Remember Peak Oil? It seems so quaint, doesn’t it? The notion that the world might run out of oil is almost laughable in today’s post hydraulic fracturing environment. The fear that the world is running out of oil has been replaced by the possibility that the United States – still the world’s largest consumer of crude oil – could actually begin exporting oil within the next few years. “Fracking” opened up millions of barrels of reserves that were previously inaccessible – especially in North America – and changed the playing field in the process.

The Organization of the Petroleum Exporting Countries (OPEC) used to call the tune in the oil market but according to its own estimates. “non-OPEC supply is projected to increase by almost 1 million barrels a day this year, largely due to a boom in production in the U.S. …” (WSJ 2-12-13), mostly due to hydraulic fracturing that releases oil previously trapped in shale. OPEC expects demand for its crude to fall by 300,000 barrels per day.

America’s Energy Information Agency (EIA) expects non-OPEC crude output to rise by 1.58 million barrel per day in 2014. And finally, the International Energy Agency (IEA) forecasts US oil production overtaking Saudi production as early as 2020 given current rates of growth.

Does this mean the era of expensive oil is over? Not by a long shot. It won’t be long before we are looking back at today’s headlines predicting “energy independence” with the same jaundiced eye we currently view past predictions of “peak oil.”

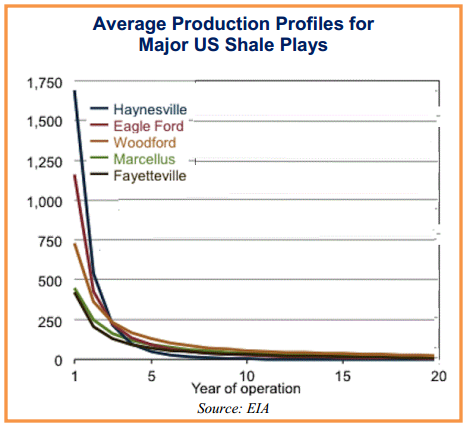

Newly-fracked wells deplete far more rapidly than conventional ones, at times losing 70% of initial production in just the first year. That means all those new discoveries trumpeted by those predicting energy independence will struggle just to keep pace with dropping production in current ones.

“Fracking” Covers Just a Small Fraction of Daily Demand

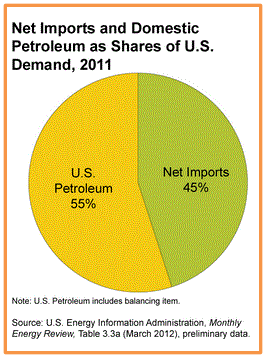

America burns roughly 19 million barrels a crude per day. Hydraulic fracturing produces roughly 1 million barrels. That means 18 million barrels per day still need to come from somewhere else. Fracking is expensive and getting more so by the day as its popularity and drilling lease acquisition costs grow. Consequently we expect new shale drilling to decline dramatically on any significant decline in the price of crude oil. For this reason we don’t expect sub $80 per barrel crude oil to last very long.

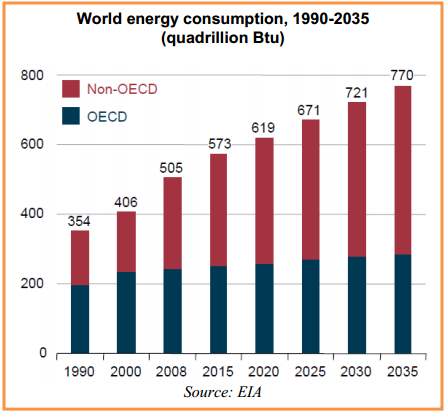

North American hydraulic fracturing may have moderated price increases, but it is not even close to putting a stake in the heart of the crude oil bull – especially not with OPEC still responsible for the Lion’s share of global production and war in the Middle East threatening escalate dramatically in the next few months. Global oil demand is expected to grow by 1 million barrels per day in 2013 to 90 million bpd. Even assuming that all of the 1.06 million barrel per day growth in IEA’s non-OPEC production estimate comes from North American Shale, fracking barely keeps pace with this year’s anemic growth in global demand for crude oil.

