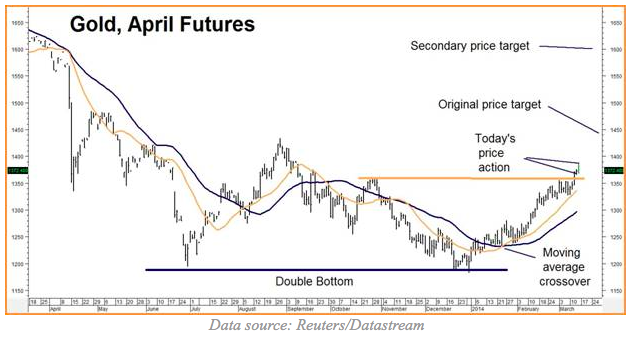

Two days ago we asked, “Is gold finally breaking out?” in Alert #10. It looks like we are getting our answer. Not only has the yellow metal closed twice over old swing highs, it has also closed higher than the previous day’s highs for two days running. Gold surged even further on the opening today, rising to $1,388 per ounce, leaving the key $1,357 level further in the rear view mirror. This former resistance level has now become support and bears watching.

Gold is overbought, but bull markets can remain overbought for a long period of time. We would not be surprised to see gold correct or shoot higher from these levels. The current bull market should remain intact as long as prices remain above the 40-day moving average which is right around $1,300 as we write this. Our upside objectives remain $1,450 and $1,600 respectively.

Silver’s Split Personality

Gold may be off to the races, but silver still hasn’t left the starting gate. We think that may change, especially if the current mini bull market in the former remains intact. Like gold, silver is a monetary metal but, unlike gold, it is also an industrial metal. Silver’s fate is almost always determined by how traders and investors view it. Industrial demand plays a small role. As a monetary metal, silver nearly always outperforms gold, sometimes by a huge margin. When viewed as an industrial metal, silver nearly always underperforms gold.

Silver is nicknamed the “poor man’s gold” because it is used as a cheaper substitute for gold in bull markets. Precious metal rallies tend to begin in gold. Silver doesn’t join in until the rally in gold is well established. Those who missed the move in gold and/or don’t want to pay up for more expensive gold crowd into silver. Silver is much less liquid, so buying and selling tends to have outsized effects. The chart below, showing the recent history of both metals, demonstrates this pretty clearly.

During the last bull market, gold rallied 180% and silver rallied 484%. Silver has declined almost twice as much as gold in the current sell-off.

In order to trade silver, you need to keep an eye on gold. We could cite a whole bunch of supply and demand statistics: 1) the fact that the vast majority of new silver production comes as a byproduct of mining for other metals like zinc and copper – the latter of which is declining sharply in price, or 2) that a fair quantity of silver is “used up” and not recovered from industrial processes, or 3) that silver stockpiles on the Comex represent just a fraction of the metal needed if long futures holders decided en masse to take delivery and forced the big-pocketed, bullion bank shorts to cover (buy back) their short contracts. These are all decent bullish arguments, but essentially meaningless until traders are willing to take them to heart.

Since we believe that the price of silver is ultimately determined by the price of gold, the yellow metal’s apparent breakout over old swing highs has piqued our interest in its poorer cousin. If the new bullish trend in gold continues, we believe the odds that silver will outperform are good – and perhaps, better than good.

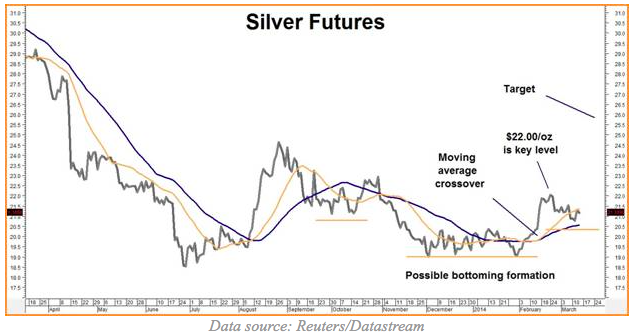

Signs of Life

Silver’s price chart is starting to show signs of life. Like gold, silver has tested and held solid support and appears to be tracing a classic chart formation called a ‘reverse head and shoulders bottom” by chartists. Like gold, silver’s 20-day moving average has crossed over the 40-day moving average, confirming a change in trend. The key is the old high at $22 per ounce. A couple of solid closes above this level could be enough to get silver out of its sideways funk and pointed toward our first upside objective of $25.75 in the July futures contract. We will use two consecutively lower closes below old lows at $18.87 per ounce as our risk point.

Rather than risking a lot of capital and paying big mark-ups and premiums for bullion or coins, we are currently recommending a simple option strategy (similar to the one we suggested in gold last January) with a current cost and risk of approximately $1,000 (plus transaction costs) and the potential to be worth as much as $10,000 should silver rise above our $25.75 per ounce objective by late June.

Prices do change so RMB trading customers should contact their broker directly for further specifics on this trade. Your broker can also help you custom design a strategy based on lower risk levels and/or differing price targets.

If you are not an RMB Trading Customer and want to know more about how we are playing this or other markets, contact us give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over a fixed risk strategy with you. You can also e-mail suertusen@rmbgroup.com. Put “Silver” in the subject line.