It’s dry in Minas Gerais. And hot… This coffee-producing region of Brazil has had just 60 mm of rain since Christmas. Normal rainfall is 175mm. Brazil is the biggest producer of high quality Arabica coffee and this is a critical time for the crop. Since 60 percent of Brazilian coffee is grown in Minas Gerais, we believe coffee futures could retest October highs of $2.25 per pound in relatively short order should these dry conditions continue.

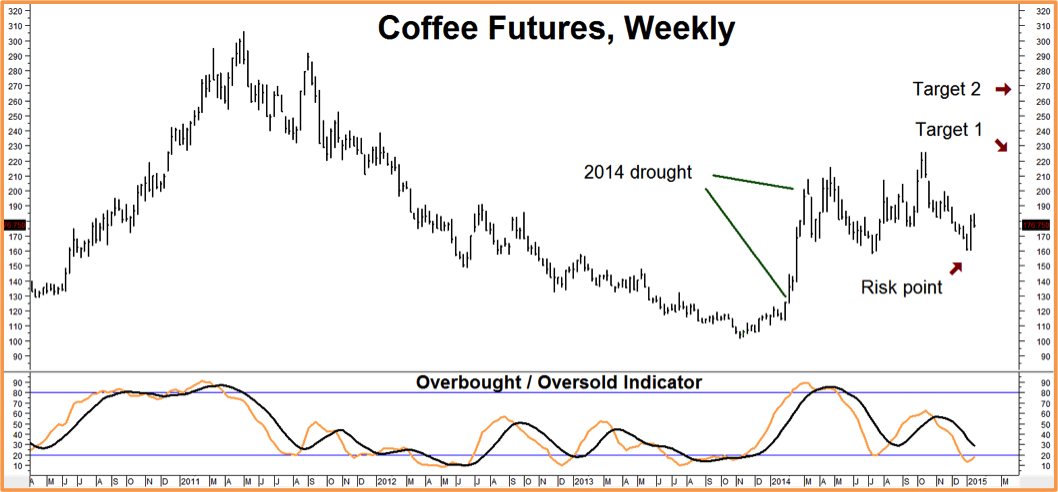

Weather can be a powerful bull market catalyst for coffee. Prices nearly doubled in just 7 weeks last year due to a devastating drought in the same region (see chart below). With this year’s crop expected to produce the same 44.1 to 46.6 million bags as last year’s drought-ravaged one, another dry year could have devastating effects on supply, leading to a significant run-up in price.

We may not know what Mother Nature has in store for the coffee-growing regions of Brazil but we do know it will be too late to enter a bullish position without a high degree of risk if we wait and the current heat and dryness continues. Prices will have already started rising rapidly. This makes now the perfect time (in our estimation at least) for a low cost speculation using options – especially since the coffee market is providing us with relatively low risk, stress-free entry and exit points.

As the chart above suggests, coffee is extremely oversold and overdue for a bounce. Consequently, we are asking RMB Group trading customers consider buying May bull call spreads in coffee targeting old swing highs of $2.25 per ounce in the May futures contract. The bull spreads we are looking at are currently going for approximately $882. This plus transaction cost is our maximum risk on this trade. Our spreads have the potential to be worth at least $5,625 each should coffee hit our $2.25 objective on or prior to option expiration on April.

We’ll use two consecutively lower closes below the recent low of $1.60 per pound as a signal we are wrong and will probably recommend exiting this position and cutting losses should it occur.

Prices can and do change so check with your personal RMB Group broker for the latest on this strategy and to get up-to-the-minute pricing and advice.

If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.