The North American shale oil phenomenon has not solved America’s dependence on foreign oil and probably won’t ever. What it has done is caused OPEC to sit up and take notice. OPEC has been threatening production slowdowns in response to reduced demand from the US and has begun to implement them. Crude oil is a global commodity — shale oil or no. With supply and demand in relative balance, relatively small disruptions in supply could have still have outsized effects on price – shale oil or no shale oil.

Nigerian, Iranian and Libyan production all fell in March due to turmoil of one sort or another. With the Sunni / Shiite unrest growing in Iraq threatening to break out into civil war, America ever-closer to intervening in Syria and the time to nuclear Iran ticking away, the Middle East could be a particularly dangerous place over the next few months. Israel bombed Syria 3 times in as many days because it was worried about a few longer range conventional missiles falling into Hezbollah’s hands. What do think they will do when and if a nuclear Iran crosses a similar “red line?”

But even if events in the Mideast do not boil over, a new era of cheap crude is not assured. China could overtake the US as the world’s largest oil imported as soon as 2014 with demand of 11 million barrels per day and imports topping 6 million bpd. China must keep growing its oil supply in order to accommodate growth and will likely greet and price decline with orders to buy.

Big Populations Mean Growing Demand

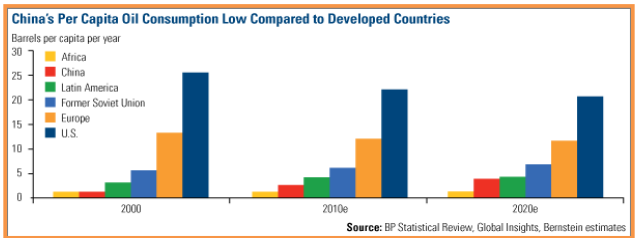

China is home to 1.4 billion people. India is home to nearly as many. That means small changes in energy consumption in these two nations alone can have outsized effects. In today’s world of raised expectations, their large populations cannot be ignored. In one decade (1995 to 2005), US oil demand grew from 17.7 million barrels per day (mbpd) to 20.7 million – a gain of 17%. Chinese demand rose from 3.4 mbpd to 7 mbpd – an increase of 106%.

India’s oil imports are expected to triple by 2020, rising to 5 million barrels per day. China, India and the rest of Asia currently account for 60% of the globe’s new oil demand. Expect this percentage to grow, despite the European debt crisis roiling the markets right now.

America, with a population of a little over 300 million, consumes roughly 20 barrels of oil per person per year. Europe, with roughly the same population, burns 10 barrels per person per year. China’s per capita consumption is miniscule – approximately 2.5 barrels per person per year. India consumes even less. It doesn’t take a math degree to figure out what small increases in consumption in these nations will do to global oil demand.

Indian and Chinese economies are suffering post-crash global slowdowns like everyone else. But both nations are growing at rates almost unimaginable for the developed world. China’s growth rate has slowed but still tops 7.5% which is pretty darn impressive when seen through the lens of the West. India’s growth is roughly 6 percent. Both China and India will need to mechanize more and more of their food production to feed their growing populations. This will require more energy. So will millions of their new appliances and automobiles.

The petrodollars that poured into oil-producing nations during the run-up in crude have increased standards of living to the point where these nations are using more and more of their own oil, leaving less for export. Both infrastructure and electricity are in short supply in China and India, but also in the Mideast as well. Resolving these shortages will require energy. The nations of the Persian Gulf and northern Africa already use almost as much oil as China. Since most of this oil is subsidized, Middle East demand for its own oil is practically guaranteed to increase, leaving even less for export.

The genie of raised expectations in both the developing world and oil-producing nations is not going back in the bottle any time soon – especially since the developing world has grown accustomed to Western lifestyles. Chinese drivers are not going to turn in their newly-purchased cars and hop back onto their bicycles. Neither are their Indian neighbors. Property developers in Dubai have no plans to ditch their brand new, air-conditioned skyscrapers for Bedouin tents.

