The next few days could provide an answer. They say bull markets climb a “wall of worry” and bear markets decline on a “slope of hope.” If you believe in these old market truisms, then stocks are due for a turnaround soon. While the world waits for the US Federal Reserve to raise short-term interest rates later this week, there is plenty of worry and not a whole lot of hope – at least as far as stocks and commodities are concerned.

Concerns about the price of oil and liquidity in the junk bond market are dominating price action. Many investors are betting on a scenario in which cheap oil causes a meltdown in the high yield debt market, taking stocks with it. Their selling is scaring other investors out of the market, adding to the sense of panic permeating the tape. Are we witnessing this decade’s “Lehman Moment” as some suggest, or is this something different?

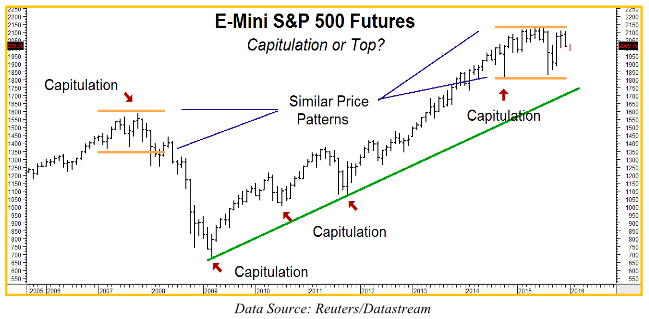

We don’t know yet. Major trends in stocks – both up and down – tend to start with capitulation – a condition where the market fails to follow through after making a higher high or lower low – fooling the general consensus and knocking bulls out of their long positions and bears out of their short positions in the process. The monthly chart above shows this phenomenon over the long term.

Today’s long-term price pattern in E-mini S&P 500 futures is scarily similar to the 2007 top, but we haven’t seen the same type of capitulation. As the chart above illustrates, stocks have stalled against resistance without making new highs. E-mini futures are now trading right in the middle of the big trading range established back in 2014.

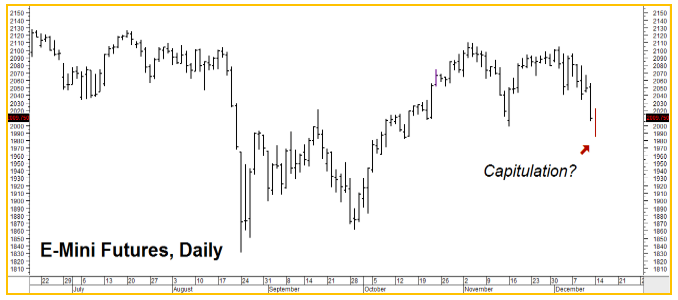

Meanwhile, the daily chart below shows a similar condition that could be developing on a shorter-term basis:

Hardly anyone saw the 2007 collapse in housing coming, but you cannot turn on CNBC or Fox Business News without hearing about the problems in the high yield market. Since everyone seems to be worried about high yield, we do not believe this is the “Lehman Moment” everyone is looking for. “Black Swans” like the ones marking the 2007 top are – by definition – not expected. Too many people are worried about the high yield bond maket right now.

A higher close in the E-mini futures today, followed by higher closes over the next two days could be signals that the worst is over in stocks – at least for now. Crude oil is also showing signs of capitulation – trading higher on the day as we write this. This could bode well for commodities in general. Consequently, we’ll be watching price movement over the next few days very closely.

We like the way things are progressing with our long sugar, long Australian dollar and long platinum / gold spread positions. We are also monitoring natural gas for signs of capitulation after making 14-year lows earlier today. We’ll let you know when we believe it’s time to jump in.

****

The RMB Group has been helping their customers trade futures and options since 1984. If you are new to futures and options and want to learn more about them, download the “RMB Short Course in Futures and Options” – our easy-to-read booklet covering all the basics. Call us toll-free at 800-345-7026 or 312-373-4970 direct or go to our website www.rmbgroup.com. Click the “Education Tools” tab at the top of the home page, scroll down to find the report and click on it.