Futures Outlook: 12/6/13

Ever Heard the Expression, Buy Low, Sell High?

As we are in the final month of the year, many people will be evaluating exits and adjustments for the year’s gains/losses. Many actions will be taken to tidy/wrap things up. In consideration of your portfolio, I want to address a couple of thoughts with regard to the “Buy Low, Sell High” agenda.

Buy Low

It is not news that the commodities markets on the whole have not had a banner year. That is certainly not to say that no money has been made in commodities. It has been a year where the headlines have highlighted the “rough” year for this side of the markets. That being said, I think that one should consider the adage of buying low. If the commodities markets have been in a slump, coming into a new year, it might be just the place to focus on opportunity.

When thinking about buying low, consider things like Wheat, Corn, Coffee and Silver, to name a few.

Wheat

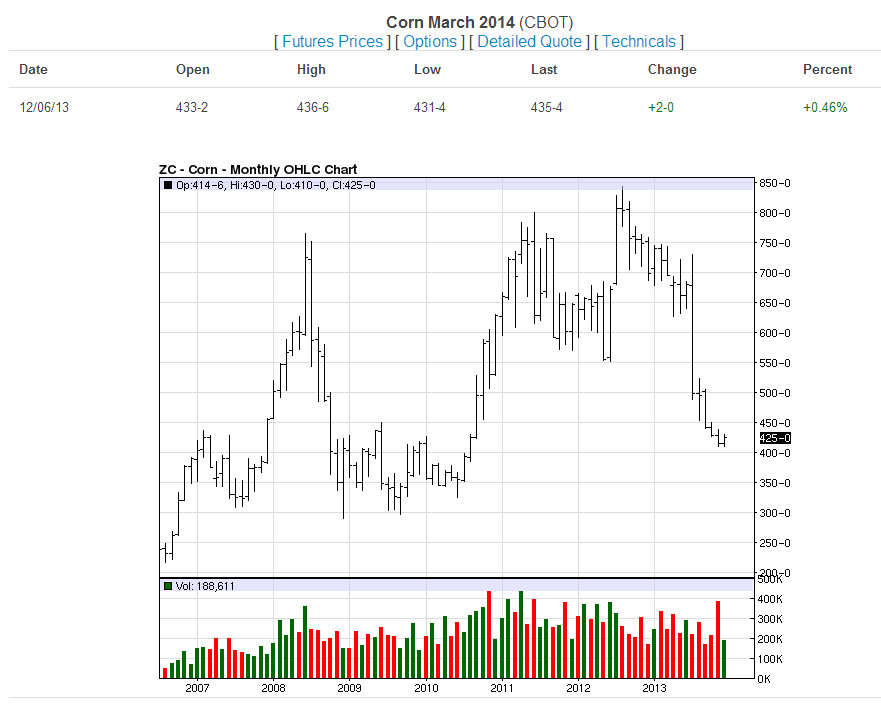

Corn

Corn had a significant failure this year, but may very well end up resting on and maybe even turning up from the support range between 300-425.

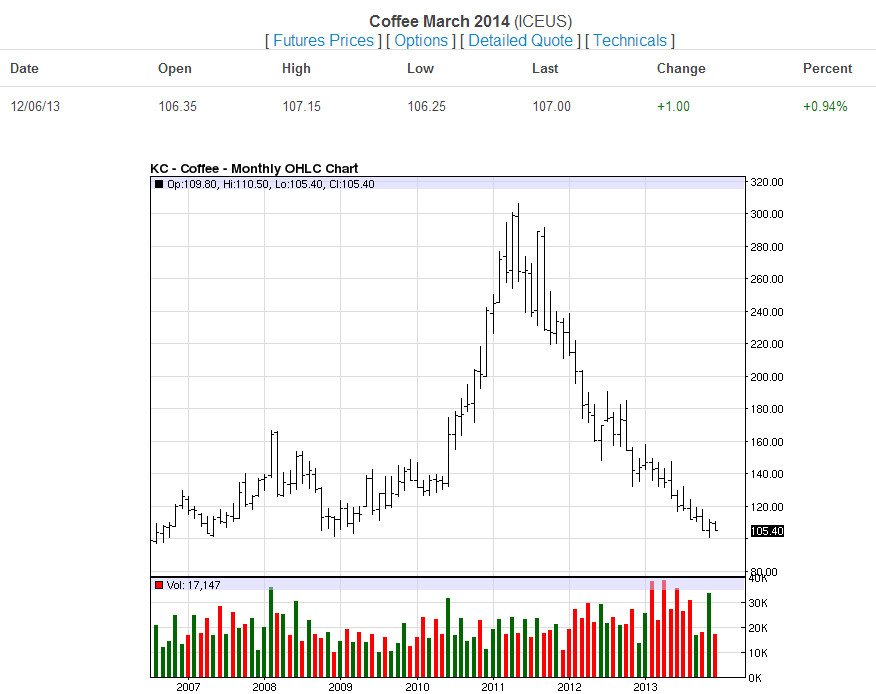

Coffee

Coffee definitely had a rough number of years. It began its downward spiral in 2011. Having come into a significant support territory around 100, it may very easily use this as a floor from which to start a new climb.

Silver

What can you say about Silver? Like most precious metals this year, it took a hit. I think that most of us knew that the metals needed retracement, but for me, they retraced a bit more than I thought they would. This failure however is actually a very healthy thing for the market. Silver now has the opportunity to climb once more. It has been extremely comfortable in the $18-25 range and with it sitting around $19, this could be a very nice place to evaluate next moves and the potential for initiating long side longer term positions. Keep in mind the fundamental issues involved as well including the supply side and the cost of production. These things should be considered ground floor in a silver recovery.