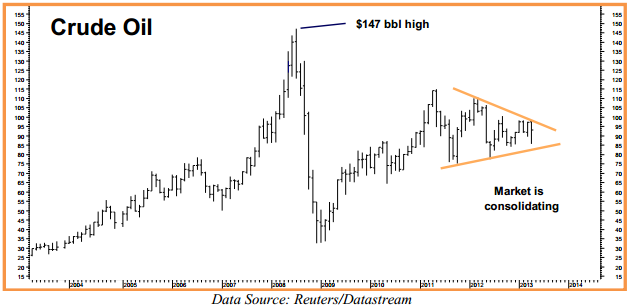

Crude Is Consolidating Gains

Crude is in the process of consolidating the gains from the 2009 washout. A couple of month-end closes above the upper down sloping boundary of it three year trading range could propel it much higher. Crude’s $147 per barrel high turned out to be unsupportable. In our opinion, emerging market demand and political necessity make prices much below $80 per barrel equally unsupportable.

Many OPEC nations have a critical stake in keeping prices as high as they can so they can continue to “buy off” ever-more-restless populations. This is true in Saudi Arabia and Venezuela, both of which share the dual distinctions of having some of the world’s largest proven reserves and being among the biggest supplies of crude to the US.

Big volatile swings mean we do not want to tie up a lot of capital in energy stocks or ETFs – both of which have a long history of underperforming crude oil. Big volatile swings in nearly all markets means we do not want to tie up a lot of capital long or short. That’s why instead of buying crude oil, we’d rather “rent” it. We expect crude to climb well above $100 per barrel again soon but don’t want to get caught with our pants down if we are wrong. Crude oil has been consolidating for the past 2 years. Given the deteriorating situation in the Mideast in, it would not surprise us to see this market surprise everyone to the upside. The question is…how do we play it?

“Renting” Crude Oil for Pennies on the Dollar

We’ll do this by using NYMEX crude oil options. NYMEX crude oil options are the most liquid (no pun intended) oil option market in the world – making buying and selling them about as easy as buying and selling most stocks. NYMEX crude options are a DIRECT PLAY on the price of the oil itself. NYMEX crude oil options also provide big leverage with limited risk. That means we can devote a small amount of capital to our oil investment while keeping the bulk of our hard-earned dollars in safe, interest-bearing instruments.

As we write this, crude oil is trading at approximately $94 per barrel. For all the reasons listed in this report, we expect crude oil to bounce and trade well above $100.00 per barrel within the next few years. Big volatility means the straight-up purchase of call options, while less expensive than the purchase of crude oil or an equivalent dollar amount of energy stocks outright, is still too rich for our blood. What we do instead is take the bulk of this “volatility premium” out of the equation by combining the sale of a call option with a higher strike price with the purchase of an option with a lower strike price. This lowers our risk and leaves us plenty of room for gains.

One of the nice things about trading crude oil itself rather than ETFs or energy companies is the availability of long-term options. Right now we are looking a professional option strategy that will keep us long through late November 2005 with a maximum cost and risk of $2,000 (plus transaction cost) and a gross profit potential of $20,000 in expectation that crude will rise back above $110 per barrel and perhaps as high as $130 per barrel in the next 2 years. We call it “The Gusher Strategy.”

RMB Group trading customers can learn more about this strategy by contacting their personal broker and requesting the full report, including the trade. If you don’t have

an RMB trading account you can call 800-345-7026 (toll free) or 312-373-4970 (direct) and we’ll send you the trade. You can also request the full report by e-mailing suerutsen@rmbgroup.com or going to our contact page. Put “crude oil report” in the subject line and provide a snail mail address and your telephone number.

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien and is, or is in the nature of, a solicitation. This material is not a research report prepared by R.J. O’Brien’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

This report was written by Investors Publishing Services, Inc. (IPS). © Copyright 2013 Investors Publishing Services, Inc. All rights reserved. The opinions contained herein do not necessarily reflect the views of any individual or other organization. Material was gathered from sources believed to be reliable; however no guarantee to its accuracy is made. The editors of this report, separate and apart from their work with IPS, are registered commodity account executives with R.J. O’Brien. R.J. O’Brien neither endorses nor assumes any responsibility for the trading advice contained therein. Privacy policy is available on request.