Futures Outlook: 10/28/13

It’s Too Late to Protect Yourself After the Fail

The stock market rally has been pretty to be sure, but the trend lines to me seem to be overextended and I don’t personally see the fundamentals necessary to support it. As gold and silver faltered this year, so could go the stock market next. The question is, what are you doing to protect yourself?

S&P 500

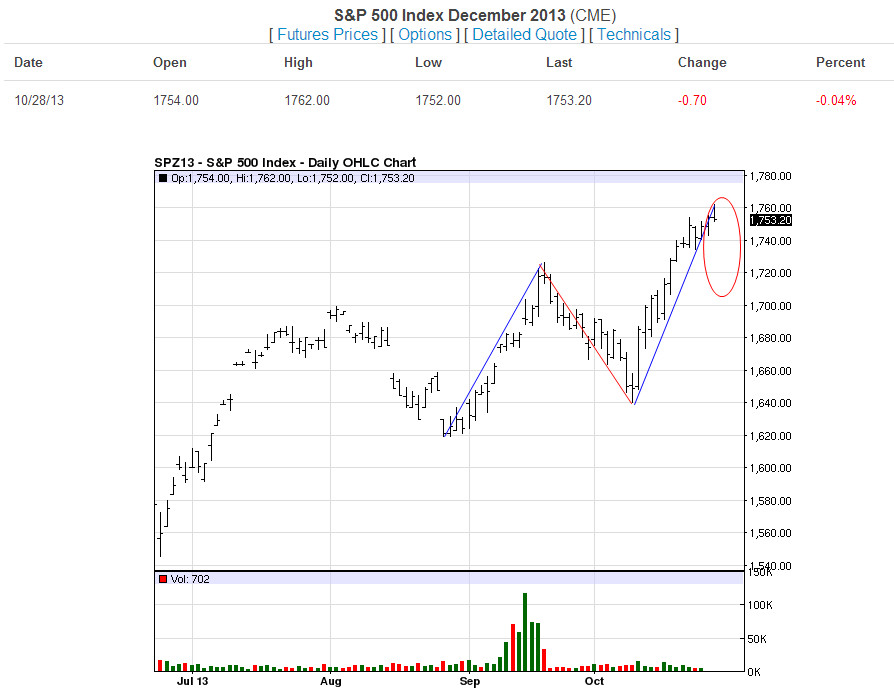

Let’s start off by looking at the Daily chart:

For every push higher at some point there has to be a rectracement or a failure. Here on the Daily chart you can see that the latest retracement before an upward swing was about 80 points on the S&P 500. That is also just a minor retracement in an upward trending market. What happens when a true retracement or reversal comes to play? How are you positioned? Right now I am looking for a near term retracement which would have greater impact if it were to break down the 1620 territory, but that is 130 points or so away. It is however something to be aware of as potential. The Daily trend is overextended at this point and needs at least a bit of failure now.