Sell High

On the flip side, ask yourself which markets have had a long strong run. Which markets are due a retracement, capitulation, or outright failure? The first two that come to mind for me are T-Notes and the S&P.

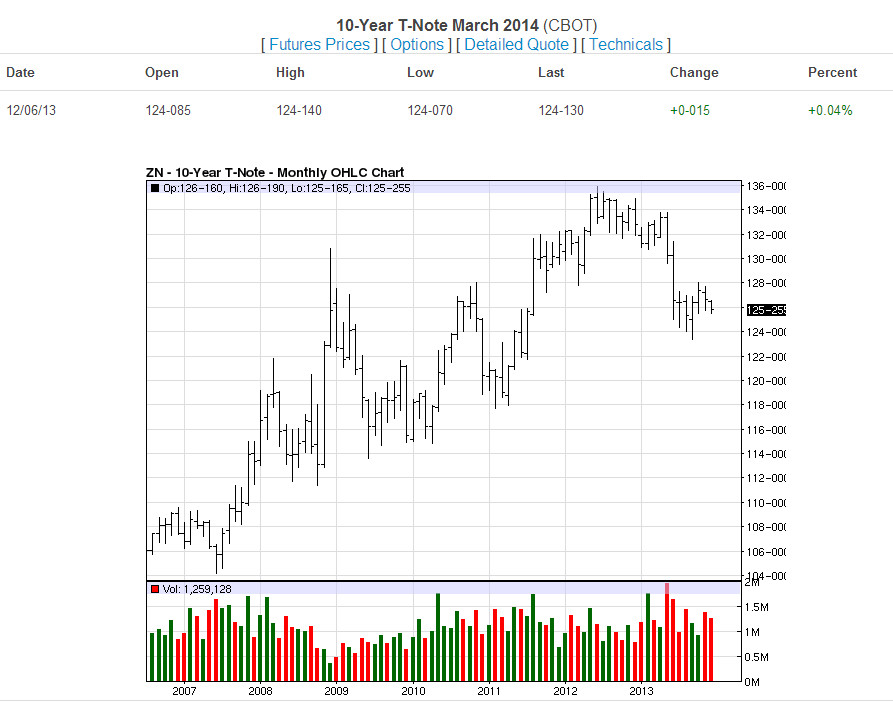

10 Year T-Notes

I’ve been talking about trading the T-Notes short for the last year and as you can see we did indeed have the beginning of a failure this year. If you didn’t take advantage of that opportunity, that’s alright. I believe that there is still plenty of room for failure in this market. It’s not too late.

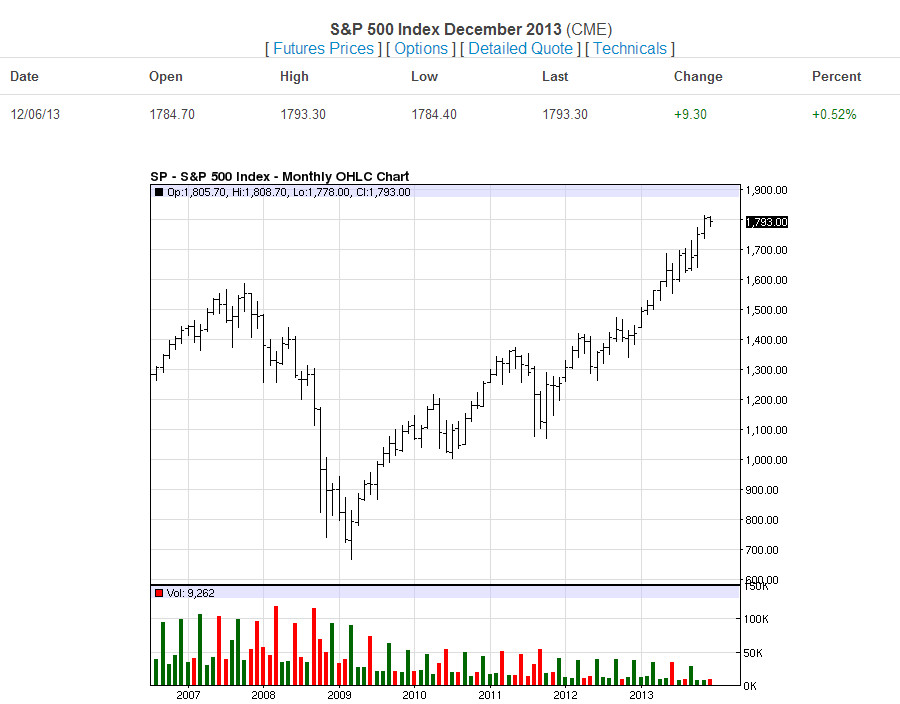

S&P 500

I still hold that this is a trend that needs a correction. Using options on the futures for the S&P is a great opportunity to be in play on the potential short without having to risk everything on it. You could use this play as a play outright or to potentially hedge a current stock portfolio.

Everyone talks about buying low and selling high, but so many people fail to employ the thought. I cannot call tops on markets or lows and get them right every time, nobody can. However, when you see markets in the states that I have shown you in the charts above, it is time to consider them.

You should never go all in on anything and understandably markets today can feel risky. There is always risk inherent as any trade is truly speculation, but there are ways to participate in longer term moves on a pure play and fixed risk using options. When you do this, you are actually using lesser capital and playing the true underlying market, while knowing every day what your maximum risk is.

Allow us to help you design the strategy that suits you best so that you can participate in these longer term Buy Low, Sell High opportunities. These market opportunities don’t show up all that often and I encourage you to talk to us about how they fit in your portfolio. Contact us directly and we will be happy to assist you in this aim.

Remember, that we are here to keep your options clear.

Questions about this report or trading futures? Contact us online or at 1-800-345-7026. Follow us on Twitter @RMBGroupFutures