Nobody likes commodities right now. A strong dollar and weakness in China – the world’s largest commodity importer – have weighed heavily on nearly all things that come from the ground. But the thing the market hasn’t accounted for is weather. Weather is typically the force behind nearly all big moves in commodities – especially agricultural commodities.

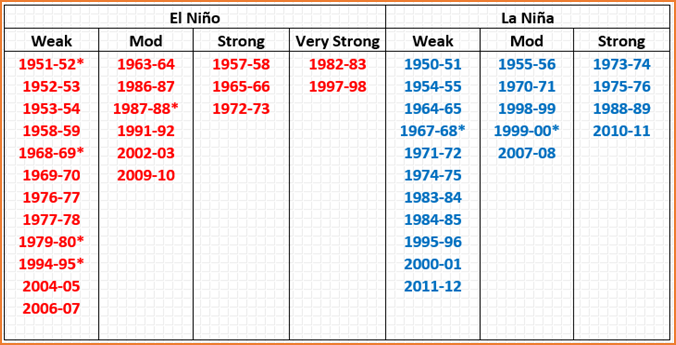

The number and intensity of major weather events is increasing but perhaps the biggest weather event commodity traders need to be aware of is the La Niña /El Niño cycle. Water sloshes back and forth across the Pacific Ocean, driven by increased wind speed much like water in a very large bathtub. The table below shows the history of this cycle. When it sloshes one way it brings warm water to the tropical Americas and cool water to Australia and southern Asia. This phenomenon is commonly known as “El Niño.” When it sloshes back we get La Niña.

Source: Golden Gate Weather Services

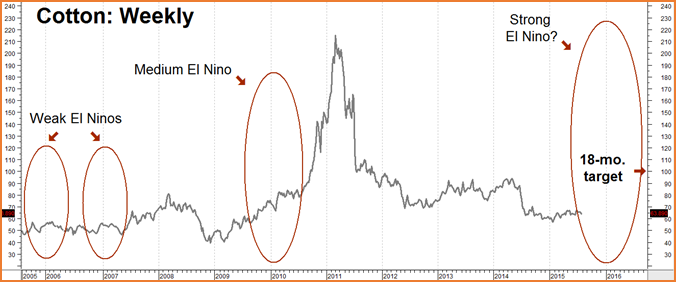

El Niño made its first appearance in February of this year – barely. It wasn’t “officially” labeled until April. Since then it has grown in intensity with waters off central and South America warming faster than many expected. Science and Environment predicts a “substantial” El Niño event developing later this year that could have a profound impact on selected commodities. The chart below shows the effect the past three El Niños had on cotton and sugar:

Data Source: Reuters/E-Signal

El Niño is a tropical phenomenon so it is not surprising that it tends to affect tropical crops more than soybeans and corn. El Niño is associated with heavy rains in the American Southwest (witness this spring’s torrential, drought-breaking rains in Texas), heatwaves in Brazil and dangerous drought conditions in Southern Australia. As you can see in the chart above – the pricing effects of El Niño often last longer than the event itself.

Weather is increasingly unpredictable, but combine the potential for a strong El Niño with extremely low prices for sugar and cotton as well as incredibly cheap options and you come up with the makings of a pretty good, low-cost “Big Move Trade” with the potential for solid gains even if prices rise just one quarter of distance they did during and following the 2009 – 2010 El Niño.

What to Do Now

Sugar and cotton are in the dumps and hardly anyone expects them to do much of anything except go down. While this may be bad for those already in the market on the long side, it is the perfect condition for those wishing to take new speculative bullish positions using options.

Let’s start with sugar…

Data Source: Reuters/E-Signal

We are currently recommending trading clients consider buying long-dated March 2017 ICE sugar call options that give them the right but not the obligation to be long from 15 cents per pound. These calls are currently going for around $950 each.

If sugar reaches our 20 cents per pound objective on or before expiration on February 15, 2017, each of these calls will be worth at least $5,600. February expiration keeps us long well beyond the expected length of the current El Niño – that’s 18 months of upside exposure for a maximum risk of $950 plus transaction cost. If sugar reaches its 2010 high of 30-cents per pound, each option would be worth at least $16,800. Talk about sweet…

Now add cotton…

Data Source: Reuters/E-Signal

We are also suggesting trading customers consider purchasing long-dated March, 2017 cotton calls that give them the right but not the obligation to be long the white, fluffy stuff at 75 cents per pound from now until February 2017 for roughly $900 plus transaction cost.

If cotton reaches our objective of $1.00 per pound prior to option expiration, each of the calls will be worth at least $12,500. Like the sugar play, the February 10, 2017 expiration of the calls keeps us long well after current El Niño is expected to fade. A rally to 2011 highs over $2.00 per pound would make each call worth at least $72,500.

Put these two call option together and this entire “El Niño Power-Pak” trade sets us back a little less than $2,000 plus transaction cost. We’d pay up to $2,500 for this kind of exposure but with these markets as morose as we’ve seen them in a long time, we can get both long-dated calls for under $2,000. If were are wrong and Mother Nature doesn’t cooperate, roughly $2,000 plus our transaction costs is the most we can lose. How much can we make if we are right? Only Mother Nature knows for sure

Trading customers should call their personal RMB Group broker for all of the details of this trade. If you don’t have an RMB Group trading account and would like to know more about this or any other “Big Move” strategy, call 800-345-7026 toll free or 312-373-4970 direct. You can also email suerutsen@rmbgroup.com to get more information or visit us online at www.rmbgroup.com.