Savers looking to keep their money secure in an FDIC-insured US bank may soon have to pay for the privilege. Nearly a decade of making no return on savings could get even worse. Negative interest rates could soon be coming to America – especially if the next recession hits sooner than expected. Negative interest rates mean investors and savers will charged for keeping money in a bank or lending it out by purchasing government bonds – virtually guaranteeing they will lose money.

This sounds crazy but negative interest rates are already the reality in Japan, Germany and Switzerland. Federal Reserve Chairwoman, Janet Yellen left the door open for negative interest rates in the US during the Fed’s Jackson Hole speech in August.

The Fed and the rest of the world’s central bankers are out of bullets after firing them all in an ultimately successful attempt to thwart global economic disaster following the 2008 Lehman Brothers crash. The only weapons they have left to fight the next recession are more Quantitative Easing and negative interest rates.

Negative interest rates are bullish for gold because they remove the biggest obstacle to owning it – lost opportunity cost. Gold costs money to store and does not generate a return, making it less desirable than interest-earning deposits in a normal interest rate market. Why own gold when you can make a return on money stored in a bank or government securities?

But what if, instead of making a return, it actually costs money to store money? The one big obstacle to owning gold is now gone.

Three Reasons Why Gold Could Outperform in the Next 6 Months

- Negative Interest Rates – reduces or eliminates “opportunity cost” of holding gold – this is big.

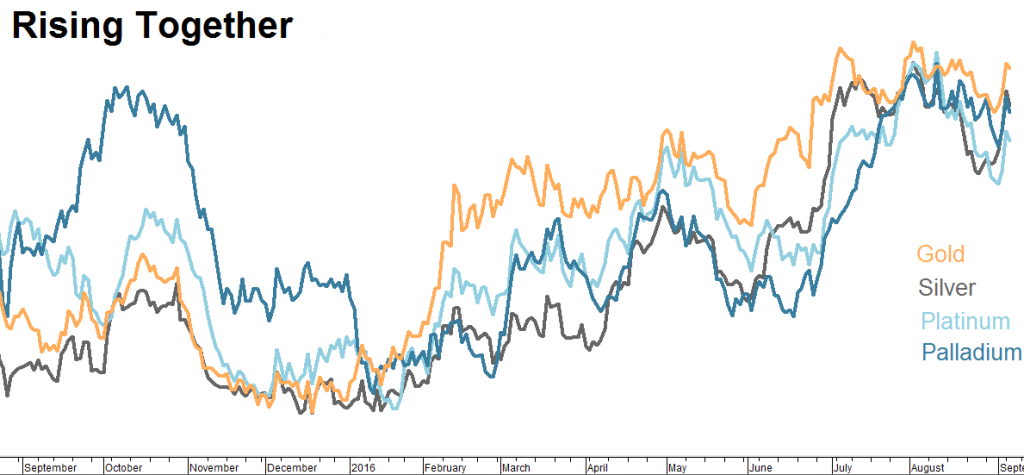

- Bull Market Confirmed By Participation – silver, platinum and palladium are all in bull markets.

- Dollar Topping — greenback in topping mode despite interest rate advantage.

Gold becomes even more interesting when one considers alternatives facing savers in a negative rate environment. Stocks won’t fit the bill because stocks aren’t really saving. Stock prices can go down and are chock full of risk at today’s bloated valuations. Savers could hoard physical cash, but storing and protecting it can be problematic.

The whole point of negative interest rates is to drive money from safe hiding places into the “real” economy. Negative rates won’t work if savers choose to store their cash in vaults or bury it in their backyards. Japan’s negative interest rates have driven vault sales in the Land of the Rising Sun through the roof. Not surprisingly, campaigns to eliminate the €500 note and the $100 bill are in the offing. Remove large denomination notes to prevent cash hoarding and gold becomes not only a solid store of value, but also a very convenient way to avoid being penalized by the banking system.

Negative interest rates – perhaps more so than even inflation in our opinion – are very bullish for gold.

Platinum, Palladium and Silver Along for the Ride

Gold was the first precious metal out of the gate in the current bull market but it is no longer alone. The Midas metal has been joined by platinum, palladium and silver. This is also bullish – especially from a longer-term perspective.

(Data Source: Reuters / Datastream)

Why Isn’t the Dollar Higher?

