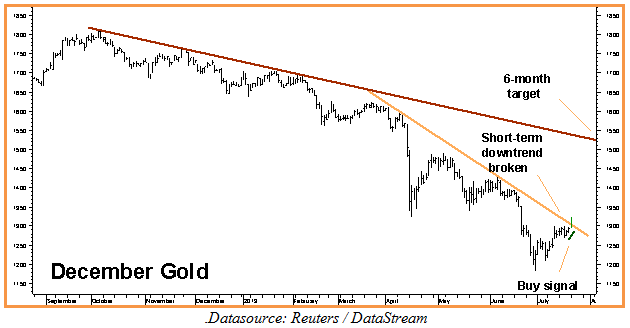

A higher close today will mark the first buy signal we’ve seen in gold since the Midas metal’s big April swoon that took prices from $1,550 per ounce to last month’s low of $1,182. If you have been following our suggestions, you are already long gold as part of the long gold / short crude pair trade we suggested entering last week (Alert #26). If you have not established a bullish position in gold, now may be the time – especially using limited-risk call option strategies.

Massive Chinese purchases, rampant central bank money printing and a shortage of physical metal – bullish factors that have been ignored by the market up to now – could move to the fore again, ending this bear run and sending the market screaming higher. The market may ignore these factors for awhile longer but we do not believe it can forever.

Today’s action is the best we’ve seen in quite some time. Gold is well above its short-term downtrend line as we write this. If it holds, the next stop could be the long term downtrend line crossing just above $1,500 in the December contract – a gain of roughly $170 per ounce. This is our 6-month target should the market manage a higher close today.

While we are certainly not recommending backing up the truck yet, we do believe we can finally start dipping our toes back into this market. A higher close today would be the icing on the cake – especially if it is near the high of the day’s trading range.

Bottom Line: If you don’t have bullish exposure to gold, now would be the time to consider getting some. Gold’s longer-term downtrend is still intact so rather than dumping a bunch of cash into bullion or ETFs we favor constructing low cost / high potential positions using gold call options instead.

Exit August Put Spreads on Higher Close in E-mini S&P 500 Today

A higher close in the E-mini S&P 500 today triggers the exit signal for the August 1600 / 1550 bear put spreads OE suggested purchasing for 11 points ($550) or less two weeks ago. However, failure to make a higher close today could prove disappointing enough to trigger a bout of profit taking – possibly signaling the beginning of a more sustained correction.