Lean Hogs

Lean Hogs have been on a tear and really great things have happened in that market if you were bullish. At this point, the charts are still strong and seasonally we are nearing peak months. This may present a short term opportunity to try and eke out additional momentum and gains should Hogs try to push higher. However, the larger potential may actually exist counter trend on this one. Right now may not be the exact moment to jump in if you are bearish as some high side risk may still exist, but it is definitely the time to start watching this market if you are looking for and wanting to play the retracement that tends to be seasonal as well as one that could be technical as well. Let me show you the charts.

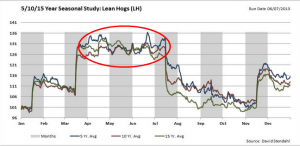

First, I would like to address seasonality. While the seasonal performance that is historical is no guarantee of what will happen in the next few months, it is definitely something to keep in mind. I have highlighted on the chart above the seasonal peak price months. You will see that in this compilation of 5 year, 10 year and 15 year seasonal studies, the peak price months tend to be from mid-March through mid July. As we are pushing into the middle of June, please note as mentioned that there is still some high side risk potential over the next month or so if you are going by seasonal patterns.

I have highlighted the same seasonal peaks here on the 20 year/30 year compilation as well. Now is the right time seasonally to start to pay attention to the potential for the retracement of Lean Hogs. With seasonality discussion out of the way, let’s move on to the charts that we actually see on Lean Hogs today.

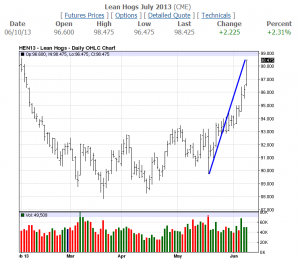

Notice that on the Daily chart, even in just the last few weeks, we have seen a dramatic push higher in Lean Hogs pricing. Not only is this trend line extremely steep, but we are also approaching a major psychological level of 100. Hogs have broken 100 before, but the question is will they break it well this year? With a daily trend line with this type of line slope, the strength has been evident, but in my view it is in need of a healthy correction.

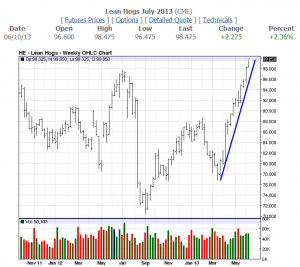

I have highlighted the same type of extreme look here on the Weekly chart as well. This time I drew my line underneath the lows so that you can see the levels of strength illustrated by the price point action. We are approaching 100 at what could spell the end of a very powerful move. It is technically difficult to sustain this same type of momentum after this lengthy a push without some type of correction, which we really haven’t seen thus far. The momentum, while present, may be a little stale.

When we look at the Monthly chart on Lean Hogs, you will see that there was a bull flag pattern on the Monthly chart that spanned almost 4 years of time. You will also see that we have been breaking out of this pattern to the high side which should be expected. From a larger picture perspective and a multi-year perspective, it is important to note here that prices on Lean Hogs may actually be in for continued price increases for the long haul.

However, if you are looking for near term action, then you will want to pay attention to our behavior in this market around the 100 mark, which is highlighted here by the blue dotted line. It has been a couple of years since we broke the 100 mark well. In my view, with an overextended push on the Daily and Weekly charts, a trend line that is too steep to maintain, maybe a month or so left in seasonal peak, and charts that in general need correction, this is one to watch for south side action.

Keeping in mind that this correction would be counter trend, it becomes important to pay attention to the charts and momentum and in addition to limit your risk.

For those of you, who may want to explore the Lean Hogs market without “going whole hog” so to speak, consider utilizing Options to dip a toe in this market. We focus on utilizing Options on these Commodities in order to lessen capital outlay and we use fixed risk strategies that allow you to rest at night knowing exactly where you stand. You should be prepared for the appropriate actions should these markets start to shift. We are here to make your options clear!