Interest rates measure the price of money. That makes them the world’s ultimate commodity. Money is cheaper now than it has ever been, yet hardly anyone believes that interest rates are going to rise significantly anytime soon. The European debt crisis and a slowing global economy have analysts comparing the US to Japan – doomed to years of recession and shrinking interest rates. Even well-known bond bear, Bill Gross of PIMCO, abandoned his higher rate outlook after suffering huge losses from his infamous call to dump US Treasuries last year.

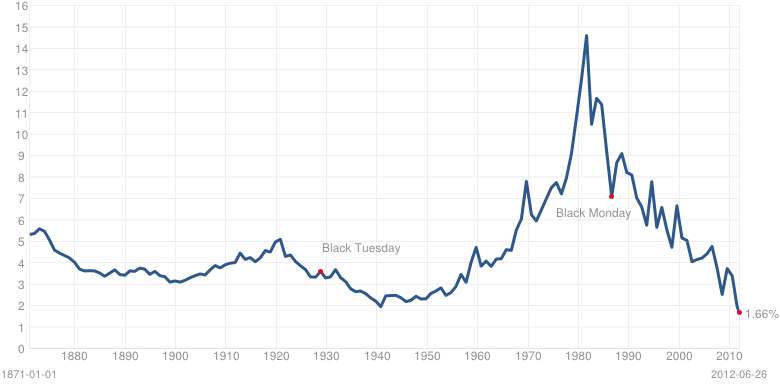

Ten-year Treasury yields collapsed to extremely depressed levels last year, setting records for new lows. (See chart below.) Like gold in 2002, sugar in 2003, crude oil in 2008, and corn in 2009, the price of money has finally fallen too far. As the first chart illustrates, 10-year T-note yields are lower than they were during the worst of the Great Depression. At these levels, a massive global slowdown and punishing global depression are already “baked into the cake.” Safety-seeking investors kept buying despite the fact that – with inflation running at 2% and a yield nearly 50 basis points lower – 10-year Treasuries were guaranteed losers even before taxes.

Chart Source: Mutlpl.com

We do not believe another “Great Depression” is in the cards. Instead, we expect the Fed and the rest of the world’s central banks to continue to do what they have been doing for the past few years: pumping cash into the global economy until they get the sustained, low-grade inflation they all desire. We believe they will continue to do this because the alternative – default – is political suicide.

Central bankers know inflation is the only way to pay off today’s massive overhang of global debt without violent revolution. Look at the violence that rocked Greece in reaction to simple austerity. Multiply that times ten in the event of a Eurozone default. This is why the ECB and Eurozone nations are dreaming up new ways to inject money into the European economy virtually every quarter. In early September, the European Central Bank announced it was prepared to buy debt from countries that needed help with their borrowing costs. Eurozone states okayed a plan to leverage the ESM bailout fund to 2 trillion euros.

But the ECB is not the only “easy” central bank…Ben Bernanke and Company plan to keep short-term interest rates at virtually zero through 2015. Determined to meet the employment mandate at any cost, the Fed finally launched its much anticipated QE3 campaign – promising to buy up to $40 billion dollars in mortgage-backed securities and $45 billion in new Treasury issues each month for “as long as it takes” to reduce unemployment. By announcing an open-ended commitment to more money printing, Gentle Ben came down decisively on the side of inflation, and did so despite soaring stock prices and an exploding money supply.

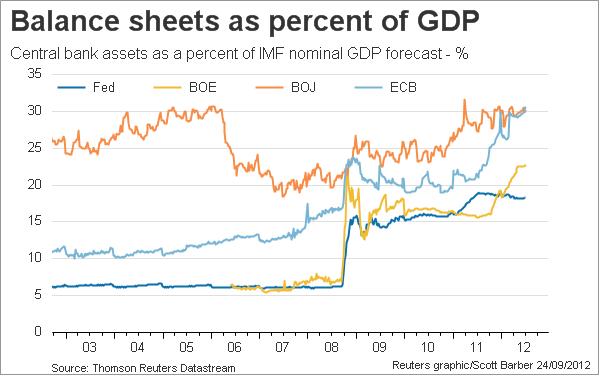

Meanwhile, China is taking a page from the US playbook and continues to stimulate its economy while Japan’s recent round of quantitative easing threatens to make Bernanke and the Fed look like a bunch of sissies. As the chart above suggests, the Bank of Japan’s ratio of financial assets – bought with newly printed money – is the highest in the industrial world, rivaling the ECB. New Japanese Prime Minister, Shinzo Abe, has targeted a 2% inflation rate and will mint more yen until he gets it. But it doesn’t matter who wins the booby prize; money printing will be the order of the day across the globe until the central banks get what they want – persistent and permanent inflation.

When will it occur? We do not know for sure. We can, however, make a reasonable assumption: the same psychological phenomenon that changed the direction of gold in 2002, sugar in 2003, crude oil in 2008, corn in 2009, stocks and countless other “cheap” markets could be at work in the US Treasury market too.

Human beings are wired to project current reality into the future, even when that future is already priced into the market. In our opinion, today’s low rates and correspondingly high T-bond and T-note prices are unsustainable and are destined to reverse.

Is the “Worst” Already Priced Into the Market?

T-note prices are currently higher (and yields lower) than during the worst of the 2008 Lehman crisis. Are problems in Europe more threatening to the global economy than the near-meltdown of the global banking system triggered by Lehman? We don’t think so – especially with central bank printing presses running 24/7. Yet 10-year notes have fully priced in another global collapse. Any outcome short of a punishing global recession will prove extremely disappointing to the bulls. The “Lehman Moment” the market is expecting will not happen precisely because everyone is expecting it.

This time the real danger is on the “risk off” side of the ledger. Americans believe government bonds are “risk free” so they have been stuffing their hard-earned cash into government bonds and bond funds, price be damned. After missing the entire rally in equities, individual investors are just starting to shift their assets from bonds to stocks.

But bonds and bond funds are not risk free. Like stocks, they can collapse with dizzying speed – especially in inflationary environments or when the creditworthiness of the issuer is in question. Just ask the unfortunate holders of Spanish bonds, or Italian bonds or worse yet, Greek bonds.

The long-term chart below shows prolonged periods of weakness (gold lines) by US 10-year Treasury notes – considered one of the world’s safest securities – during the biggest bull market ever known. If these declines can happen in a bull market, imagine what is possible once sentiment turns.

The long-term chart below shows prolonged periods of weakness (gold lines) by US 10-year Treasury notes – considered one of the world’s safest securities – during the biggest bull market ever known. If these declines can happen in a bull market, imagine what is possible once sentiment turns.

Bond “Bomb” Hiding in Plain Sight

Americans’ love affair with bonds could prove disastrous to their portfolios. Yet they continue to buy them despite yields well below the current rate of inflation. They seem unaware that at current, unsustainable levels, US Treasury debt is like a ticking time bomb, hiding in plain sight, right in the middle of their portfolios.

The global bond market is estimated to be 30% larger than the global stock markets…and the world is up to its neck and choking on bonds. China alone holds $21 trillion of our debt. There are over 17,000 municipal issues, untold billions in domestic and foreign ETFs/funds and IRAs/Keoghs. For tens of millions of retirees, this is intended to be their primary source of income.

What do you think investors will do when their bonds and bond funds begin to head south? Odds are the same thing they did when their stock funds hit the skids in 2008 – run! This could lead to a huge correction in the US Treasury market as selling begets more selling in a destructive feedback loop. If yields merely return to “normal” levels of 5%, T-note prices would drop nearly 20%, decimating the Treasury-heavy holding of millions of Americans. 30-year bonds would drop much more.

The Recession Began With Housing…

Analysts have been predicting the demise of the Treasury market for years and traders have paid dearly for being wrong. So why is now any different? The answer is housing. The US housing market – the initial source of the 2008 global meltdown – is on the road to recovery. Prices have been rising. The supply of homes – new and existing – is drying up. Inventories of existing homes have dropped and, more importantly, prices are rising.

Sources: S&P Dow Jones Indices Wall Street Journal

…And Will End the Same Way

The Fed’s medicine is working. Housing is recovering. The housing crisis led the US and the world into this downturn, so it is not unreasonable to expect a resolution to lead them out. We believe the bottom in real estate should precede, if just by a little, a corresponding bottom in bond yields, leading to potentially much higher interest rates down the road. The data tells us that housing is in the process of bottoming now.

A big recovery in housing should lead to a similar renaissance in the economy. That recovery is now underway. Prices are up, sales are up and inventory remains depressed. Buying a house is now more affordable than at any time in this generation. Dogged by two years of big increases, renters are finding it cheaper to buy.

But housing is not the only reason we like the short side of the US Treasury market…

4 Reasons T-Notes Will Top

1.) Housing has bottomed. A collapse in housing led to the Lehman bankruptcy which led to a global economic collapse. Housing got us into this mess and will probably lead us out. We expect the current recovery in the real estate market to spill over into the general economy. Higher home prices build consumer confidence, which in turn affects spending positively.

2.) 10-year real yields are negative with inflation running anywhere over 2% – and that’s before taxes! Capital will gush out of Treasuries once the fear keeping it there abates. How long do you think investors will accept puny, sub-2 percent yields when the price of everything else is going up?

3.) Stocks are stealing all the glory – Individual investors have just begun to pile into stocks. While this could end badly, fear of losing in equities is now being trumped by fear of missing out. Treasury investments are starting to suffer as investors chase yield. Expect more capital to flow out of bonds in search of higher returns.

4.) Treasury note yields are too low versus stocks. At 2.05%, the dividend yield of the S&P 500 is currently 25 basis points higher than T-notes. This is an anomaly that will probably not last long.

That doesn’t mean rates can’t languish at current levels, or fall a little more first. Any trader will tell you that it is impossible to pick the exact top or bottom in any market. That’s why we won’t try. Our approach will be much more methodical. Higher interest rates mean lower T-note prices. To make our bet on higher interest rates, we will take a short position using fixed-risk, “in-the-money” T-note put options traded on the CME.

Get the Trade!

Fill out the form below and receive specific trade ideas that

stipulate entry and exit points and risk management techniques.