Falling interest rates mean gold continues to shine. The yellow metal is up 8.1 % since our first “Alert” of the New Year when we explored the relationship between interest rates – specifically US 10-Year Note yields – and gold. (Click here to read this report.) As we pointed out last week in Alert #3, the ongoing freefall in long-term interest rates has significantly reduced the opportunity cost of holding gold. In many cases, gold is cheaper to own than government paper – especially if that paper happens to be German or Swiss.

Investors are actually paying for the privilege of loaning money to Germany and Switzerland! It currently costs 0.16 percent to own the perceived safety of 5-Year German Bunds and 0.08 percent to own Swiss 10-Year bonds. Want to park your money in the Swiss Franc? Be ready to pony up 75 basis points. No wonder gold is going bonkers. Gold may not pay anything, but it doesn’t cost much to own either. It is not subject to the whims of a central banker which makes it extremely attractive after what the Swiss National Bank pulled last week.

Better still, there is a way to generate “yield” from gold…The recent spike in precious metal volatility means you can sell out-of-the-money call options against gold (and silver) holdings and get a return far greater than what is being offered by many of Europe’s big central banks.

Here’s an example: As of yesterday, April 1450 COMEX calls were going for $800 each while gold itself was trading at $1,300 per ounce. April 1450 gold calls are a full $150 per ounce or 11.5% above the market price for gold and have only 63 days of life left. Selling one for every $130,000 worth of gold in one’s portfolio (each option covers 100 ounces) puts $800 into the seller’s pockets which he gets to keep no matter what. $800 in 63 days is an annualized return of roughly 3.56% — almost 2 full percentage points more than US 10-year notes were yielding yesterday.

What’s the downside? The seller is contractually obligated to sell gold at $1,450 per ounce and cannot participate in further appreciation. However, he still gets to book a gain of 11.5% and keep the $800 he received when he sold the call. Not a bad consolation prize…

Of course, not everyone is sophisticated enough or owns enough gold to do this. But the fact than one can speaks volumes about why gold is doing so well despite the uber strong dollar and deflation fears. (Call your RMB Group broker if you would like to learn more about covered call strategies in gold and silver.) This is also why we believe the yellow metal could climb higher than many think – especially if long-term interest rates continue their swoon.

Potential Flies in the Ointment

What if the Fed surprises everyone and raises rates sooner than expected? What if default concerns – especially in Europe and Japan – cause investors to pull their money from sovereign debt across the board? Safety is becoming increasingly expensive. What happens when it becomes too dear and investors say “enough is enough?” Japan is getting close to this scenario right now. Massive Bank of Japan buying has reduced the yield on Japanese Government Bonds (JGBs) to the point where Japanese insurance companies invested in JGBs can no longer cover their liabilities with the proceeds from their “safe” government bonds.

The Swiss National Bank’s decision to lift its euro peg overnight could be the first of a whole flock of potential “black swans” that could pop up in the coming year. If one of the world’s most respected currencies can appreciate over 30% virtually overnight, then it is not much of a stretch to expect something like this to happen in the sovereign debt market as well, only to the downside. All it would take is a loss in confidence and the collapse in one major bond market to spread fear across the entire sector. Will that happen? We hope not… but it certainly could, and virtually no one is looking for it.

Gold and Bonds Have a Lot of Catching Up to Do

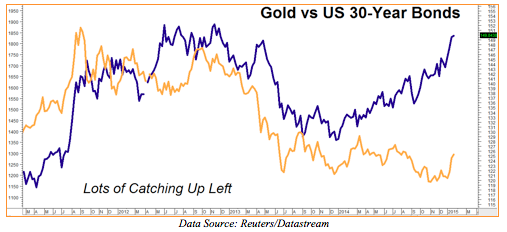

In Alert #1 we explored the relationship between gold and US 10-year notes. Here’s a similar relationship using 30-year bonds. Look how closely these two markets track. Low interest rates mean high bond prices, so this chart is really showing the effect of low interest rates on the price of gold.

But the gold / bond relationship can adjust the other way, too. Instead of gold rallying to meet bonds, the latter can decline to meet gold. You can also have a scenario where gold rallies and bonds decline simultaneously. With 30-year US Treasury prices approaching all-time highs (see chart below) and yields setting records for new lows, we believe it’s time to add a short bond position to our bull call spread positions in gold and silver. This gives us positive exposure to a host of potentially destabilizing scenarios.

What to Do Now

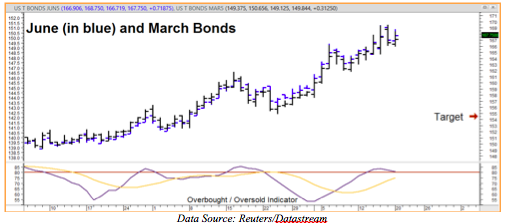

Right now we are asking RMB Group trading customers to consider purchasing June bear put spreads in the US 30-year Treasury futures, targeting a decline to 154-00 in the June contract. Please note that due to a change in the contract regarding the cheapest to deliver bonds – the June futures contract is quoted higher than the March futures contract. We’ve overlaid the June contract month over the March contract so you can see the comparison in the chart below. Out 154-00 target is the rough equivalent of a decline to 142-00 in the March contract. (Note: March prices are reflected in the weekly chart above.)

We want to add a bearish bond position to the bullish gold and silver positions we’ve already established in order to take advantage of the wide discrepancy between these markets. We are currently recommending bear put spreads with a cost and total risk of approximately $875 plus transaction cost. These spreads have the potential to be worth at least $5,000 each should June US Treasury Futures hit our 154-00 objective prior to option expiration on June 19. June options are still relatively thin, so work with your broker to get a fair price. Some patience may be required.

Editors’ Note: We like this play not only as a hedge for our bullish gold positions, but as a contrarian play in its own right. As the chart above suggests, bonds are currently overbought. Nobody expects interest rates to do anything but fall anytime soon.

Consequently, it won’t be very pretty when (and if) they do. Prices can and do change so check with your personal RMB Group broker for the latest on this strategy and get up-to-the-minute pricing and advice. They may recommend a similar strategy with different strike prices depending on market action. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com or visit us online at www.rmbgroup.com.