Commodities have a well-deserved reputation of being far more volatile than the stock market. We are mainly commodity traders which means we are accustomed to volatility. However, the Trump Presidency has completely turned this notion on its head. Stocks appear to be where all the action is while commodities (and currencies) continue to linger in sideways trading ranges.

Our suggestion to “sell the rip” two weeks ago was an attempt use this volatility to our advantage. Stocks travelled further north than we expected, but we are not convinced that the big bottom the bulls have been excited about is in. Bear markets in stocks are nearly always accompanied by big rallies. Could yesterday’s big decline be the start of another leg lower? It is too early to tell.

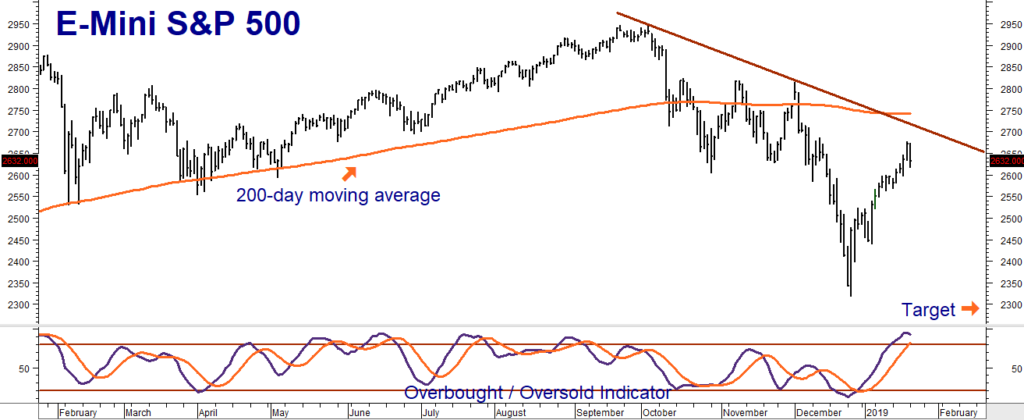

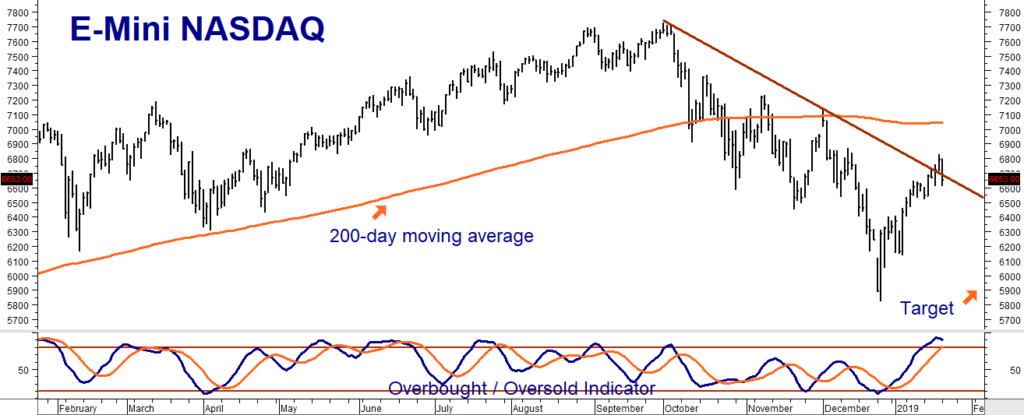

Fears of higher interest rates and a tariff-induced slowdown in China led to the Christmas Eve massacre that saw both the S&P 500 and the NASDAQ dip as low as 20% from last summer highs. It took dovish talk by Fed Chairman Powell and a promise of negotiation – including the potential lifting of sanctions — by the Trump Administration to stem the decline. Stocks responded to this jawboning by rallying smartly, turning the fear of losing money into the fear of missing out (FOMO).

Data Source: Reuters

The charts tell us that both the S&P 500 and the NASDAQ are still well below critical levels. Until they can close convincingly back above their respective 200-day moving averages we will maintain our bearish bias. Neither has been able to do that yet. Both indexes continue to make lower highs and lower lows — tell-tale signs of a bear market. The oversold conditions of late December have switched polarity and become the overbought conditions of late January. This increases the potential for another reversal, this time to the downside.

The Fed hasn’t signaled an intention to lower rates and absolutely no progress has been made on the trade front despite President Trump’s assurances that “Things are going well.” Tariffs remain firmly in place. Chinese growth is the slowest it has been in 28 years. Home sales declined 6.4% in December. The International Monetary Fund (IMF) just lowered its global growth forecast for 2019. One could make the argument that the global economic outlook may actually be worse than it was when stocks collapsed in December.

The US government shutdown is now a month old and beginning to become a drag on the American economy affecting air travel, agriculture, the housing market and many other sectors. We don’t believe it will take much to reverse the New Year FOMO optimism responsible for January’s rally, especially as the negative economic consequences of the US government shutdown continue to make themselves felt.

Data Source: Reuters

For these reasons, we intend to remain with our low cost, bearish option positions for the time being. Our targets at December 2018 lows remain the same for both the E-mini S&P 500 and the E-mini NASDAQ. The NASDAQ 100 led the market down in December and back up in January. We will be monitoring the price action in both of these markets closely. Visit us at RMB Group to learn more.

Please be advised that you need a futures account to trade the markets in this post. The RMB Group has been helping its clientele trade futures and options since 1984 and are very familiar with all kinds of option strategies. Call us toll-free at 800-345-7026 or 312-373-4970 (direct) for more information and/or to open a trading account. Or visit our website at www.rmbgroup.com.

* * * * * * * *

The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606

This material has been prepared by a sales or trading employee or agent of R.J. O’Brien & Associates (“RJO”)/RMB Group and is, or is in the nature of, a solicitation. This material is not a research report prepared by a Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that RJO/RMB believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.