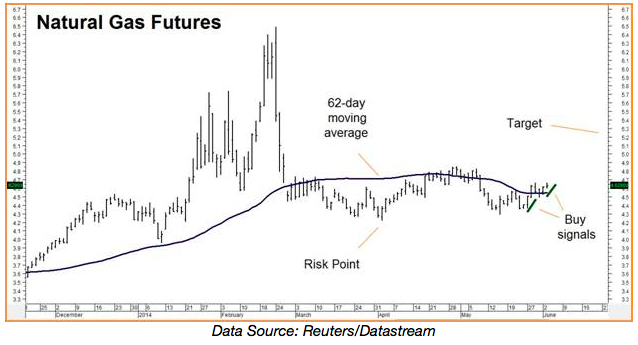

Natural gas has been moving sideways since last winter’s cold weather spike. Could it be ready for another trip north? Yesterday marked the second consecutively higher close over the critical 62 day moving average. It was also the second consecutively higher close over a previous day’s high and the second buy signal in gas in as many weeks. We believe this market is forming a base that could be used as a springboard higher. Our upside target is a move back to $5.30 in the December futures contract which is a 50% retracement of the last down move. We’ll risk two consecutively lower closes below $4.22 in the spot (front) contract.

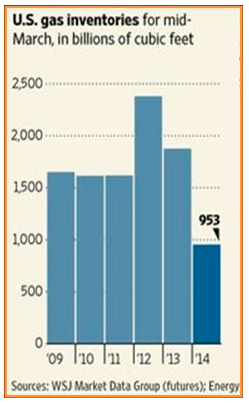

This year’s colder than normal winter has left natural gas supplies lower than they’ve been in a decade. Fracked oil and gas wells deplete far faster than more traditional methods. New discoveries must continuously be developed in order to maintain a consistent supply.

The perception is natural gas will remain cheap forever but demand can remain in lockstep with a supply and even exceed it, especially during periods of extreme heat or cold. The Obama administration’s new carbon guidelines penalizing coal will stimulate even more natural gas generating capacity, bulking up the demand side of the equation even further.

Fracking is expensive. The pumps, pipes, and drill bits needed for horizontal shale drilling are not cheap. Some independent producers are spending $1.50 for every $1.00 in revenue they’ll get back this year. They will continue to lose money unless there’s a sustained rise in price. The market will need to replace the inventories used up by last year’s brutally cold winter. Higher prices would be a good incentive to do so.

We are currently recommending a bullish option strategy with a total cost and risk of roughly $1,000 plus transaction costs and the potential to be worth as much as $4,000 should the natural gas hit our $5.30 objective prior to option expiration in late November. Prices can and do change so RMB trading customers should contact their broker directly for further specifics on this trade. Your broker can also help you custom design a strategy based on your risk level and/or differing price targets.

If you are not an RMB Trading Customer and want to know more about how we are playing this or any other market, contact us or give us a call at 800-345-7026 (toll free) or 312-373-4970 (direct) and we’d be happy to go over some of our fixed- risk, “Big Move” strategies with you. You can also e-mail suertusen@rmbgroup.com. Put “Natural Gas” in the subject line.