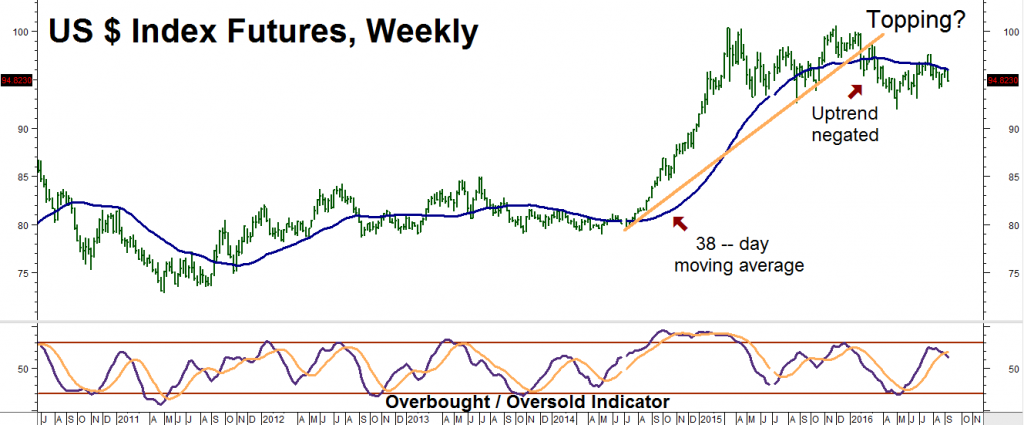

The strong dollar has been one of the biggest impediments to gold and silver. If you read the financial press, you get the impression that the dollar is in a rip-snorting bull market. But is it? Not according to the chart below.

In fact, the mighty dollar is starting to look a little “long in the tooth” despite being the beneficiary of having some of the highest relative interest rates of the globe’s top economic powers. The dollar has had a decided interest rate advantage over the yen and the euro for quite some time but this hasn’t seemed to help the greenback at all.

(Data Source: Reuters / Datastream)

The greenback has been moving sideways instead, negating its long-term uptrend earlier this year by closing below both its long-term trend line and the key 38-week moving average. We don’t know what is holding the dollar back but something surely is. Overbought and making lower highs and lower lows, it looks very vulnerable. Cheaper dollars mean more expensive gold.

Bottom Line: It’s Not Too Late to Buy Gold

We expect negative interest rates to be around for a while. They may get even more negative as Japan and Europe struggle to avoid recession. Add in the looming American election, China’s precarious banking system and the increased possibility that the US and Russia will become more active, making the debacle in Syria even more dangerous over the coming months and you get an financial and political environment that could be very friendly for gold.

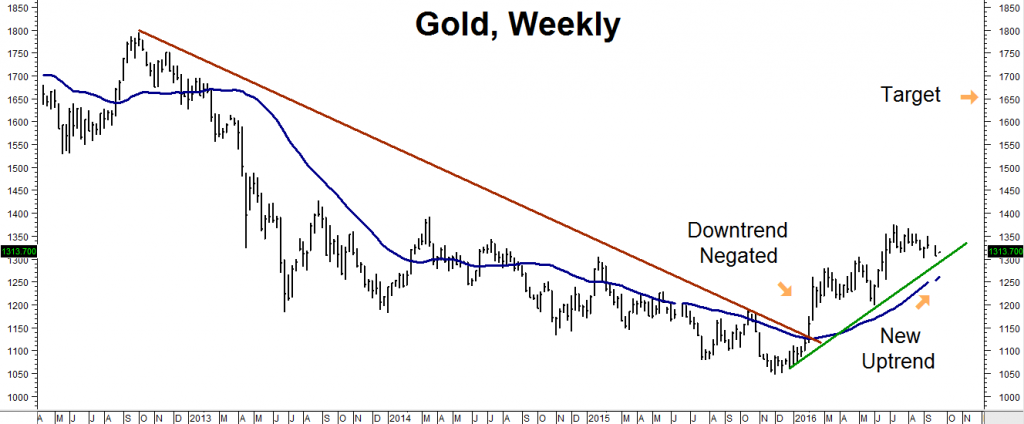

The yellow metal negated its long-term downtrend in February, closing solidly above its 38-week moving average and running the shorts out of the market. Since then it has managed to establish an impressive new uptrend marked by a series of higher lows and higher highs. Key levels of support are $1,250 and $1,200. Our 13 month target is $1,650 in the December 2017 futures contract.

(Data Source: Reuters / Datastream)

“Rent” Gold for Pennies on the Dollar

RMB Group recommended a professional trading strategy that allowed our customers to “rent” gold for pennies in March. (That Big Move Trade Alert is still on our website for those who want to read it again.) If you took that recommendation, congratulations. If you didn’t, it’s not too late to take another look at gold now.

Consider buying December 2017 $1,500 COMEX gold calls while simultaneously selling an equal number of December 2017 $1,650 COMEX gold calls. This trade currently costs $1,500 to execute and could be worth as much as $15,000 should gold reach our $1,650 price target by option expiration on May 25, 2017. $1,500 plus transaction cost is the most you can lose.

Your personal RMB Group broker knows this strategy backwards and forwards and would be happy to walk you through it. Give him or her a call if you are interested.

If You Are Not an RMB Group Trading Client…

Please be advised that you need a futures account to trade the recommendations in this report. The RMB Group has been helping their customers trade futures and options since 1984 and are very familiar with the strategies suggested in this report. Call us toll-free at 800-345-7026 or 312-373-4970 direct to learn more. We’ll send you everything you need to get started. You can also visit www.rmbgroup.com to open an account online.

If you are new to futures and options and want to learn more, download the RMB Short Course in Futures and Options. This free, easy-to-read guide covers all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct for your free copy or go to our website at www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page and scroll down to find the report.

—

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2016 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.