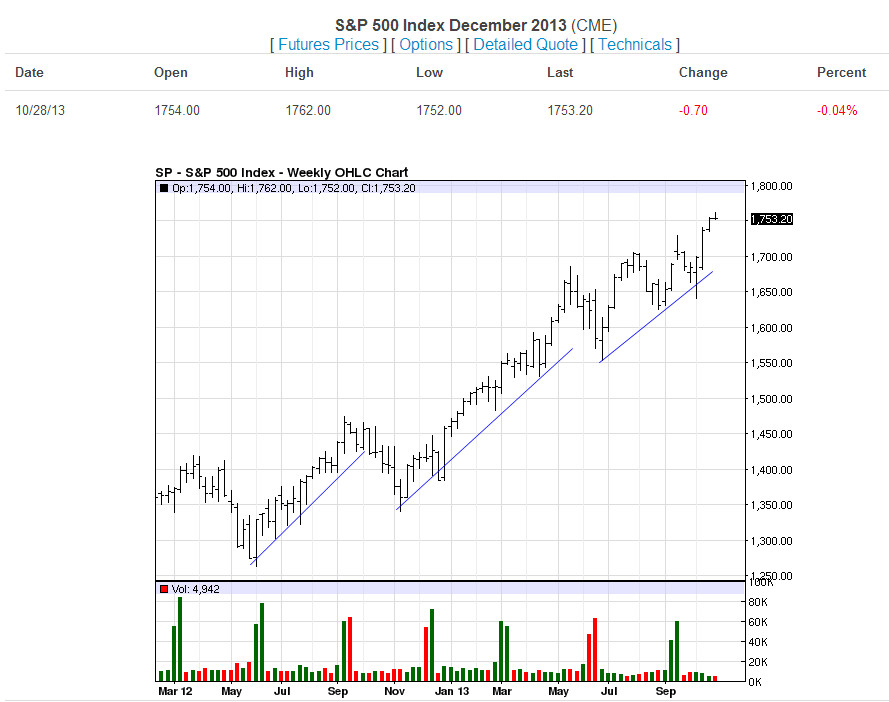

As we move forward to our Weekly chart:

This chart illustrates the amazing upward trend that we have seen since May of 2012 which is a continuation of what was the recovery after the fail in 2008. We have only seen a couple of slight retracements along the way, but now it seems that the slope of the trend line is starting to lessen in strength and it should. This trend in my view is too far gone and difficult to sustain.

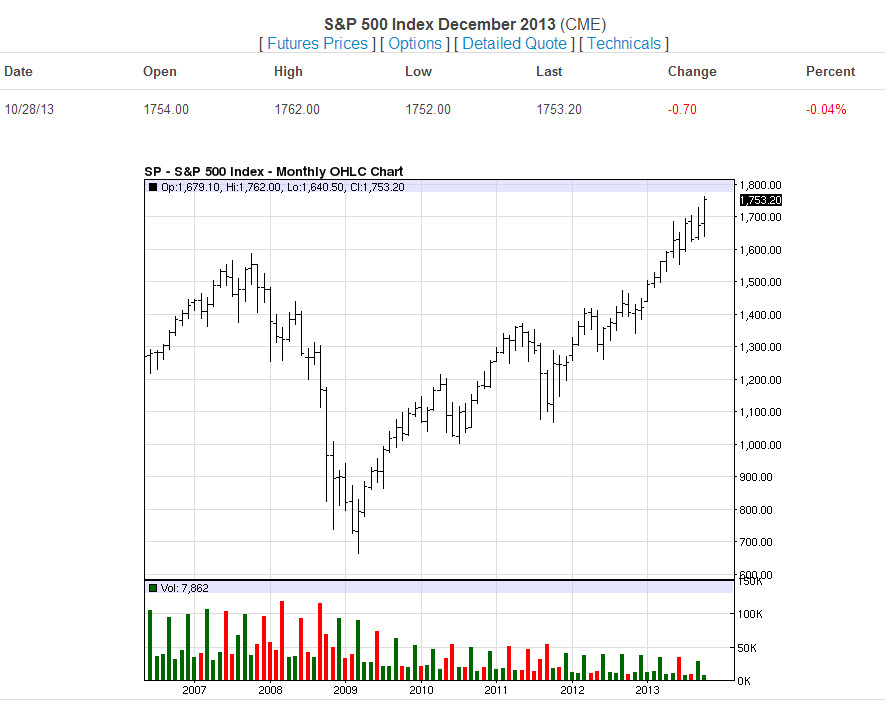

Moving to the Monthly chart:

This shows even more dramatically on the Monthly chart. Now I’m not calling for the S&P to fail to 600, but at this point this rally has been extreme and a healthy retracement is in order. Everyone is entitled to their opinion, but the last thing I want to see is the bottom fall out from under everyone while nobody is prepared. People on the whole tend to see la vie en rose when you have bullish markets that just don’t stop. The joy ride will go on forever. We all know in our heart of hearts that this is not the case. So whether it is a retracement of a couple hundred points or a thousand, don’t you owe it to yourself to protect yourself against the next downward moves?

Using Options is a great way to be involved in the pure play, potentially protect what you already own, and utilize a fixed risk scenario. Allow us to help you design the protection strategy that suits you best based on what you already own. It’s too late to protect yourself after the fail.

Remember, that we are here to keep your options clear.

Questions about this report or trading futures? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures