Caution Flags for Those in Play:

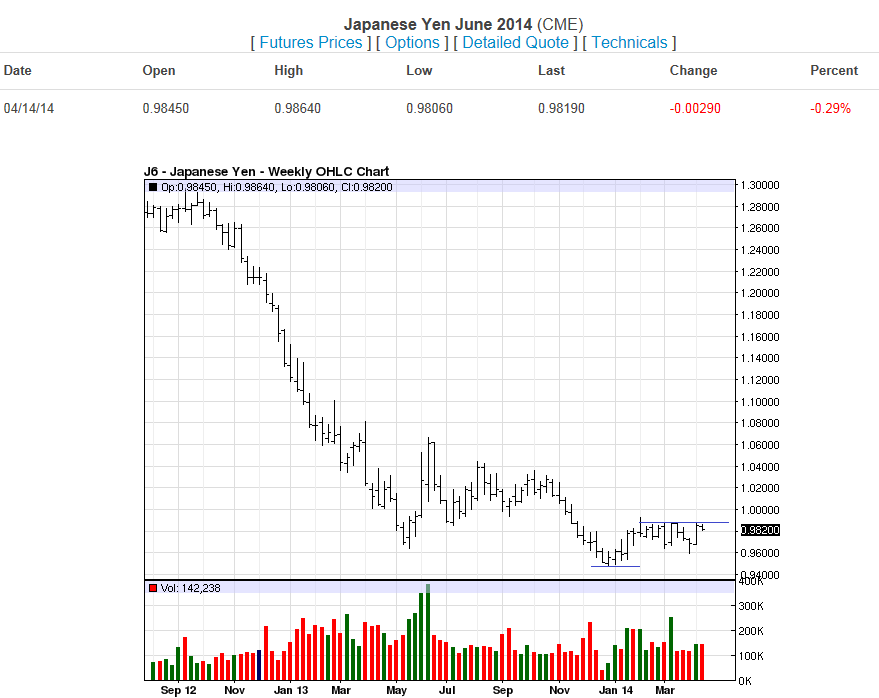

Japanese Yen

While we have not yet reached our risk points on the Japanese Yen trade, I would like to note that there seems to be a potential for long side activity. If you are in a position and profitable, you may want to evaluate your comfort level and personal exit targets.

Here on the Daily Chart, you will see that we have been side-winding a bit. If we begin to use the 0.98 territory as a baseline from which to build higher then we may be in for a rough ride. Again, consider where you stand in any open position that you may have.

On the Weekly chart, you can also see that we seem to have tested 0.96 and moved higher from there. Our latest activity pushes against the resistance levels around 0.98/0.99. If the Yen breaks above these levels then you may see significant activity trying to push higher. Again, I would like to raise a caution flag for the Yen at this time.

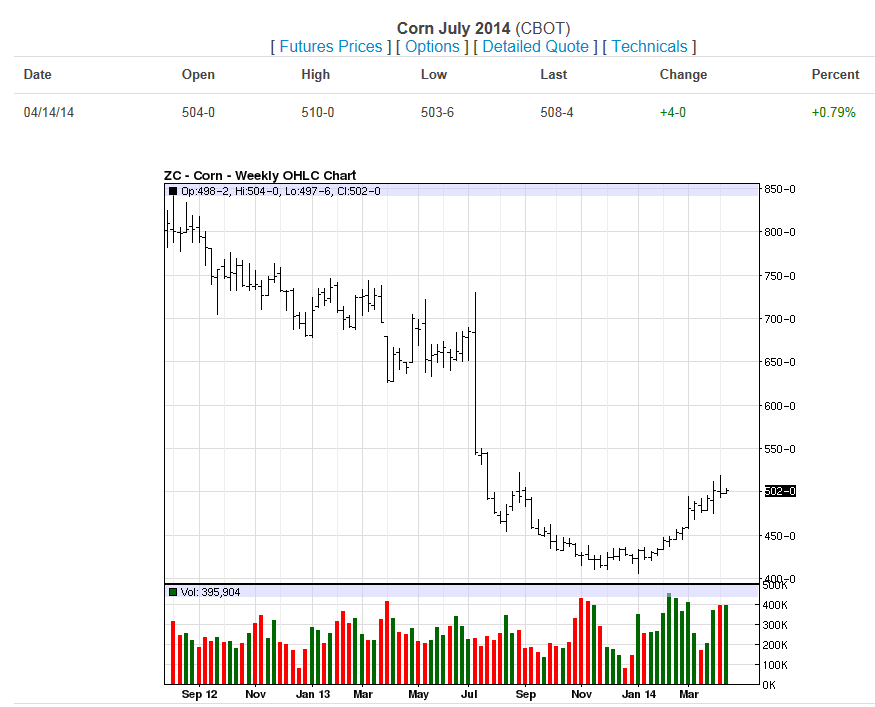

Corn

In this last week we have seen Corn come very close to our initial profit target, but as it has started to slip a little I would recommend that you consider your position and where you stand. I know that many of you may have already removed half of your positions in profit. I would encourage all of you to evaluate what you may have remaining in this trade.

Per the Daily Chart, you can see where we spiked almost to our 530 target, but the combination of the slip backwards and the extended daily trend has me prepped for a short term retracement.

The Weekly Chart has the same overextended look on the upswing. This could consolidate or retrace on an intermediate basis. Again, our positions in Corn have been good to us and per the longer term, there might still be some bullish opportunity. I want everyone to be aware however of the near to intermediate term potential for retracement. If you have not already done so, please consider your position size and what you may/may not want to leave open. If you are profitable and have not yet lessened your position size to keep some of those profits, please contact your broker directly to discuss this.

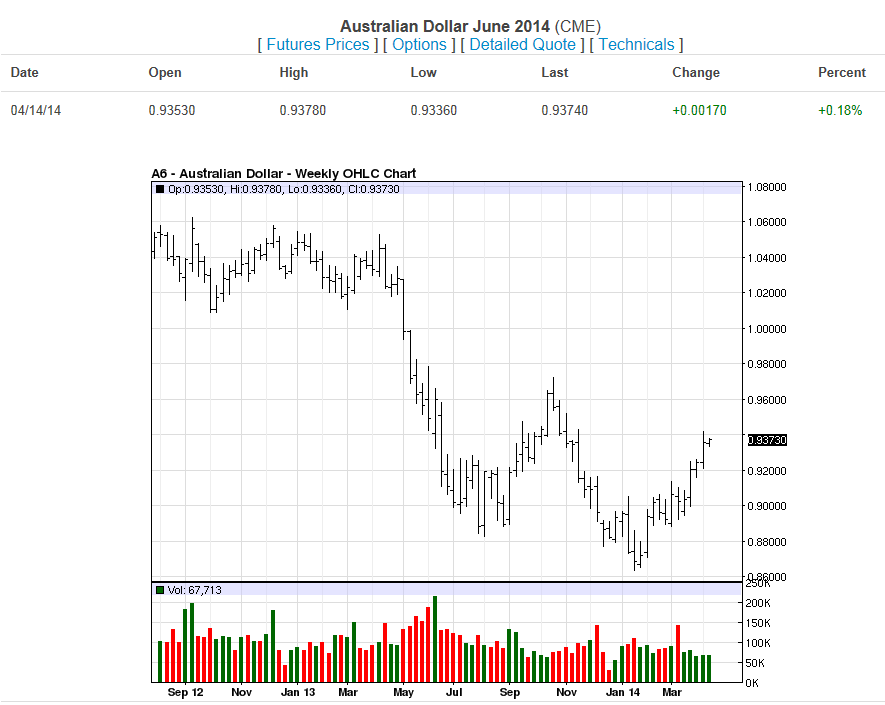

Australian Dollar (Aussie)

Last but definitely not least, the bullish run on the Australian Dollar may take a reprieve.

Here on the Daily chart you can see that we’ve had a nice solid run upwards. At this point I am looking for a retracement. If you are in positions in this and are profitable, please consider keeping your profits. Anyone in positions to the long side on this should be aware of the potential for near term retracement here and should balance themselves appropriately. If you are in positions in the Aussie, please consider your time horizon and whether or not you want to keep all of the positions open. Consult your broker directly.

The retracement, should it begin with any real power to the short side, could also cause this Weekly chart to fail and retest prior support territories. Any selling strength that builds via the Daily chart could cause weeks of failure as well. Again, at this point consider protecting your positions as you and your broker deem appropriate for your portfolio.