Like most tropical agricultural products, sugar has a reputation of being very volatile. Shortages caused by weather, unexpected demand or a combination of both can cause price to rise rapidly. Rising prices eventually spur more production creating oversupply which causes prices to fall right back down again. Add global climate change to the mix which increases the odds of a catastrophic weather event – especially in the tropics – and you get a formula for big price moves.

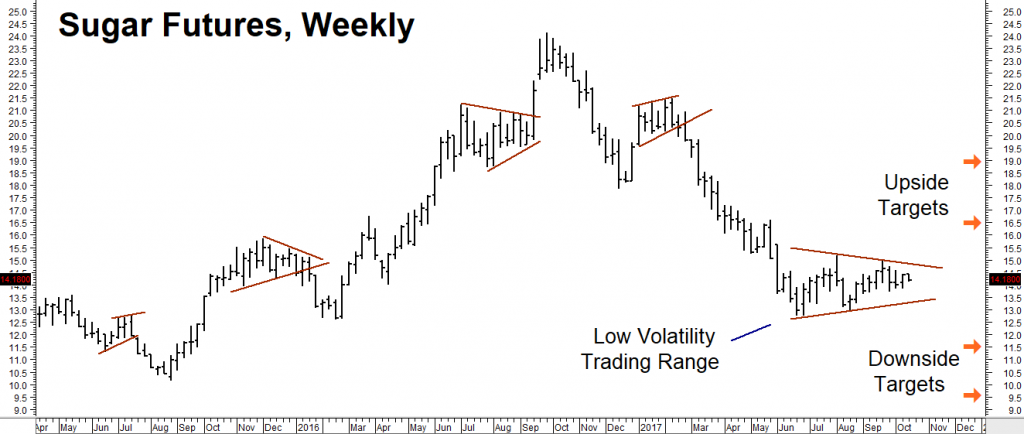

The chart below illustrates just how volatile sugar can be. The sweet stuff soared 56% from mid-August 2015 to early December 2015, in just 3 months. After declining 20% from early December 2015 to mid-February 2016 (2 months), sugar took off again, skyrocketing to a high of 24.10 cents per pound in just 6 months for a gain of 91%.

Data Source: Reuters / Datastream

Data Source: Reuters / Datastream

The way back down has been almost as volatile. Sugar declined 30% from its September 2016 high in just 3 months, before bottoming in mid-December 2016 and, after a short-lived 18% upward correction, plummeted another 41% early this summer. It has done nothing but move sideways since.

As the chart suggests, sugar tends not to stay in sideways trading patterns for long and often experiences significant moves once prices break out in one direction or another. Tomorrow will mark the 21st week of the current sideways pattern, making it one of the longest sideways trading patterns sugar has experienced in the past 10-years. And while this does not guarantee a breakout anytime soon, we believe it does represent an excellent trading opportunity.

Sugar Options Pricing In Mere 10.5% Move Next 17 Weeks

March sugar options expire 17 weeks from now. The cost of buying both a 14-cent call (which gives us the right but not the obligation to be long sugar at 14 cents per pound) and a 14-cent put (which gives us the right but not the obligation to be short sugar at 14 cents per pound) is 1.47 cents ($1,646.40). 1.47 cents is 10.5% of the current 14.05-cent price of sugar. This means that option traders do not expect prices to move more than 10.5% in the next 17 weeks. Why? Because traders could buy both options at the same time (this is called a “long straddle”) and profit from any move greater than 1.47 cents in either direction.

The recent history of this market suggests that if and when sugar does decide to breakout in one direction or the other – it will do so in a much more dramatic fashion than a move of 10.47%. In fact, the smallest breakout from the trading range highs or lows illustrated in the chart above was 17%. This occurred in December of last year and was a counter-trend breakout. All other breakouts were greater, and in three cases, significantly greater. What this tells us is sugar options are relatively cheap, especially in relation to the traditionally volatile nature of this market.

How to Play It

The last time we took advantage of extremely low volatility in a market was in gold. You can reread that suggestion here. Like gold then, we do not expect the relative quiet in the sugar market to last. Consequently, we recommend RMB trading customers to consider playing this market “both sides from the middle” by purchasing both call options and put options, looking for a “sweet” move in either direction.

Consider buying an equal number of May 15-cent sugar calls and May 13-cent sugar puts for a combined cost of no more than 0.87 cents ($974.40) looking for May sugar futures to hit either our upside target(s) or downside target(s) prior to May option expiration on April 16, 2018.

If we are wrong and sugar does not break out of its current trading range, the most we can lose is the $974.40 we’ve paid for our 15-cent call / 13-cent put “strangles” plus transaction costs. This position will be worth at least $1,680 at our 16.5-cent upside objective and at least $4,480 at our 19-cent upside objective. Similarly, it will be worth at least $1,680 at our 11.5-cent downside objective and at least $3,920 at our 9.5-cent downside objective. All objectives are derived from Fibonacci projections.

Please be advised that you need a futures account to trade the recommendation in this report. The RMB Group has been helping clients trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more about this trade.

If you are new to futures and options and simply want to learn more about them, you are welcome to download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free hard copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find a downloadable pdf. There is no obligation.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2017 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.